Asia week ahead: Regional PMI reports and industrial output data

Regional PMI reports and industrial output data are the highlights of the coming week

Regional PMI readings: weak manufacturing PMI is expected

China’s PMI is expected to follow the declining trajectory of the previous months. The worrying amount of Covid cases in China led to the tightening of measures in multiple cities including in the tech hub of Shenzhen, as well as a weeks-long lockdown in Chengdu. This could contribute to falls in orders, employment and business confidence, leading to the Caixin Manufacturing PMI and NBS non-manufacturing PMI falling for the fourth straight month. The impact of the economy might be cushioned for large-scale and state-owned firms surveyed in the NBS manufacturing PMI as orders and input costs for these companies are stable and business sentiment is less affected, contrary to that of private companies.

In Japan, we believe that the reopening of the economy is likely to support service sector activity. Thus, the composite PMI is expected to rebound mainly on a rise in the services PMI while the manufacturing PMI continues to fall.

In Korea, local business surveys are due to be released next week, and these are expected to deteriorate amid several headwinds, such as high interest rates both at home and abroad, production disruptions at major steel factories due to typhoons, and poor performance expectations in the semiconductor sector. The recent depreciation of the Korean won probably played a role in worsening the sentiment as well.

Regional industrial production data points to a slowdown

Japan, Korea, and Singapore will release their August industrial production data next week which will suggest a slowdown in manufacturing activity throughout the Asian region. In Japan, despite a boost from the reopening, industrial production in August is expected to take a breather and decline moderately after a strong gain over the past two months. South Korea's industrial production is expected to contract more intensely on the back of weak output from automobiles and IT/semiconductors. In Singapore, we also expect a modest monthly decline as the manufacturing PMI fell in August. However, as the material shortage situation has improved since June, the magnitude of the decline should be smaller than in the previous month.

India's repo rate

The Reserve Bank of India will meet on 30 September to discuss interest rates. It is likely the Bank will hike its key repo rate by 30bp to 5.7%. As inflation rose from 6.7% in July to 7% in August, policymakers should continue to feel the pressure and increase repo rates in an attempt to cool the economy.

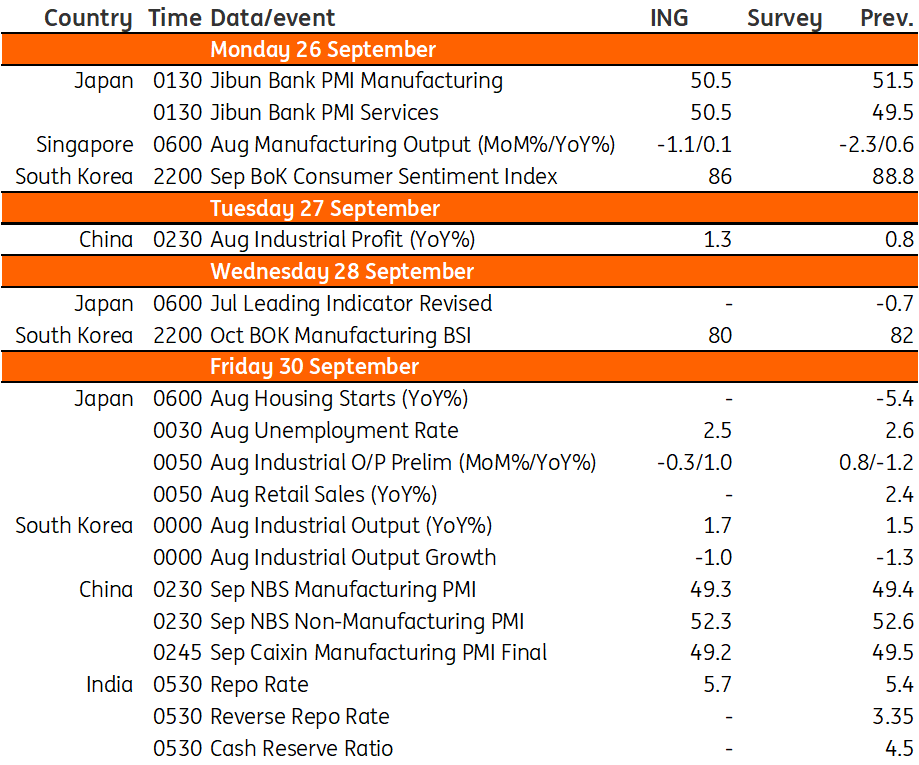

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 September 2022

Our view on next week’s key events This bundle contains 3 Articles