Asian LNG drags the gas complex higher

Gas markets had a volatile 2020, with prices initially coming under pressure with not only a demand hit, but a ramping up in LNG capacity. However, a rallying Asian LNG market more recently has dragged the whole natural gas complex higher. In fact, LNG turned out to be the best performing commodity in 2020, and has made record highs at the start of 2021

Soggy demand and growing capacity

As seen with most markets in 2020, LNG was unable to escape the Covid-19 related demand hit, with industrial gas demand weighed down by lockdowns. This saw LNG prices in Asia trading to record lows, which also weighed on regional gas hub pricing around the globe, and in particular Europe. This only added to what was already set to be a bearish year for LNG markets, following a mild winter, along with the fact that around 24mtpa of LNG export capacity was scheduled to start up over the course of 2020, with the bulk of this capacity coming online in the US.

Therefore the market witnessed a large number of US LNG cargo cancellations over the summer, with the price collapse in Asia and Europe making it uneconomical for buyers in the region to take delivery of cargoes. Nearly 175 LNG cargoes were cancelled between March and October of 2020, with the majority of these cancellations taking place in June-August 2020, a seasonally softer period for gas demand.

If we look at export data from the US, volumes collapsed over the summer months as a result of these cancellations. Volumes hit a low of below 1.9mt in August, which is the lowest monthly number seen since 2018, and well below the roughly 5.5mt exported in February. However since then, and with cancellations easing, we have started to see volumes pick up once again. Due to the recovery we are seeing, along with strong export volumes at the start of 2020, total exports from the US over the first 11 months of 2020 are still up around 32% year-on-year, according to IHS Markit, and full year exports will still see very impressive growth.

In Asia, while LNG imports over April and May fell YoY as a result of lockdowns across the region, we have seen quite the recovery in demand since then. Data from IHS Markit shows that LNG imports into Asia over the first 11 months of 2020 totalled a little over 233mt, which is still up almost 7% YoY.

As for Europe, the region continued to see strong growth in LNG imports through until the end of May. Since then though, volumes have come under pressure as a result of cancellations, while more recently given the premium that the Asian market is trading at to Europe, any spot cargoes will likely make their way to Asia rather than Europe. However, over the first 11 months of 2020, imports total a little over 82mt, up 2% YoY, according to IHS Markit data.

US LNG cargo cancellations in 2020

The market roars back

LNG cargo cancellations certainly helped in rebalancing regional markets, which has been more supportive for prices in recent months. A number of unplanned outages in the US as a result of hurricane activity, along with extended maintenance at some LNG plants in Australia, has only provided further support. In addition, colder than usual weather in North Asia has been a bullish driver, while a delay in shipments through the Panama canal, along with rallying freight rates has only helped to push the market even higher. Spot Asian LNG prices have reached record levels in early January, with JKM trading above US$20/MMBtu. While these very high prices may see some buyers taking a step back, with cold weather expected to continue, prices are likely to remain well supported in the near term.

The spread between Asian LNG prices and Henry Hub in the US is wider than US$17/MMBtu, suggesting very little chance of seeing further cancellations anytime soon, in fact a spread of that level should see LNG plants in the US maximising throughput. Meanwhile, the spread between Asian LNG and European prices (TTF) is almost US$13/MMBtu, and so there is a clear incentive for spot cargoes to flow into Asia rather than Europe.

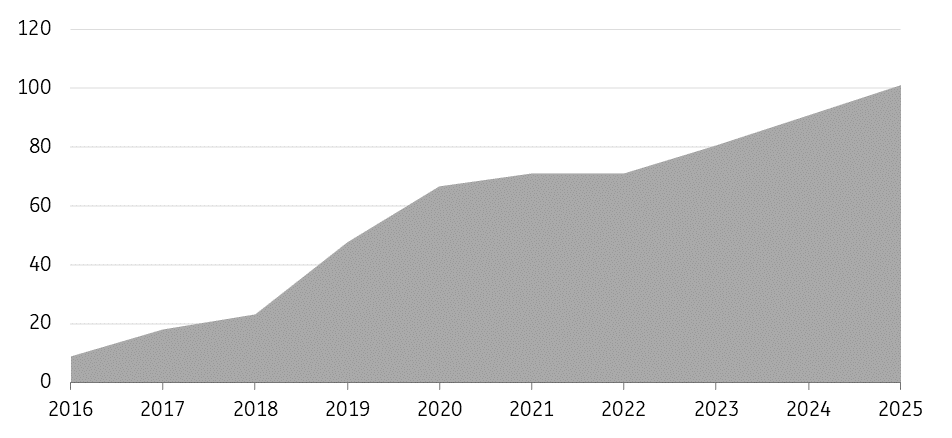

Looking further ahead, and in terms of liquefaction capacity, we do appear to be behind the bulk of capacity additions, at least for the next several years. In 2021, only about 8mtpa of capacity is expected to come online, which should be much more manageable for the market to absorb, particularly with demand expected to grow at a healthy pace.

This all suggests that regional gas markets will be better supported over 2021, and it looks increasingly unlikely that we will see a repeat of cargo cancellations this year. Clearly, Covid-19 remains a risk if we were to see further waves over the course of the year.

Limited US LNG export capacity set to come online over the next two years (mtpa)

ING natural gas forecasts

This article is part of our Energy Outlook 2021. You can read the full report here.

Download

Download article15 January 2021

More power, flower This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more