Asia week ahead: Big policy week in India

India takes the spotlight next week with its FY21-22 budget and the central bank meeting shaping expectations of the economy’s recovery. Sustained easier policies remain the order of the day, not just in India but elsewhere too

India: Not the right time for policy reversal just yet

Next week, India unveils its FY21- FY22 budget on 1 February.

With close to 10% GDP contraction sharply denting revenue and record stimulus spending, the fiscal deficit is going to be through the roof in the current fiscal year (new fiscal year starts on 1 April). Our forecast for the deficit is 7.1% of GDP, which is twice the initial target of the government at 3.5% for the year (and up from 4.6% in the previous year). The risk to this forecast is tilted to the upside.

The government may strive for some fiscal consolidation without losing sight on the policy objective of supporting recovery.

This may call for some fiscal consolidation in FY21-22, of course without losing sight of the main policy objective of supporting recovery and, at the same time, boosting investor confidence and thus keeping sovereign downgrade risk at bay. It’s a balancing act.

There has been news of possible hike on import duties, which aside from raising more revenue also serves the government’s ‘Make in India’ drive. There may be some spending curbs in the pipeline too. We anticipate the deficit being programmed to fall below 6% of GDP. Yet, we don’t think it’s time for fiscal consolidation given that the headwind to the economy from Covid-19 pandemic is likely to remain strong.

The key question for the RBI meeting is whether the central bank see through the recent dip in inflation and leave policy on hold?

The Reserve Bank of India also meets on 5 February. The return of inflation to the RBI’s 2-6% policy target zone in December, after a year of remaining above-target, could tip the central bank to resume its easing cycle. However, any such move could prove to be premature, especially as the inflation risk isn’t yet fully eliminated.

The banking system remains flushed with liquidity, which is potentially inflationary. Nor do we think it’s the right time to unwind policy accommodation just yet.

Rest of Asia: Data-packed calendar

China’s official purchasing manager indices due over the weekend and the Caixin counterpart due out on early Monday will set the tone for Asian markets.

The January data may reflect some front-loading activity ahead of the Lunar New Year holiday in mid-February. Likewise, Korea’s trade figures for January, which will be the first to provide a glimpse of regional exports coming into the new year. We see electronics remaining to be the main exports driver as the global semiconductor cycle is in the full swing.

The January data may bear out some front-loading of activity ahead of the Lunar New Year holiday in mid-February.

Among January CPI inflation data next week, Indonesia and the Philippines should stand out, given that inflation in both countries has started to tick up in recent months and likely remained on the upward path in January, closing the door on more rate cuts. Other countries to release CPI figures are Korea, Taiwan and Thailand and all are extremely low or close to negative inflation. Hong Kong and Singapore also sit in this group as their retail sales data should show.

The Australian and Thai central bank are also due to meet next week and both are expected to stay on hold. The ultra-low policy rates at 0.10% and 0.5% respectively are here to stay throughout 2021.

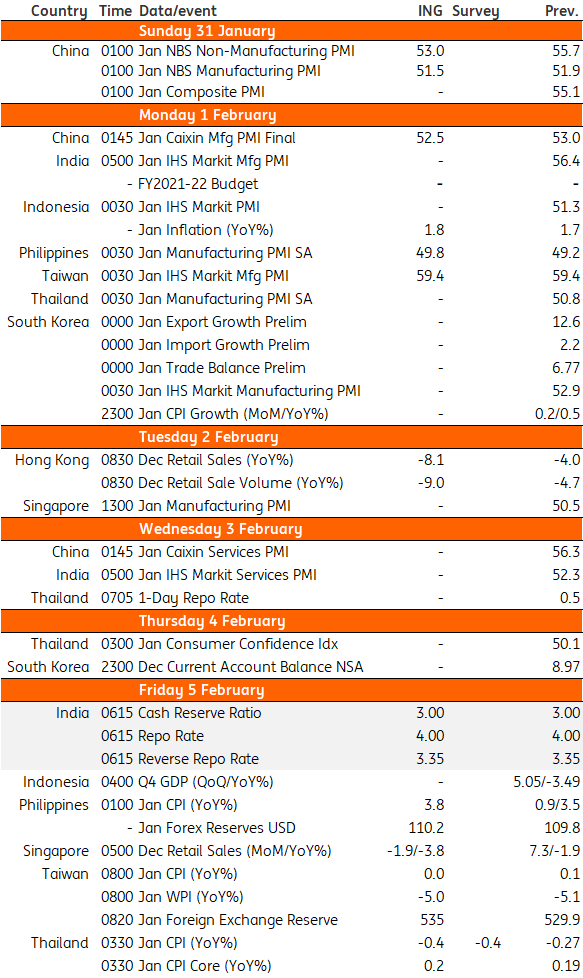

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article29 January 2021

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).