Asia week ahead: Malaysian central bank decides policy

Monthly data dump in China and Japan packs the Asian economic calendar next week, but our focus will be on Malaysia's central bank's decision

China and Japan data dump

August activity data from China including trade, foreign reserves, inflation and monetary indicators will be under the spotlight for the economic recovery in the current quarter.

Exports are back in play to be the key driver for Asia's biggest economy. At $237.6 billion in July, China's monthly exports were just shy of the $238.3 billion record level achieved in December 2019. If materialised, our forecast of a 16% year-on-year rise in August will lead to a new record of $249 billion. The persistently large trade surplus and hot money inflows in the global risk-on rally in August should shore up foreign reserves. Inflation should remain subdued and monetary data should underscore continued accommodative policy.

Exports are back in play to be the key driver for Asia's biggest economy. At $237.6 billion in July, China's monthly exports were just shy of the $238.3 billion record level achieved in December 2019

The Japanese economy has been reeling under the Covid-19 impact on consumer and business spending. Labour cash earnings and household spending growth is likely to remain in negative territory in July, although to a lesser extent than in June. Businesses continued to observe caution on their capital spending given low confidence currently, as the July core machine orders and 3Q BSI Confidence Index releases will likely confirm.

| 1.50% |

ING forecast of BNM policy rateAfter a 25bp cut next week |

Malaysia central bank meeting

The Malaysian central bank will meet next week in a two-day meeting to be concluded on Thursday, 10 September. We have long been calling a 25 basis point rate cut at this meeting, taking the overnight policy rate down to a fresh low of 1.50%.

Even as Malaysia remains largely immune to the Covid-19 outbreak, its economy was one of the hardest hit in Asia with a 17% YoY GDP plunge in 2Q. Things are looking better as we move into 3Q with a second straight monthly export bounce in July boosting the trade surplus to the highest ever, 25 billion Malaysian ringgit (MYR). While this bodes well for GDP growth, a couple more quarters of negative GDP growth still looks inevitable.

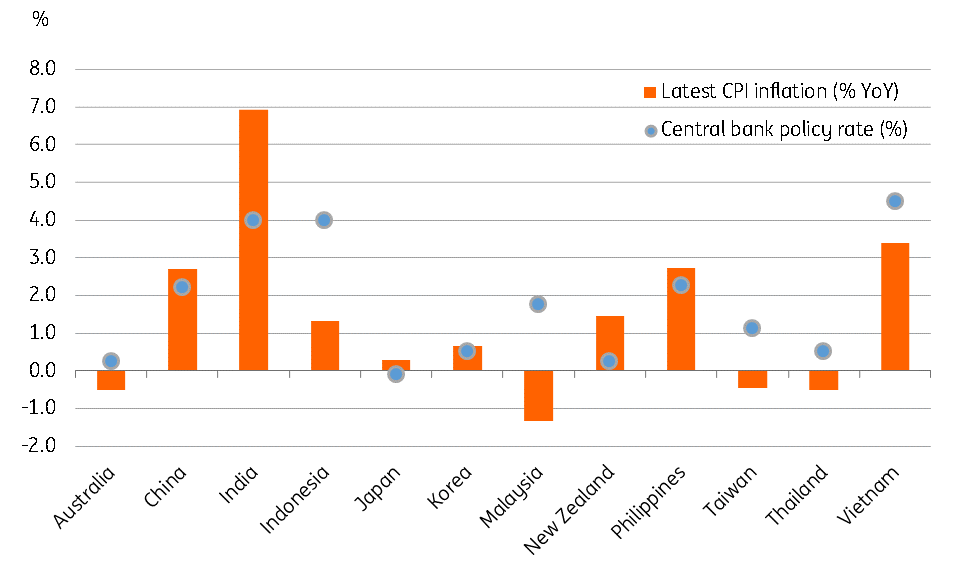

Substantiating the rate cut argument further is the negative CPI inflation streak that’s likely to prevail through the rest of the year as a result of anaemic domestic demand. With -1.3% YoY inflation in July, the real policy interest rate is one of the highest in Asia (see figure) -- not a good backdrop for economic recovery.

And, the relative outperformance of the MYR in the emerging market rally since June should provide more comfort to the central bank in cutting rates to stimulate growth.

Real interest rate* in Malaysia is one of the highest in Asia

Asia Economic Calendar

Download

Download article4 September 2020

Our view on next week’s events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).