Asia week ahead: Entering another exciting month

Trade, manufacturing, and inflation releases dominate next week’s Asian economic calendar, but the trade war will continue to dominate headlines. With several other important events lined up, we are in for another exciting month

Get ready for an exciting September

The trade war will persist as a major overhang on global and Asian markets. The consultation period for further US tariffs on China ends next week (5 September) after which Washington could impose duties on another $200 billion worth of Chinese goods. China has pledged $60 billion of retaliatory tariffs on US products.

We believe the markets are pretty much priced for this oncoming trade risk and are unlikely to be jolted by it. Hopefully, a stable start to the new month will also bring more clarity on a host of other important economic issues in developed markets; the Fed’s tightening cycle, the ECB tapering timeframe, and the Brexit deal. And if that's not enough, the contagion risks from emerging economies continue to linger with Argentina and Turkey remaining on edge, so we'll be in for a month full of excitement and elevated market volatility.

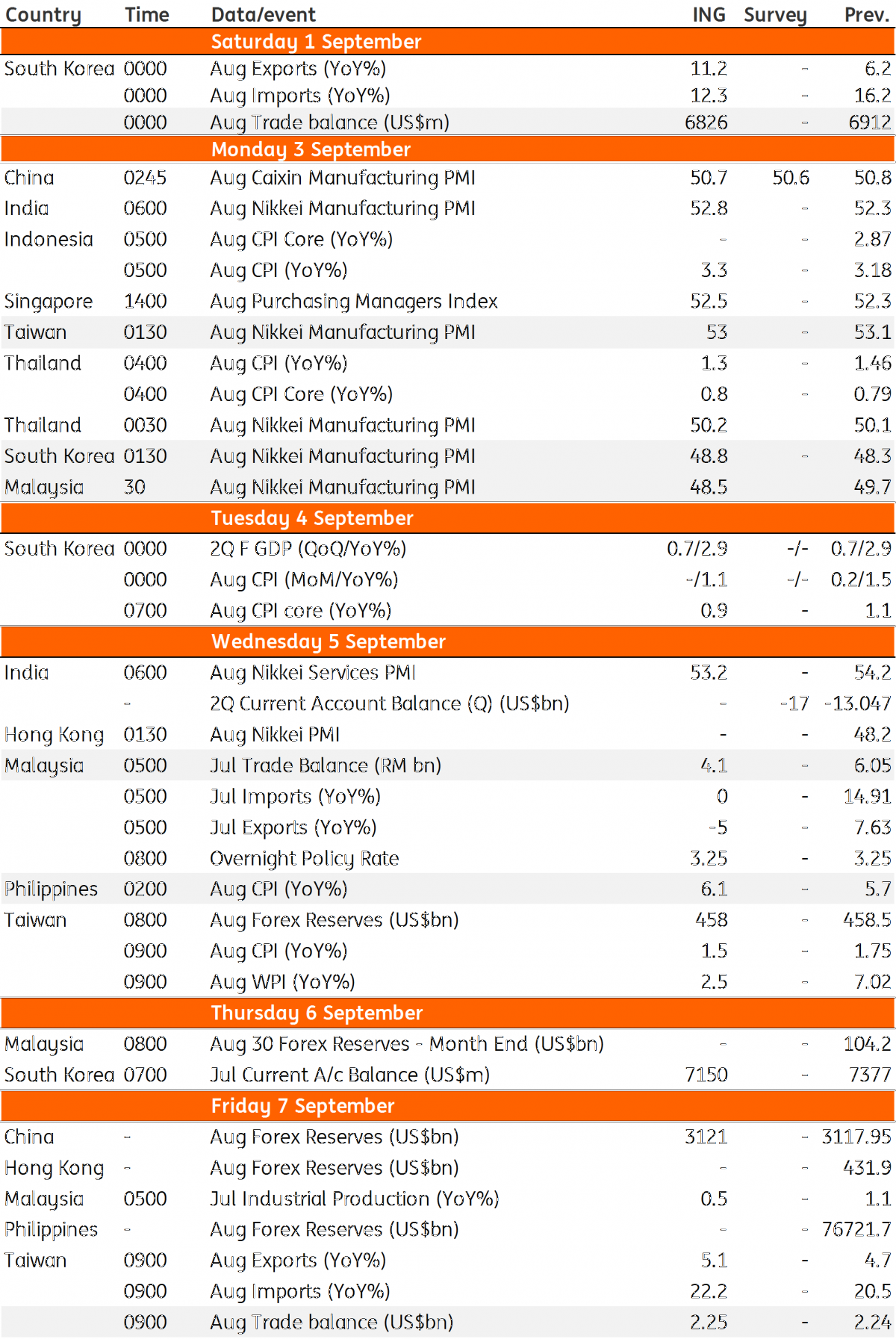

On the data front, next week in Asia is packed with trade, manufacturing and inflation releases from across the region. There is little on the policy front except for a Malaysian central bank (BNM) meeting which will likely be a non-event, though ugly inflation data from the Philippines will keep the central bank there (BSP) on its toes.

Export performance still not too bad

August trade releases from Korea and Taiwan, the first for the month from the region, will be closely watched for the trade war impact. The focus will also be on the manufacturing purchasing manager indexes (PMIs) from around the region, particularly the new export orders component.

Our house forecasts for export growth - 11% year-on-year for Korea and 5% for Taiwan- imply positive month-on-month gains for two consecutive months, indicating there has been no impact yet from escalating trade tensions. Already-released data showing a 15% year-on-year surge in Korean exports in the first 20 days of August confirms this point.

Semiconductors continue to be the main driver of Korean exports but tariff-hit steel exports are also holding up. It looks like the shift in trade away from the US to other countries has already started, judging by the recent surge in Korea’s and Japan’s steel exports to India.

Philippines inflation monster rears its head higher

There's a slew of August inflation data from the region next week but figures from the Philippines’ will be the most important. We see inflation surging past the 6% mark for the first time in over a decade from 5.7% in July, consistent with the consensus centred on 6%. Bad inflation data will keep the central bank (BSP) on its toes, even as the currency (PHP) has stabilised from a Turkish-led downturn in early August.

High inflation and twin-deficits (trade and government) have kept the PHP under intense weakening pressure this year, with a 6.6% year-to-date depreciation. The question is, will the BSP overlook the inflation data and wait for the recent 100 basis point rate hike to take effect. The current economic backdrop suggests the BSP policy tightening has further room to run. The next BSP meeting is on 28 September. We expect the BSP to pause at this meeting but hike again in the final quarter of the year.

Asia Economic Calendar

Download

Download article31 August 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).