Asia week ahead: Spotlight stays on China

All that matters for markets is news about the epidemic and how the outbreak will impact economies around the region. Unfortunately, this week's data won't do much to help

Scant economic data from China

As the number of infections and fatalities from the coronavirus continues to rise, the economic data from China remains under scrutiny for the impact of the disease. However, it’s a bit too early for data to capture the impact of the disease, which is still evolving. There isn't much on the calendar this week either, aside from inflation and monetary indicators for January.

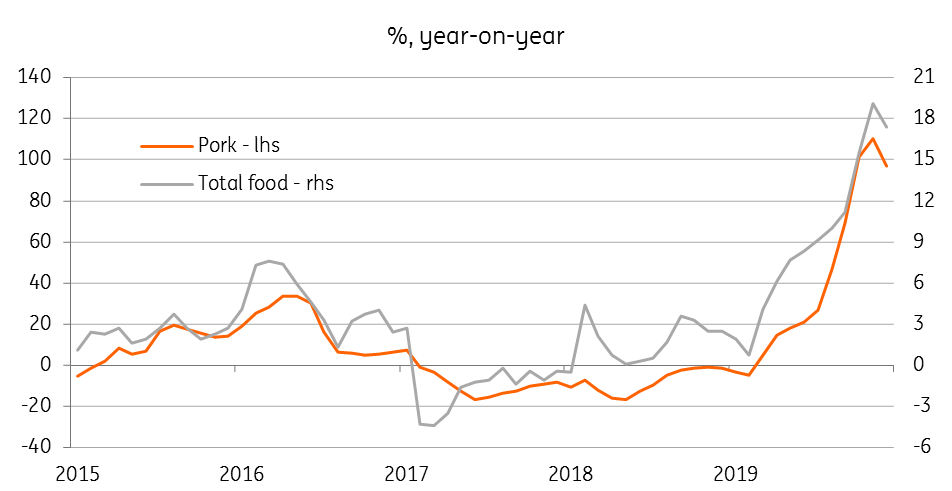

Higher food prices typically boost consumer price inflation in the New Year month. And one of the main drivers within the food category is pork prices. As an added whammy this year, an African swine fever has swelled pork prices out of proportion. On the flip-side though, one could wonder whether the outbreak of the virus and its spread countrywide dampened new year festivities and the food price increase was rather muted.

All that said, in line with consensus we are looking for CPI inflation advancing to 4.9% YoY from 4.5% in November. On the monetary side, behind the consensus of a bounce in new bank lending and aggregate financing lies the pre-holiday boost to the liquidity by the central bank (PBoC).

China Consumer Price Inflation

Not much going on elsewhere either

India’s January CPI data is likely to testify to the central bank's decision last week to leave policy on hold. We expect inflation to remain elevated, but no change from a 7.4% YoY rate in December. The fresh harvest entering the market should ease some pressure on food prices, but that’s likely to be offset by firmer fuel and utility prices.

In Malaysia, moderate manufacturing growth in the fourth quarter of 2019 suggests the same about GDP growth for the period, bringing the annual growth last year to 4.5%, down from 4.7% in 2018. With the coronavirus threatening tourism and overall demand, we would expect a couple more quarters of a slowdown ahead. If so, the Bank Negara Malaysia easing cycle will have further to run, while the government is also drafting a stimulus package.

Elsewhere, the Reserve Bank of New Zealand's policy meeting will almost be a non-event judging from the unanimous consensus forecast of no change to the 1% policy rate. Indonesia’s 4Q19 current account data may have some negative bias for the rupiah as the deficit is expected to widen.

Asia Economic Calendar

Download

Download article

10 February 2020

Good MornING Asia - 10 February 2020 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).