Bank non-performing loans in 2021: The calm before the storm

Helped by extensive government support measures and payment holidays, many businesses have been surviving in 2020. In fact, bankruptcy rates have dropped in most countries. Support measures are not forever though. A sharp increase in non-performing loans is a question of 'when, not if', but will hit some countries more than others

Defaults and non-performing loans are deceptively quiet in 2020…

One lesson governments took from the 2008 and 2012 crisis response was: do not start increasing taxes and cutting expenditure too soon. That lesson was well heeded during the spring lockdown this year. Helped by accommodative monetary policy, governments indeed focused on supporting businesses and households. Austerity measures are nowhere on the agenda – yet.

Support for businesses took the form of tax deferrals and direct grants to compensate for lost turnover, and temporary employment benefits to allow businesses to keep their employees despite steep drops in revenues. Governments also devised loan guarantee schemes, allowing businesses with liquidity needs to borrow more easily from banks. Loan payment holidays were also implemented in many countries.

Regulatory measures were implemented to prevent banks from having to massively mark loans as problematic when a payment holiday was granted or a government guarantee was extended, which in turn would have impacted bank capital and discouraged bank lending. The ECB made sure there was ample liquidity in the financial system, providing TLTRO funding on generous terms.

As a result, bank lending sharply increased in the initial lockdown months. Though many businesses suffered, the number of defaults in many countries actually dropped, compared to a year earlier. In recent months, bankruptcies appear to stabilise at rates some 15-30% below what was “normal” just before Covid-19. This suggests that support packages while helping businesses getting through the crisis are also keeping alive a number of “zombie firms”.

Number of business bankruptcies (seasonally adjusted, index, avg 2019 = 100)

NPLs will rise everywhere in 2021, but some countries are more vulnerable

So what to expect for 2021? The Covid-induced recession will increase non-performing loans for banks when government support is phased out. “Zombie firms” that survived 2020 may further add to NPLs at that time. On the other hand, losses on loans that are covered by guarantee schemes will mainly accrue to government and less to banks. It appears that loan guarantee schemes were used more widely in countries in the south, mainly Spain and Italy but also France, than in northern countries. So, let's examine three factors that will drive NPL developments in 2021 and beyond:

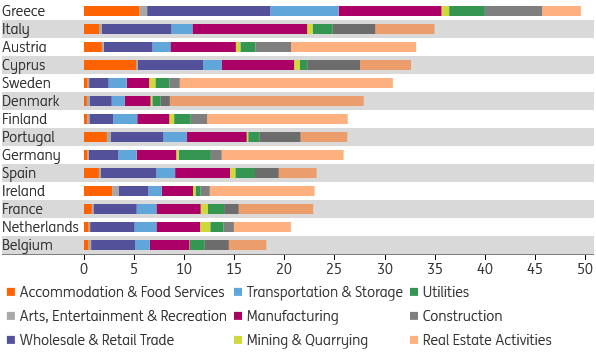

Sectoral composition of corporate loan books

The sectoral composition of bank corporate loan books matters for NPL development. In the chart below, we show exposures to business sectors that are generally considered more vulnerable to the economic disturbances created by the pandemic response, as a share of the total loan portfolio (including exposures to households, government and financials).

Share of vulnerable sectors in total loan portfolio (%)

Generally speaking, banks headquartered in France, the Netherlands and Belgium have the lowest exposure to vulnerable business sectors. Vulnerable exposures in Scandinavia are mainly driven by commercial real estate loans. High exposures to the tourism sector can mainly be found in Greece, Cyprus, Ireland and Portugal, while Italian banks have relatively large exposure to manufacturing and trade.

It’s important to consider that these sectors are normally impacted in different stages of the cycle, and a similar logic applies in the different stages of the Covid-19 crisis. Tourism, for example, is hit immediately and severely during lockdowns, but may also quickly recover. The same applies to transportation and storage. The initial hit to manufacturing was relatively less severe, but its recovery may also take more time. Real estate and construction may lag the most: initially, running construction projects are finished, while rents keep coming in as tenants survive on government support. As government liquidity is phased out, tenants may increasingly default. Meanwhile, a tepid economic recovery reduces demand for shopping space and a structural shift to working from home reduces office space demand. Construction companies will struggle with less well-filled new orders portfolios in the years ahead.

Share of SMEs in loan books

A second factor we consider for the NPL outlook is the share of SMEs in loan books. We assume that SMEs are hit relatively harder than larger companies, and may find it more difficult to recover. The share of SMEs in bank business loan books is highest in Cyprus, Portugal and Sweden, while the Netherlands and Germany score relatively low.

Share of SMEs in bank corporate loan books

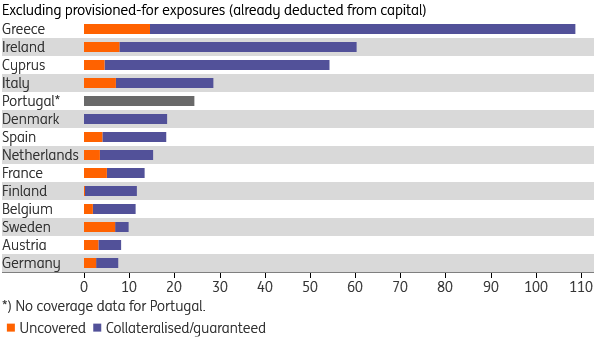

Legacy NPL portfolios

To assess banks’ ability to absorb NPLs, we look at the size of existing unprovisioned NPL portfolios as a share of bank capital. This is the pre-Covid legacy NPL luggage that banks bring into the Covid-19 crisis. Generally speaking, southern countries were already facing elevated NPL ratios before Covid-19, although in recent years a lot of progress has been made bringing those ratios down. Spanish NPL ratios (3.1% in 2020Q1) were converging to ratios in northern countries, while those in Italy and Portugal (slightly above 6%) more than halved between 2016 and 2020. The Italian banking sector has entered the Covid-19 crisis with NPL-ratios comparable to ratios before the 2008 financial crisis.

Unsurprisingly, Greece, Ireland and Cyprus top the list, while NPLs still comprise over 25% of bank equity in Italy and Portugal. Do note that in all countries, most of the non-performing exposures are collateralised or guaranteed yet the recoverability of such collateral varies. Of the southern countries, Spain is better positioned, both in terms of expected impact (in the eurozone loan book at least), and the ratio of existing NPLs over equity.

Non-performing exposures, % of bank equity

Taking it all together: where and when?

Three quite high-level indicators do not do justice to the nuanced and complicated nature of national NPL developments. That said, a worrying picture emerges. Covid-19 may deal another blow to those countries and banking sectors that are worst positioned to deal with it. Averaging the factors, NPLs are likely to continue to pose most challenges in Greece, Cyprus, Italy, Portugal and Ireland. Countries where we expect the smallest problems are Germany, Belgium, the Netherlands and Finland.

NPL heatmap

An important question is when NPLs will start to rise. Everything depends on the development of Covid-19 and government responses. Many businesses may currently depend on government support, for example, in the form of tax deferrals or wage payments, and may run into trouble once government support is phased out. This is currently expected to happen in the course of 2021. NPLs may further increase in 2022.

Tags

Banks Outlook 2021Download

Download article30 October 2020

Banks Outlook 2021 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).