Key events in Asia next week

Besides trade war noise, economic releases on GDP, manufacturing, and inflation will be the highlights of the Asian economic calendar in a shortened trading week

Next round of US-China trade tariffs kicks off

First some good news. Latest media reports of trade negotiations resuming between the US and China by the end of August lift hopes of trade tension being averted. However, this comes as the US gets ready to implement the second round of tariffs on $16bn of Chinese goods. The kick-off date is set for next Thursday (23 August).

Markets should have taken the next batch of tariff implementation into their stride by now, but with the consultation for the next phase of tariffs already underway and set to be completed by early September, trade war concerns are unlikely to fade from being an overhang so soon - a small tweet-trigger by President Trump is enough to unsettle markets.

Thailand’s economy to get 2Q report card

Thailand’s GDP data for the second quarter comes in on Monday (20 August). We think the economy performed better than expected in the last quarter, drawing support from continued strong exports and manufacturing. We recently raised our second quarter GDP growth forecast for Thailand from 4.0% to 4.5%, implying only a modest slowdown from 4.8% growth in 1Q.

Thailand’s July trade data is also due next week and is likely to reveal exports strength continued at least in the second half of the year. Trade war risk makes things uncertain for the rest of 2018, and with the likelihood of inflation falling short of the central bank’s 1-4% in the coming months, an on-hold Bank of Thailand monetary policy looks like a safe bet.

| 4.5% |

Thai GDP growth forecastConsensus for 2Q is 4.3% |

A slew of manufacturing and inflation data elsewhere

July manufacturing data from Singapore and Taiwan comes as an initial guide to 3Q GDP performance for these countries. The heavy reliance on exports makes these economies vulnerable to the US-China trade war contagion. Judging by the already existing July trade data from Asia, there hasn't been an obvious dent in exports just yet. Singapore non-oil domestic exports (NODX) for July due tomorrow (17 August) will be key for manufacturing growth.

Malaysia and Singapore report July CPI data next week, but that shouldn't be a cause for concern.

In Singapore, weak housing and transport CPI components are likely to have had a further negative boost in July. The rebate of Services and Conservancy Charges (S&CC) for public housing depressed the accommodation CPI component, while lower cost of Certificate of Entitlements (COE) for vehicle ownership weighed on the private road transport component. Stripping these two components from the total, core CPI inflation is likely to be steady in July but still close to the top end of the central bank’s 1-2% forecast range.

The balance of economic risks is tilted toward growth as trade tensions dampen export outlook. We think Singapore's policy tightening will prove to be one-off for some time.

In Malaysia, the lingering effect of the Goods and Services Tax removal is expected to keep inflation low. Like Thailand, low inflation should be accompanied by firmer GDP growth. Look out for Malaysia's 2Q GDP report tomorrow (17 August) – supporting our baseline of no change to the central bank (BNM) policy in the remainder of the year.

A short trading week for Southeast Asian markets

It will be a short trading week for South and Southeast Asian markets - the Philippines has a public holiday next Tuesday (21 August) and India, Indonesia, Malaysia, and Singapore markets are closed on Wednesday.

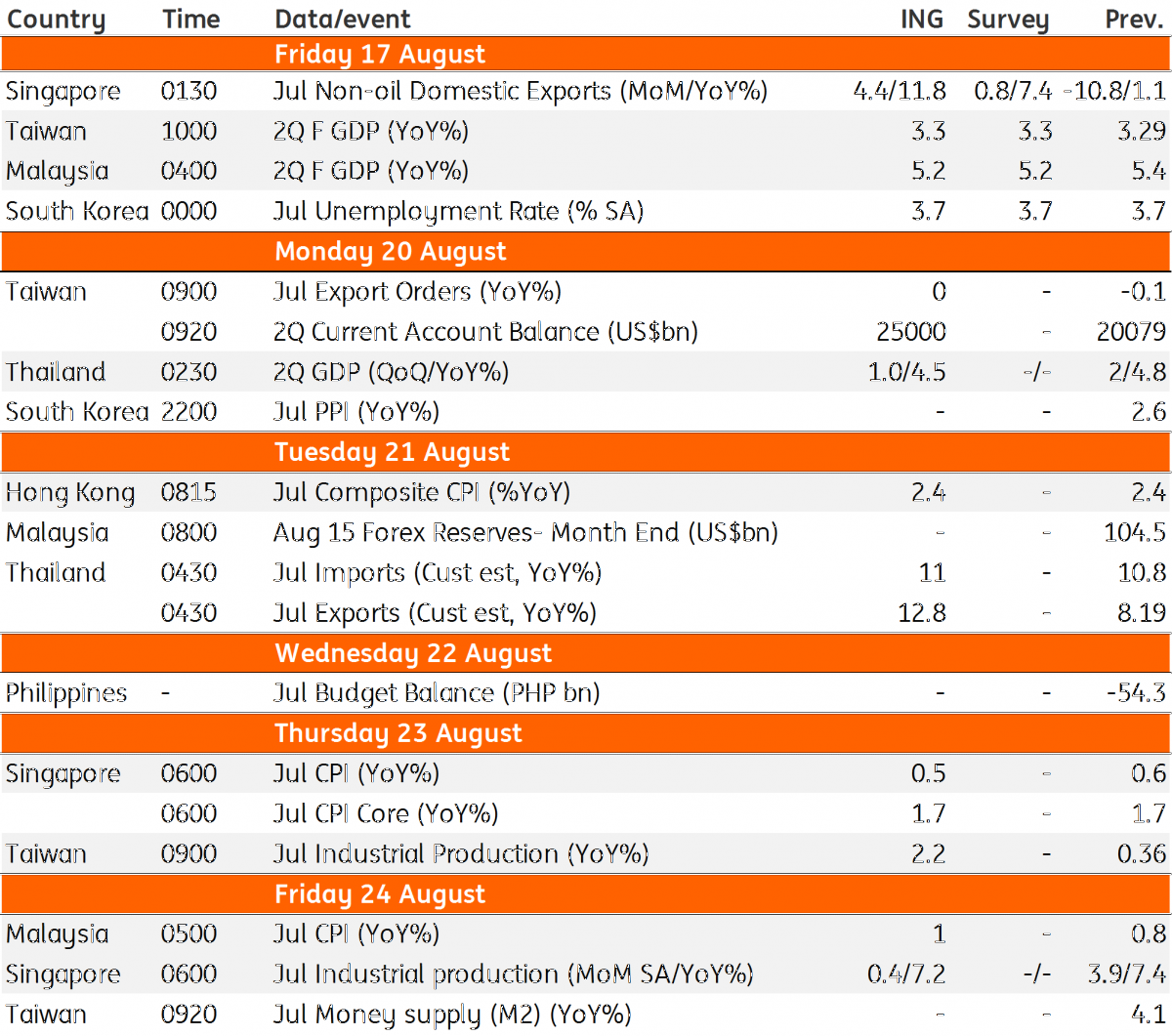

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article17 August 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).