Bank of Russia to ease rhetoric, may specify guidance

The Bank of Russia will keep the key rate flat at 7.75% on Friday, but the mid-term guidance may turn dovish as stronger FX and weaker local demand keeps inflation in check. Our expectation of just one 25 basis point cut in 4Q this year may become too pessimistic if the government secures a local gasoline price freeze beyond 1 July at the budget's expense

| 7.75% |

CBR key rate forecastin line with consensus |

CBR likely to issue dovish guidance

There are several reasons that the CBR should be more comfortable in guiding the market to a return to easing at some point this year:

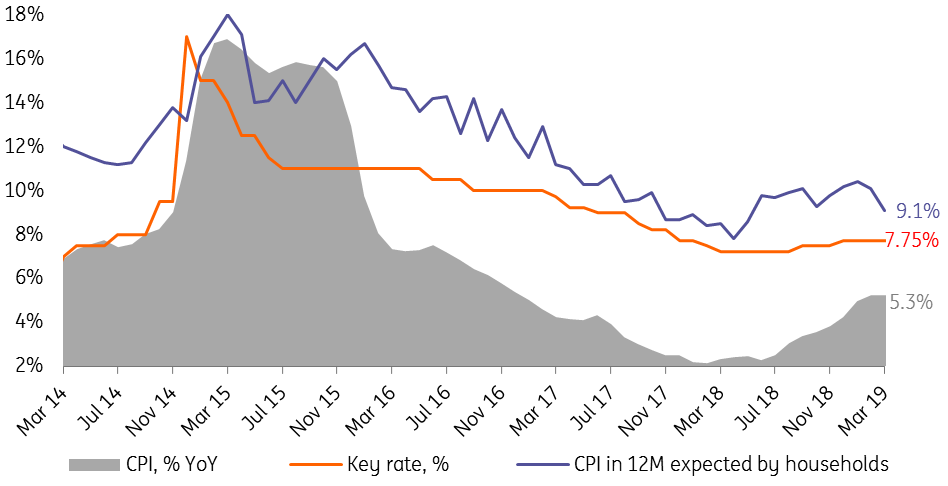

- March CPI of 5.3% year-on-year was below the CBR's previous 5.5-6.0 expectation, and the preliminary weekly data for April suggests that the acceleration of CPI, post VAT hike, has stopped amid the freeze in gasoline prices, which has been extended till 1 July.

- Inflationary expectations have moderated: the CPI expected by households in 12 months declined from 10.1% to 9.1% over the last month, and the share of corporates expecting higher inflation in the near term has also dropped.

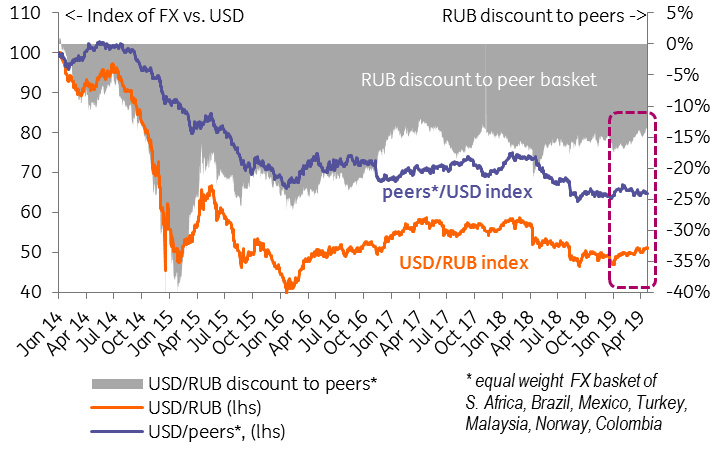

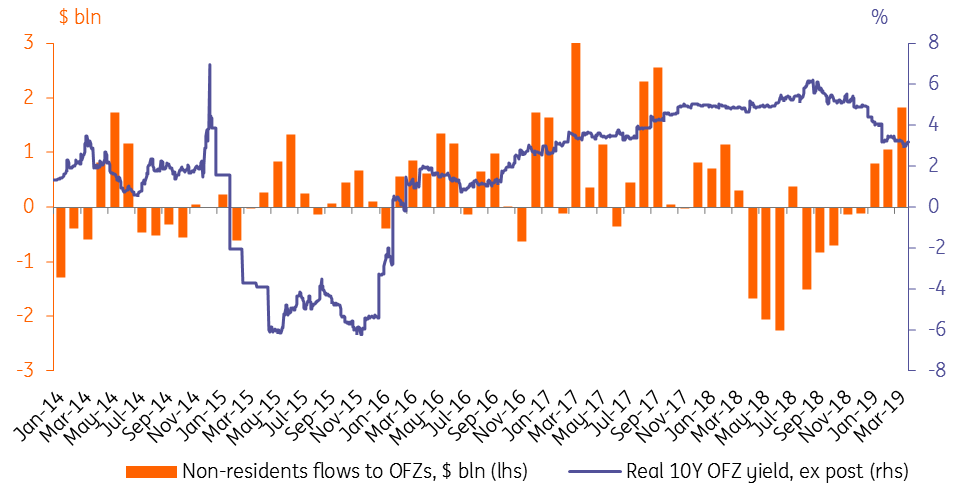

- The better-than-expected CPI trend is partially supported by the rouble's 1% appreciation against the US dollar since the previous CBR meeting on 22 March, and by 9% year-to-date, outperforming peers in both periods (flat since 22 March and +1% YTD). RUB is apparently benefitting from stronger oil and a recovery in global portfolio investors' appetite for local state bonds. In 1Q19, OFZ recovered around half of the $9 billion of outflows seen in April-December 2018. According to our own poll, a number of large global emerging market funds believe the possible introduction of sanctions against new state debt to be already priced in by the market.

- Another possible contributor to the below-expected CPI growth is the weakness in consumer demand, as retail trade growth decelerated from 1.9-2.0% YoY in January-February to 1.6% YoY in March amid zero real wage growth for the second month in a row.

CPI, key rate, and households' inflationary expectations

Performance of RUB and peers vs. USD

Non-resident portfolio flows in OFZ and real yields

It's still too early to cut in April

Most of the reasons against an actual cut in the rate at the upcoming meeting revolve around mid-term concerns that the positive surprises on the CPI front are due to factors that may prove temporary:

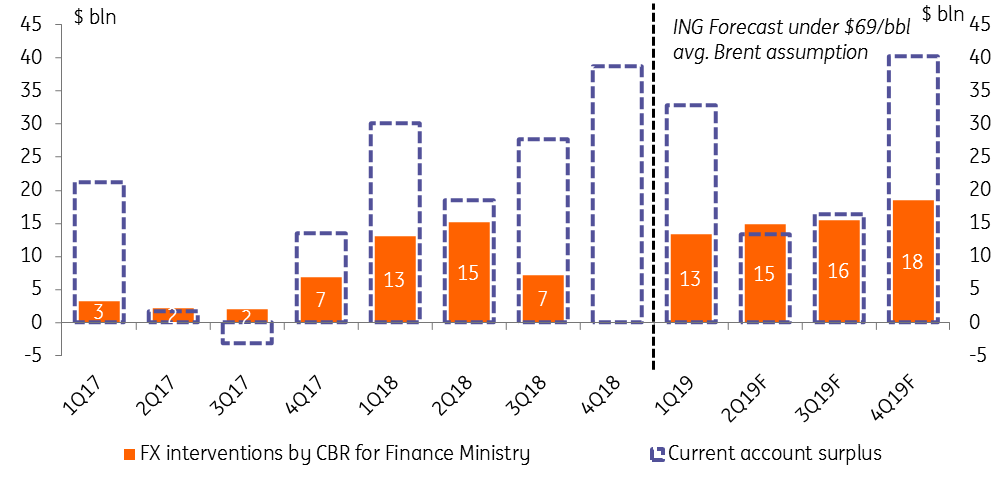

- The prospects for the USD/RUB pair after a 9% YTD rally are now increasingly cloudy. The monthly current account surplus is expected to decline from $10-11 billion in 1Q19 to $4-6 billion in 2Q-3Q19 on dividends, the vacation period and other seasonal factors. The surplus will be fully sterilised by the expected $5-6 billion monthly FX purchases needed to fulfil the budget rule. This makes RUB increasingly dependent on the portfolio flows in OFZ, which are subject to uncertainty related to global risk appetite and sanctions.

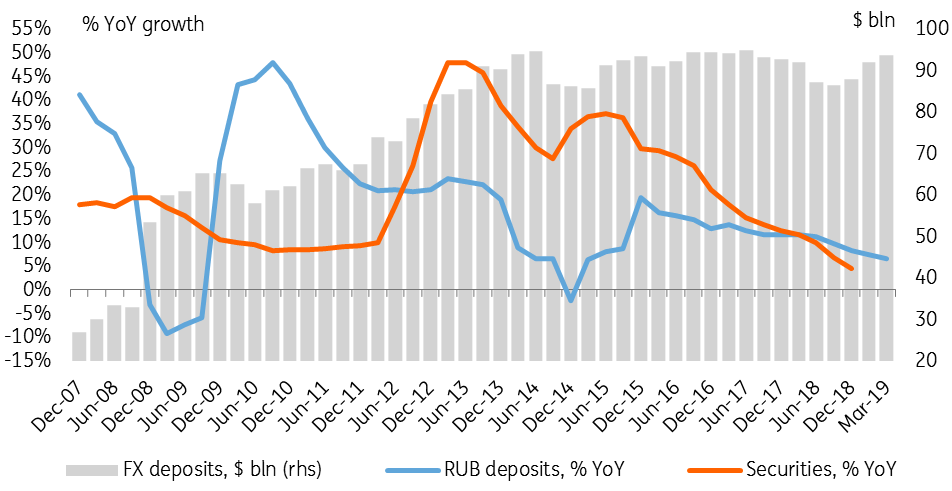

- RUB is losing its attractiveness as a savings currency. RUB deposit growth has slowed to a four-year low of 7% YoY, investments in RUB securities are also slowing down while FX deposits show solid nominal growth, increasing by $6 billion in 1Q19, close to a historically high level of $94-95 billion.

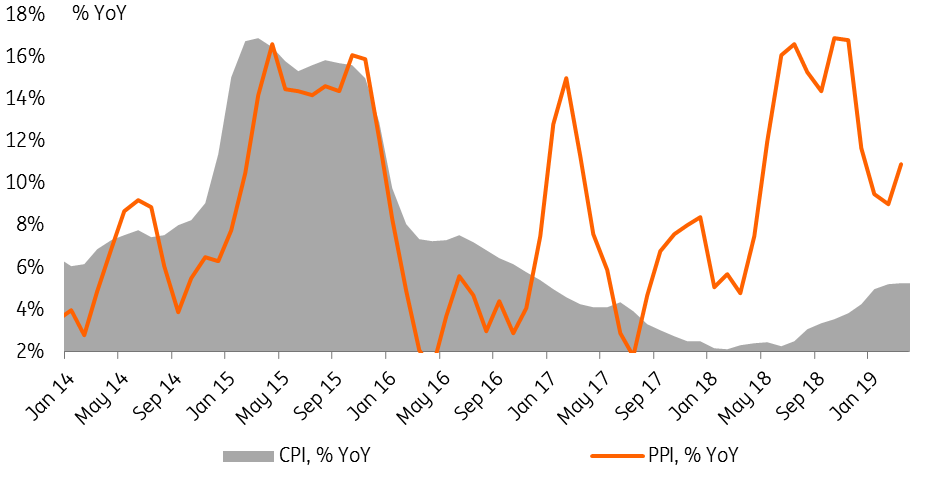

- The ability of the corporate sector to absorb the effect of the VAT rate hike and other cost inflation is under question. Retailers profits are down 16% in two years and producer prices have risen more than consumer prices over the last two years, with the PPI accelerating to 10.9% YoY in March. This accumulated pressure on margins remains a factor of elevated inflationary expectations and might become an obstacle to a swift return of CPI to the CBR target of 4%.

Current account surplus vs. FX interventions

Key indicators of household savings preferences

Russian CPI vs. PPI growth

CBR may start cutting earlier than 4Q19 if gasoline price freeze is extended

While our base case scenario for this year remains just one 25 basis point cut in 4Q19, there are conditions that can make this forecast too conservative. In addition to the possibility that the above-mentioned mid-term risks fail to materialise, especially on the OFZ flows, the key factor to watch over the coming months is the news flow on the gasoline price freeze, currently effective until 1 July.

With a contribution to the CPI basket of as much as 8%, through direct and secondary effects, the price of gasoline has led to uncertainty regarding the mid-term CPI trend. We do not exclude that the agreement between the government and the largest downstream suppliers to freeze local prices since 2018 has contributed to the below-expected CPI trend year-to-date. As the agreement required the government to compensate producers from the budget, we had doubts about its longevity. However, the stronger-than-expected budget execution this year (RUB550 billion surplus was reported in 1Q19) on both high oil prices and strong non-fuel revenue collection has apparently increased the government's tolerance to accepting the costs of the price freeze. According to the Finance Ministry, around RUB210 billion will be returned to oil producers this year due to the freeze, and the Ministry of Energy is proposing increasing this sum by another RUB150 billion.

In our view, this discussion increases the likelihood of the gasoline price freeze being extended beyond 1 July. Should this be the case, our YE19 CPI and key rate forecasts of 5.0% and 7.50%, respectively, would become too conservative, and the CBR might start cutting earlier than the currently expected 4Q19. One of the core meetings (that are accompanied by a monetary policy report and the governor's press conference), such as 14 June or 6 September are more likely than non-core meetings (such as 26 April), as three out of four actions taken in 2018 took place at the core meetings.

The commentary alongside the CBR decision, to be released on 26 April, may contain hints at a more detailed timeframe for the first cut.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more