Asia week ahead: Regional inflation and GDP reports out next week

Inflation readings and growth reports are the highlights for the coming week

Inflation readings from Australia, Tokyo and Singapore

Following Australia’s recent strong labour report, 2Q22 CPI will need to come in soft to avoid another 50bp rate hike by the Reserve Bank of Australia at its 2 August meeting. A stronger inflation figure could bring 75bp hikes into play, but with the wage cost index for 2Q still to come later in August, we believe the RBA can take its time, especially as the Bank meets monthly. The RBA may be less pressured to deliver bigger increments at each meeting than say the US Federal Reserve, which meets less frequently.

We anticipate the 2Q CPI figure rising 1.2% quarter-on-quarter from the previous quarter (a bit less than the 1.9% QoQ gain in 1Q22) but still taking the year-on-year inflation rate to 5.5%-5.6%, up from 5.1% in 1Q22.

Singapore also reports inflation next week and we expect headline inflation to accelerate further, settling at 5.9% for the month of June. The potent mix of supply side pressures and resurgent demand are expected to drive prices higher which should also be reflected in a higher core inflation reading. Faster inflation could keep the Monetary Authority of Singapore (MAS) on notice with further tightening a possibility despite several tightening moves by MAS to date.

Meanwhile, Tokyo CPI inflation is likely to stabilise as commodity prices fell mainly due to the government’s subsidy programme.

Growth momentum slowing in Korea and Taiwan

The coming week also features growth reports, with Korea’s 2Q GDP expected to decelerate from the first quarter. The contribution from net exports likely turned negative while manufacturing activity worsened during the quarter due to supply chain disruptions. However, we believe that the reopening of the economy and fiscal support, which began in early June, should partially offset the slowdown.

Taiwan's 2Q GDP should also be slower than the first quarter due to logistical disruptions from Mainland China’s lockdowns from March to May. Weaker consumption demand for handsets in Mainland China could further derail the growth of semiconductor manufacturing, which is a key support to the economy. As such, industrial production for June should reflect growth similar to that in May of roughly 4%-5%, with potential for a downside surprise.

India’s fiscal deficit

The May fiscal deficit for India moved quite a bit higher than for the same month last year, with pressure on government finances to absorb high prices of global commodities through subsidies and reduced excise revenues. We think the June numbers may also overshoot what would be consistent with the government’s 6.4% fiscal deficit target for FY22/23.

Other important releases

Other important data releases next week include China’s industrial profits, which should show a small contraction on a yearly basis in June. However, the continuous contraction in profits implies that the number of jobs offered by manufacturing industries should be fewer than last year. This would put pressure on consumer purchasing power and therefore demand for goods, which will in turn affect production activity further.

Japan’s June industrial production is likely to increase after having contracted for the past two months amid better external demand conditions coupled with a modest pickup in retail sales.

Lastly, Korea reports a slew of reports covering both soft and hard data. Soft data, including consumer and business sentiment, is expected to remain soft. The Bank of Korea’s recent 50bp rate hike is believed to have dampened consumer sentiment due to the burden of household debt and has raised concern about future investment.

Meanwhile, Korea’s hard activity data should improve. Industrial production is expected to bounce, led by the normalisation of production activity in the automobile sector while services are expected to continue to improve thanks to the reopening of the economy.

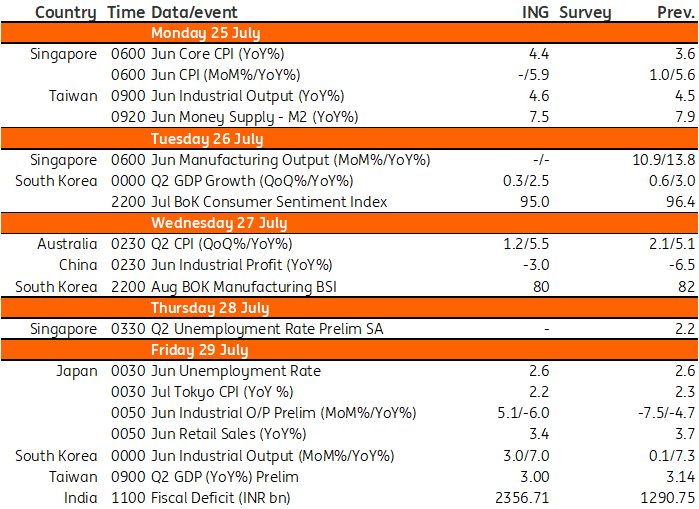

Asia Economic Calendar

Download

Download article22 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more