Australia: rate hikes coming sooner and faster than we all thought

The Reserve Bank of Australia (RBA) has been gradually making room for itself to tighten in the coming months. But much higher-than-expected inflation in 1Q22 means a May hike is in the frame, and there is a good argument for some front-loading too in subsequent meetings. Any positive impact on AUD may be offset by a challenging external environment

Macroeconomy – it's all about inflation now

Inflation has been on everyone’s mind since the Russian invasion of Ukraine resulted in a massive global supply shock across multiple axes – energy obviously, but also agriculture and metals.

If there is one economy in the Asia Pacific region that comes out of this better than any other, it is Australia – a major net producer across all the commodity lines affected.

Australia’s trade surplus remains very strong, helped by this massive positive terms-of-trade shift, and sad to say, the supply disruptions that have given rise to this shock look likely to remain in place for the foreseeable future, with little sign of a potential peace breakthrough any time soon.

Australia’s unemployment rate is already at a record low rate of just 4.0% and though we won’t get 1Q GDP numbers until early June, the growth picture looks to be holding up well if PMI numbers can be relied on. And that positive conclusion comes despite the obvious problems that China is having thanks to its zero covid policy and earlier regulatory blitz.

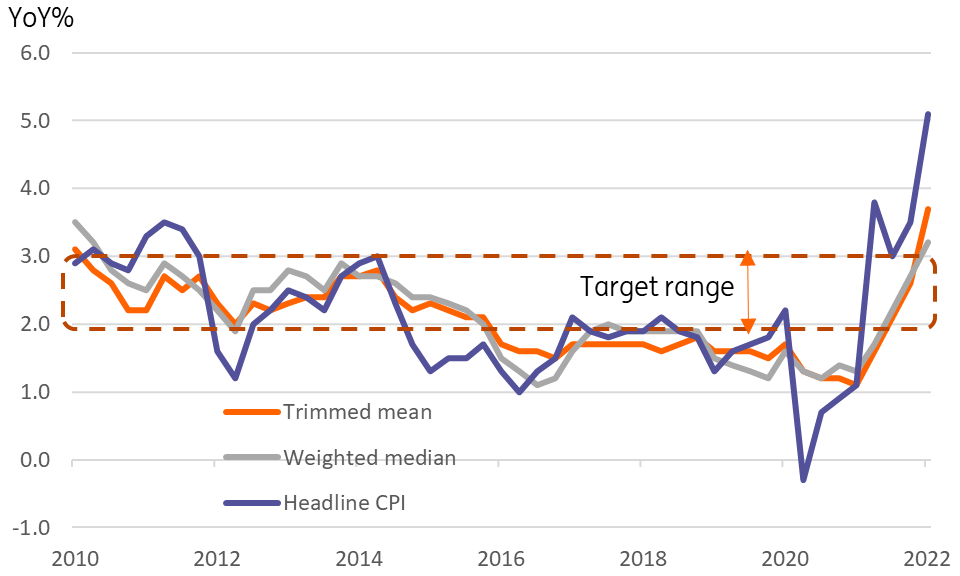

Headline and core inflation rates

Where does this leave the RBA?

So with 1Q22 CPI inflation coming in at 5.1%, and the core measures favoured by the RBA all coming in above the top of the upper band of the target range, the arguments for a rate hike are looking stronger now than ever.

All the hurdles the RBA has previously placed in front of any rate hikes are arguably already met. The main bone of contention was that they have previously argued that for the inflation we are seeing to be “sustained” and therefore needing a policy response, there had to be a wage element. And the line in the sand that had previously been set was a wage-price inflation rate of 3.0% year on year. This wage data is released quarterly, and we won’t get 1Q22 data until 18 May. In other words, not until after the forthcoming 3 May RBA rate-setting meeting.

We had previously anticipated that the 3 May RBA meeting would lay the groundwork for a June hike but leave policy rates unchanged. The wage price index would subsequently be released, and although it may not have reached the 3% threshold, it would be close enough to enable the RBA to say that all the conditions for hiking rates had been met. And then at the 7 June RBA meeting, the bank would finally hike rates by 40bp taking the cash rate to 0.5% and lifting the Exchange Settlement (ES) rate by more than that to help push the cash rate closer to the target rate.

This was still our view immediately following the inflation release, and spelt out in the snap we wrote immediately after. But after some suitable reflection, we now have to admit that not hiking rates in May will look extremely odd and would likely get a very negative reaction from the Australian bond market, which is already under some pressure. Normally we might also consider the 21 May Federal Election as another argument for delaying the first hike in the business cycle until June. But the consensus seems to be coalescing around the view that this is a poor excuse to delay tightening in the face of such strong inflation, and we have to say that we agree.

A revised timeline for the RBA

So this is the timeline we now believe is more likely:

- 3 May RBA Meeting – hike cash rates by 40bp (ES rate raised 45bp)

- 18 May – Wage price inflation – close enough to 3% year on year not to matter if it still remains below – it may not…

- 21 May Federal election – no longer viewed as an impediment to a rate hike

- 7 June RBA meeting – 25bp or more likely now 50bp of additional tightening

We are veering towards a 50bp hike for the subsequent June meeting rather than 25bp. Now that the rate hike genie looks as if it is out of the bottle, there are good reasons for the RBA to “front load” the tightening that is inevitably coming.

The RBA has very clearly been slow to adjust to the strong growth and high inflation backdrop that it now faces. But the longer they lag behind the curve, the higher rates may eventually have to go. It is a sort of “stitch in time saves nine” argument.

Helping that argument along, the US Fed’s own anticipated aggressive front-loading will still leave the RBA on the dovish side of the Fed. And the AUD’s recent weakness also adds some additional policy flexibility that might otherwise have been viewed as problematic.

Market outlook

The market until very recently had seemed to be pricing in way too much tightening over much too short a time frame. It has done this since the beginning of the year, long before the Russian invasion of Ukraine or the subsequent commodity price surge.

Following the latest inflation shock, the market is now pricing in an implied yield on the December 2022 3m bank bill future of 2.8%. Is this too high?

Well, if you agree that the cash rate will rise to 0.5% next week, and then rise a further 50bp in June, and then by a further 25bp at every meeting until the end of the year, then maybe not. Likewise, the 3.6% implied rate for end-2023 only assumes a further couple of rate hikes in 2023. For choice, it is still probably a bit higher than we would feel comfortable with. But it is no longer looking totally ridiculous.

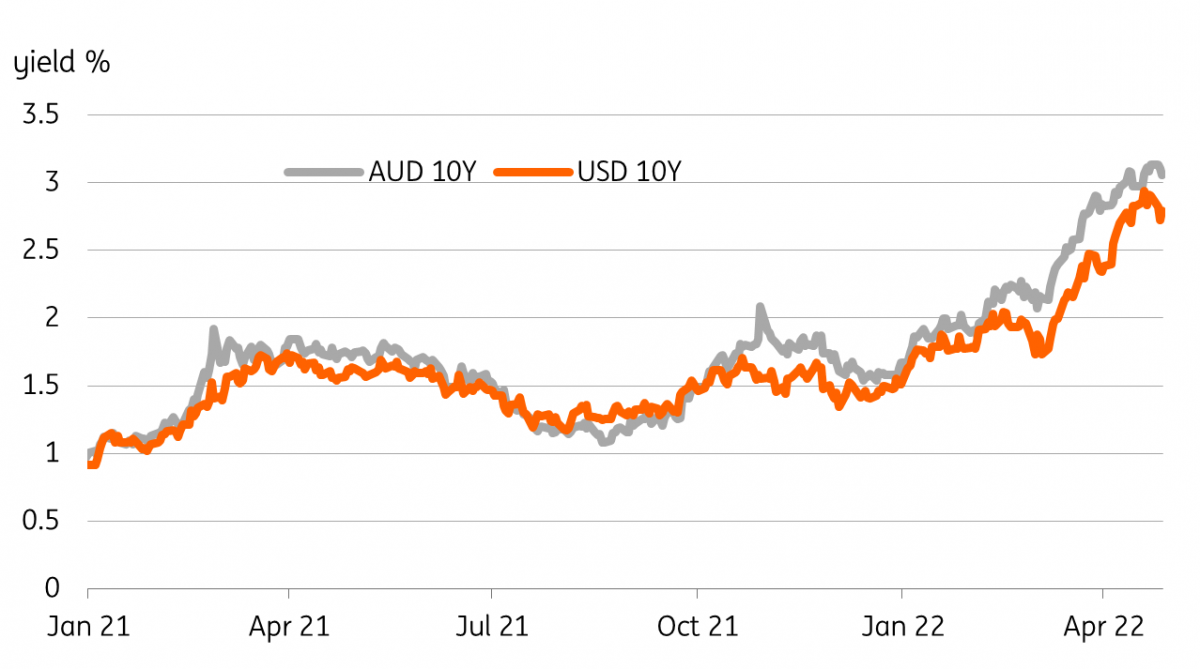

Australian and US 10Y Government bond yields

Bond yields

While the front end of the Australian yield curve is driven by domestic considerations of RBA rate policy, which in turn are based on the macroeconomic backdrop, in simplistic terms, the back end of the yield curve is simply mirroring US Treasury movements, plus a bit of spread widening as the RBA lags behind the curve.

Picking where this goes next is very difficult. But a 3% US Treasury yield is not looking out of the question, and so a 3.30-3.35% 10Y Australian bond yield within the next few months would be consistent with that.

Further out, a lot depends on where you believe the neutral rate for US Fed funds rates is. The consensus view is that this is about 2.50-2.75%, so a 3% Fed funds rate takes US policy to slightly restrictive territory needed to deliver a slowdown in inflation. With a bit of positive yield curve slope still being maintained at slightly restrictive levels, this could easily take Australian 10Y bond yields to around the 3.5-3.6% area.

But James Bullard of the St Louis Fed believes the US neutral rate may in fact be much closer to 3.5%. If he is right, and he is a very considered and thoughtful member of the US Federal Open Market Committee, then both Fed funds and the 10Y US Treasury yield are headed a lot higher, and by implication, so too are Australian 10Y government bond yields. It isn’t yet our house view, but it may not be wise to rule out a 4-handle on 10Y AUS yields later this year.

FX: Positive impact on AUD may not last long

At the time of writing, markets are pricing in 18bp of tightening at the May meeting. If our expectation for a 40bp hike proves correct, AUD is looking at some decent upside potential next week. The market’s pricing further down the road is, however, more aggressive (around 240bp worth of hikes), and while the notion of front-loaded tightening can offer support to the currency in the near term, it can limit the room for appreciation in the longer run.

Looking at the coming weeks, there is a risk that the impact from an RBA hike may prove a one-off positive event for the Aussie dollar, as the external environment remains highly challenging for the currency, due to its high beta to: 1) China’s Covid crisis and the negative implications for the demand outlook in the region; 2) Global risk sentiment as markets grow increasingly concerned of a global slowdown; 3) Fresh weakness in iron ore prices (strictly related to China’s anti-Covid policy).

With this in mind, and adding some limited USD downside risks as the Fed starts a more aggressive phase of monetary tightening, we think any RBA-induced rally in AUD/USD may stall around the 0.7300 area, if it even reaches such levels. Contrasting factors suggest a flattish profile in AUD/USD into the summer.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more