Asia week ahead: Where is growth headed in the second quarter?

Asian economies continue to build on their export strength as Taiwan and Korea's 1Q21 GDP reports should reveal next week. However, forward-looking confidence indicators may be more closely watched for the likely path of growth in the current quarter

Export-led recovery is strengthening

Korea and Taiwan are the next Asian countries to release GDP numbers for 1Q21, and we expect both countries to have built on their export strength in the last quarter.

Taiwan was a notable exception to an unprecedented economic slump during the Covid-19 crisis as year-on-year GDP growth remained positive throughout 2020. While this had the island economy off to a strong start in 2021, disproportionate benefits of global semiconductor shortages kept exports and GDP growth accelerating. Our house forecast for Taiwan's 1Q GDP growth is 5.5% year-on-year, up from 5.1% in 4Q20.

Our house forecast for Taiwan's 1Q GDP growth is 5.5% year-on-year, up from 5.1% in 4Q20

Korea is the next Asian economy to have snapped the negative year-on-year GDP growth trend in the first quarter. We're looking for 1% YoY GDP growth after the contraction in the preceding three quarters (-1.2% YoY in 4Q20). Strong exports buoyed manufacturing, while multiple Covid-19 waves continued to hold back the recovery of services output. But even then, we think our growth forecast is at risk of more upside than downside surprise.

Our Korean growth forecast is at risk of more upside than downside surprise

Elsewhere in Asia, lots of industrial production numbers for March will help us fine-tune 1Q GDP estimates of the countries reporting next week -- Japan, Singapore, and Thailand. Released earlier this month, an advance estimate of Singapore's 1Q GDP eked out a 0.2% YoY growth. So, March industrial production data will signal the direction of revision to the initial estimate, which will most likely be upward given the persistent strong non-oil domestic exports in March.

We don’t think manufacturing in Japan or Thailand was strong enough to pull GDP growths up into positive territory in 1Q. Moreover, the prospects of this happening in the current quarter are diminishing, too, with the fourth wave of the pandemic.

But prospects continue to be uncertain

GDP releases may well be carrying some market impact, though that’s not going to change the fact that 1Q21 is pretty much a thing of the past. So, markets will be more interested in ascertaining the direction of GDP growth in the second quarter, or even beyond, while multiple waves of the pandemic continue to dampen the outlook.

The forward-looking consumer and business sentiment indicators come in handy for this purpose, so do purchasing manager indices (PMIs) or even corporate profits for what they say about future investments - and there are plenty of those on the calendar next week.

The key standouts are China’s industrial profits data for March as well as the manufacturing and non-manufacturing PMIs for April -- all likely reflecting the steady advance of Asia’s biggest economy. And in Korea, consumer and business confidence indicators may show further improvements over their March readings, paving the way for even more growth this quarter despite the increasing number of Covid-19 cases yet again.

The Bank of Japan policymakers meet on Tuesday (27 April). Having tweaked the policy at the March meeting for a broader trading range for benchmark bond yields and scrapping the target for ETF purchases, there is little likelihood of the central bank tempering it again in just over a month.

In Australia, inflation remains far behind the reserve Bank of Australia's 2-3% policy target as we get 1Q CPI data next week (ING forecast 1.0% YoY). It should hit the target in the current quarter, though that's due in part to the low base effects rather than underlying demand recovery.

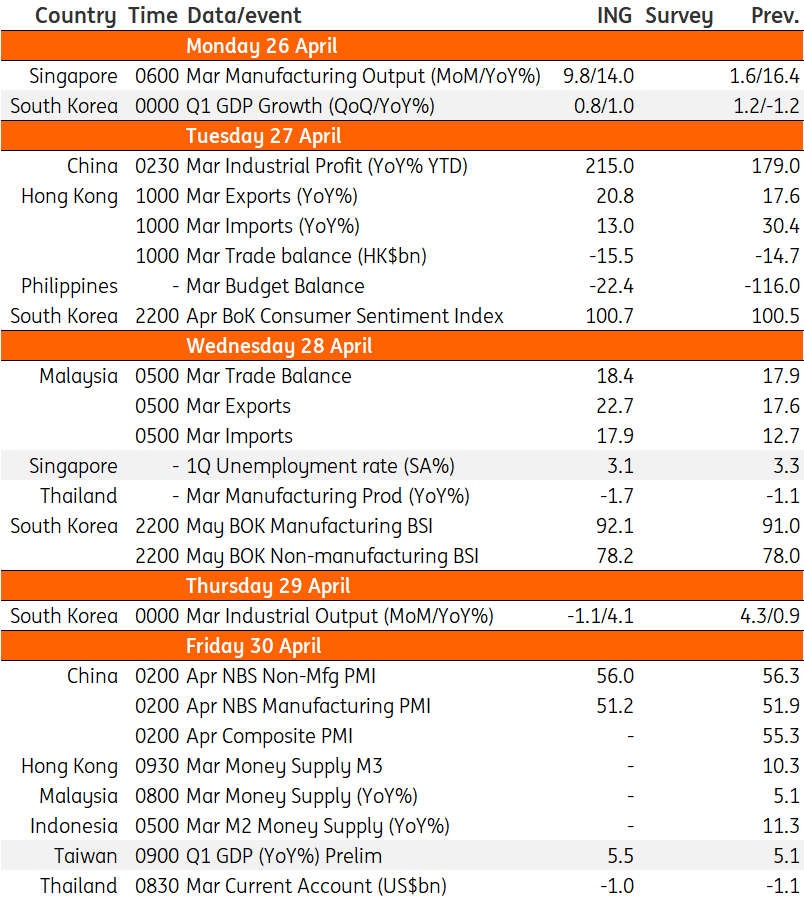

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Asia week aheadDownload

Download article

22 April 2021

Good MornING Asia - 26 April 2021 This bundle contains 3 Articles