Bank of England: Six things to expect this Thursday

Downgraded forecasts and more quantitative easing are likely to be the major headlines from the Bank of England this week. But on negative rates - the topic markets are most interested in - we suspect policymakers will keep their cards relatively close to their chests

Forecasts set for inevitable downgrade

The sudden announcement of a lockdown will have come quite late in the day in the Bank of England's (BoE) forecasting schedule, and it’s possible that policymakers won’t have had enough time to fully adjust their numbers to account for the new restrictions.

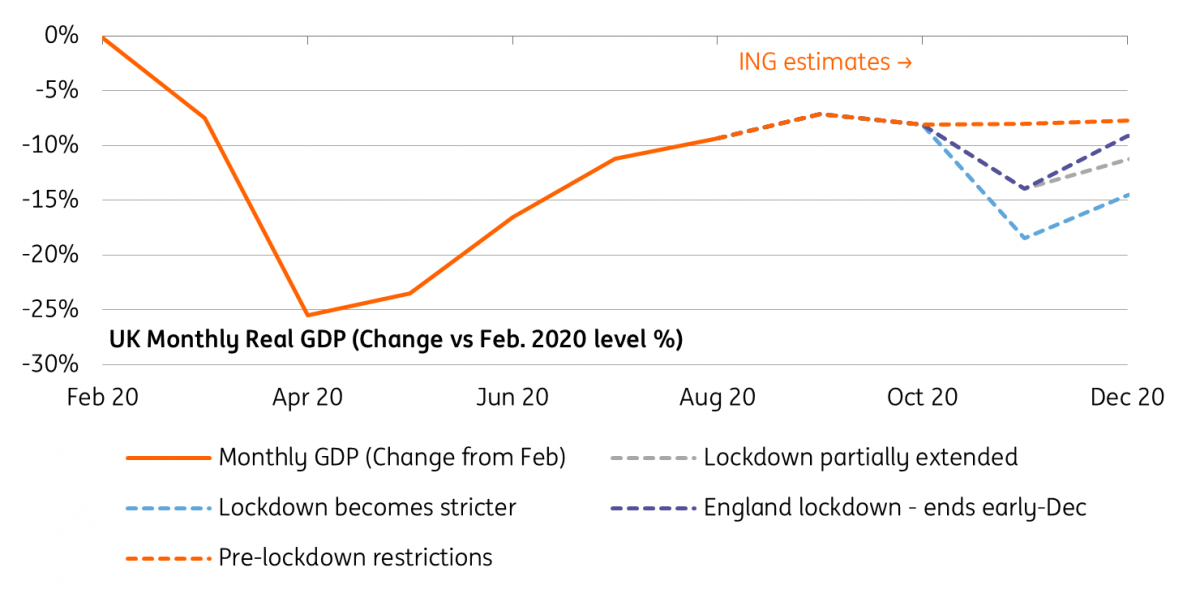

Either way, expect the Bank to give some indication of the damage, which we think could see 6-7% shaved off November’s GDP. This could see overall fourth quarter GDP dip by 1.5%, or by more than 2% if restrictions last longer than the initial early December cut-off date. We’d also expect the Bank to push back the timing of when the economy will reach its pre-virus levels. Back in August the BoE projected this would happen before the end of 2021, which already seemed a bit ambitious to us.

The announcement of the new Job Support Scheme (offering government subsidies for workers only able to work part-time) and subsequently, the extended furlough scheme, means the Bank is also likely to downgrade its 7.5% unemployment forecast for the end of 2020.

The jobless rate will still inevitably climb over coming months - we know redundancies have risen through the summer despite the latest support announcements, and could feasibly increase further should government wage support be tapered before social distancing can be safely unwound for good.

The impact of new restrictions on UK monthly GDP

Expect a QE top-up

The lower growth profile means the Bank looks poised to top-up the quantitative easing programme, we think by a further £100bn this week, enabling it to continue bond purchases at the current pace until early next summer. For the time being though, that’s likely to be it. We think it’s unlikely that interest rates will be touched this week.

Fresh hints on negative rates? We think probably not

The BoE is conducting a review of negative rates, and has asked commercial banks for their feedback on how it might impact bank profitability. The deadline for responses isn’t for another week, and it’s highly unlikely the Bank will want to front-run those findings. We therefore suspect the Bank won’t offer many fresh hints on the likelihood of negative rates at this meeting.

If we do hear anything though, the real question is whether there is now a consensus on the policy being useful. While a handful of the external MPC members have hinted they think the overseas experience of negative rates is positive, others, including Chief Economist Andy Haldane, appear less convinced. Keep an eye on the minutes for any fresh discussion.

The wildcard scenario - a 10bp rate cut

With lockdowns back upon us, the Bank may feel it needs to go further than simply boosting QE. While it has few other options, a tail-risk scenario could see the Bank cutting rates to zero and accompanying it with a strong hint that negative rates could follow. We could also see the BoE tweak the Term Funding Scheme (designed to encourage lending to SMEs) to be more generous.

In reality this scenario, in particular a cut to Bank rate, seems unlikely - not least because the communications would be complicated in light of the ongoing review into negative rates. But if you're looking for the wildcard scenario, this is perhaps it.

Announcement unlikely to move the needle for rates markets, barring new negative rate hints

With a QE increase nearly a foregone conclusion, BoE policy has not been the primary driver of Gilt yields in the past few weeks. Instead, rising Brexit optimism and the imposition of nationwide lockdowns have had opposite effects on yields. We would not dismiss the importance of this week’s meeting out of hand however. The messaging around the likelihood of negative rates will be key in confirming or questioning the assumption that negative rates will be implemented in 2021.

Still, the meeting is unlikely to move the needle much in the Gilt market unless there is a flat out rebuke of negative rates. Clearly, a lower than expected increase in QE would have implications for the likelihood of cuts next year (whilst there may be a substitution effect between the two measures). Since the September meeting, the odds of a 25bp cut next year have oscillated between 50-80%, with current pricing at the bottom of this range.

Inversely, hints about a move towards a negative interest rate policy (NIRP) would help 10Y Gilts revisit the bottom of their recent range at 0.20%. We surmise it would take an actual cut this week to re-test the August 0.10% low for 10Y Gilts. If the BoE cuts the Bank rate to -0.15% sometime next year, we think yields could briefly dip below 0%. Barring further cuts, we think Gilt yields are unlikely to re-visit their earlier lows.

Developments in other corners of GBP rate markets have been muted to say the least. A lack of data has hampered the reporting of commercial paper yields but, judging from the very stable Libor fixings, financial conditions remain exceptionally easy. This was likely a key reason for the BoE to confirm it will stop commercial paper purchases as part of its CCFF facility by March 2021. This leaves the BoE ample time to react should market conditions worsen as a result of current lockdowns.

10Y Gilt fair value under various BoE easing scenarios

GBP: Limited impact from the widely expected QE extension

The mix of the increase in quantitative easing by £100bn but no pre-commitment to rate cuts should have a limited impact on GBP as such an outcome is expected by the market. The key factor for the near- and medium- term GBP outlook remains the UK-EU trade deal with, among other things, the possible negative rate scenario being tightly linked to the deal vs no deal outcome.

While the light UK-EU trade deal is our base case, we continue to underscore the likely asymmetric GBP reaction function to the negotiation outcomes - skewed to larger losses should the trade negotiations fail vs limited gains should a light trade deal be agreed. This is because our estimates suggest no risk premium is currently built into the pound (based on our short-term financial fair value model).

While EUR/GBP should remain fairly stable this week, we are likely to see larger volatility in GBP/USD which should be impacted by the outcome of the US presidential election and its effect on the dollar (see our US Presidential election G10 FX scorecard). In the case of a 'blue wave', we expect GB/USD to move above the 1.30 level this week, with USD weakness being of larger importance than the widely anticipated extension of the BoE's QE.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article