Asia week ahead: Indonesia and Philippines unscathed

Data on trade, inflation, and GDP, together with central bank policy meetings is likely to add to the market volatility, but concerns around the slowdown in China remain at the fore. Surprisingly, the consensus around the growth forecasts for Indonesia and the Philippines isn't that bad given the duo were the hardest hit economies by the EM contagion

China slowdown concerns downplayed

China’s October data dump started this week on a mixed note.

The official manufacturing purchasing manager's index fell in October, but its Caixin counterpart rose, but both indexes remained in the expansionary territory - a figure above 50. However, what is striking is the seventh consecutive fall in the PMI new export orders component, a sign of the trade war impact slowly coming through.

However, the hard data paints a positive picture. The average 12% year on year growth of China’s export in the first nine months of this year was twice as fast as a year ago and based on our house forecast of 23% YoY growth in October, the strength persisted into the final quarter of the year, even as the US tariffs on $260bn of Chinese goods took effect. Likewise, a 23% surge in Korea’s exports in October reinforces the message.

But Beijing isn’t quite as relaxed. This week China’s Politburo signalled timely measures to counter the slowdown, and the State Council announced a stimulus plan but stopped short of revealing the total amount. We suspect the details must be in the making and will drive the markets as soon as they hit the newswires over the coming weeks.

| 23% |

China's October export growthING forecast |

Indonesia and Philippines on steady growth path

It wasn’t all bad for Indonesia and the Philippines - the two Asian economies hit hardest by the emerging market contagion in the third quarter. At least that’s what the consensus 3Q GDP growth forecasts for the duo suggest.

Despite the aggressive tightening by respective central banks, the 5.2% consensus estimate for Indonesia is hardly a slowdown from the 5.3% pace of the previous quarter, while the Philippines’ growth rate sped to 6.4% from 6.0%.

Firmer growth also means greater resolve by central banks to tighten the policies if emerging market contagion hits again as external risks loom large. But with the inflation pressure in both economies starting to subside and currencies stabilised, the tightening pressure also appears to have eased. Inflation in Indonesia remains anchored at the 3% level and is expected to recede from the 6.7% peak reached in September in the Philippines. That said, we still expect one more 25bp policy rate hikes by Bank Indonesia and the Bangko Sentral ng Pilipinas before the end of the year.

| 6.3% |

Philippines 3Q GDP growthING forecast - Up from 6% in 2Q |

Malaysia's central bank to stay on hold

Malaysia’s 2019 budget, due to be released tomorrow will set the tone for local markets for the week in which the country’s central bank also announces its monetary policy decision. Coming just ahead of the meeting, September data on trade and industrial production will be key inputs for the Bank. We expect the Bank to remain on hold and leave the policy rate at 3.25%. And we aren’t alone; there is a solid consensus behind this view.

The activity data will reinforce a sustained slowdown in Malaysia’s GDP growth. This warrants continued monetary policy accommodation to the economy, especially when weak public finances are squeezing the fiscal support. The government budget deficit is poised to rise above the 3% mark in the current year (ING forecast 3.2%) and remain there through 2020.

| 3.25% |

BNM policy rateTo be unchanged through 2019 |

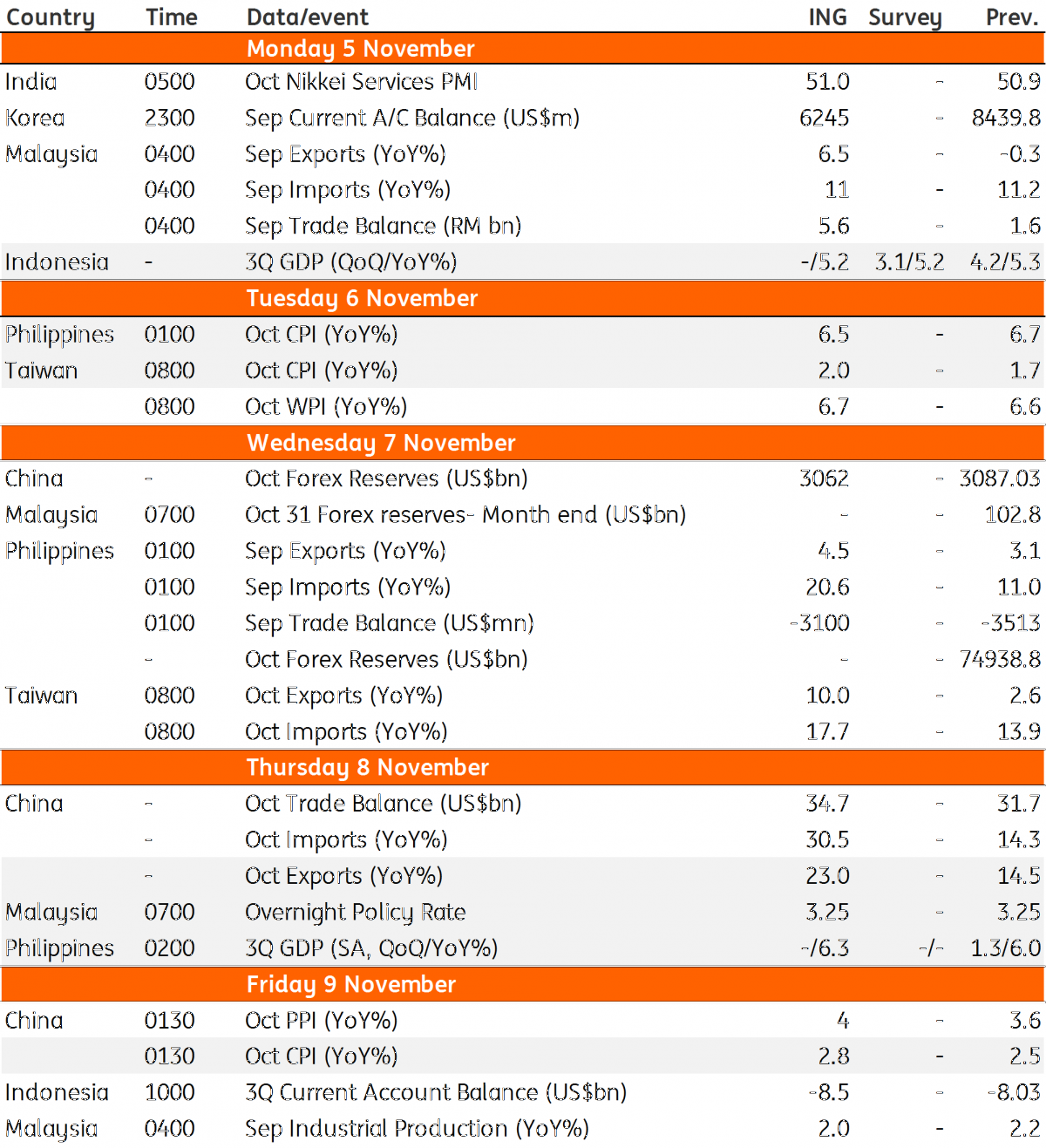

Asia Economic Calendar

Tags

AsiaDownload

Download article2 November 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).