Asia week ahead: Engineering a soft Chinese landing

China’s economic data will provide a sense of GDP growth in the first quarter of 2019. Indian inflation numbers are out too, though we don't expect it to become a policy problem this year. Elsewhere, trade releases dominate the calendar in the region

China’s monthly data dump begins

China’s monthly economic data dump for February has just started and will continue to come through for most of next week. The data is distorted by the Lunar New Year holiday in February, so it should be read in conjunction with the January figures. The Bloomberg consensus estimates point to weak growth for most activity indicators, suggesting a further slowdown in China’s GDP growth this quarter.

The authorities are engineering a soft-landing of the economy with fiscal pump-priming

But it all depends on reaching a trade deal with the US. The news on that front has been increasingly positive, and if things stay that way, should counter negative market impact from the hard data.

Indian inflation - race to the bottom is over

We also get most of India’s February economic data next week. All the excitement here lies in the inflation rate after it hit the low-end of the central bank’s 2-6% target in January.

We don’t see any further downside from here as the food component - the main source of disinflation last year is about to snap its declining streak. Among other drivers, the effect of rising global oil prices to domestic fuel prices and a significant fiscal thrust to domestic demand will sustain the upward pressure on prices. That said, we don’t expect inflation to become a policy problem again this year. But this doesn't mean the central bank will have more room to cut policy rates further.

Among other Indian data, trade and industrial production are likely to underpin further moderation of GDP growth in the current quarter. Like Indonesia and the Philippines, high trade deficit remains a key negative for the rupee. With rising political uncertainty, currency appreciation isn't going to be a lasting relief for investors in the Indian markets.

| 2.5% |

ING forecast of India's inflationIn February |

Better trade news for Indonesia, but not Philippines

Trade releases in Indonesia and Philippines matter for their currencies. We anticipate firmer growth in Indonesian exports in February pushing trade deficit to its lowest in the last five months. The Indonesian rupiah has been recovering this year from the heavy losses of 2018, thanks to the government’s measures to curb imports and deficit.

The Philippine peso has also been in consolidation mode this year, but there hasn’t been any relief for the currency from external payments. The trade deficit continues to be high, running around $4 billion per month, and remittances from overseas Filipinos, which historically covered for the deficit, have been insufficient, running around $2.5bn. Next week's trade and remittances releases for January are unlikely to show any departure from these trends.

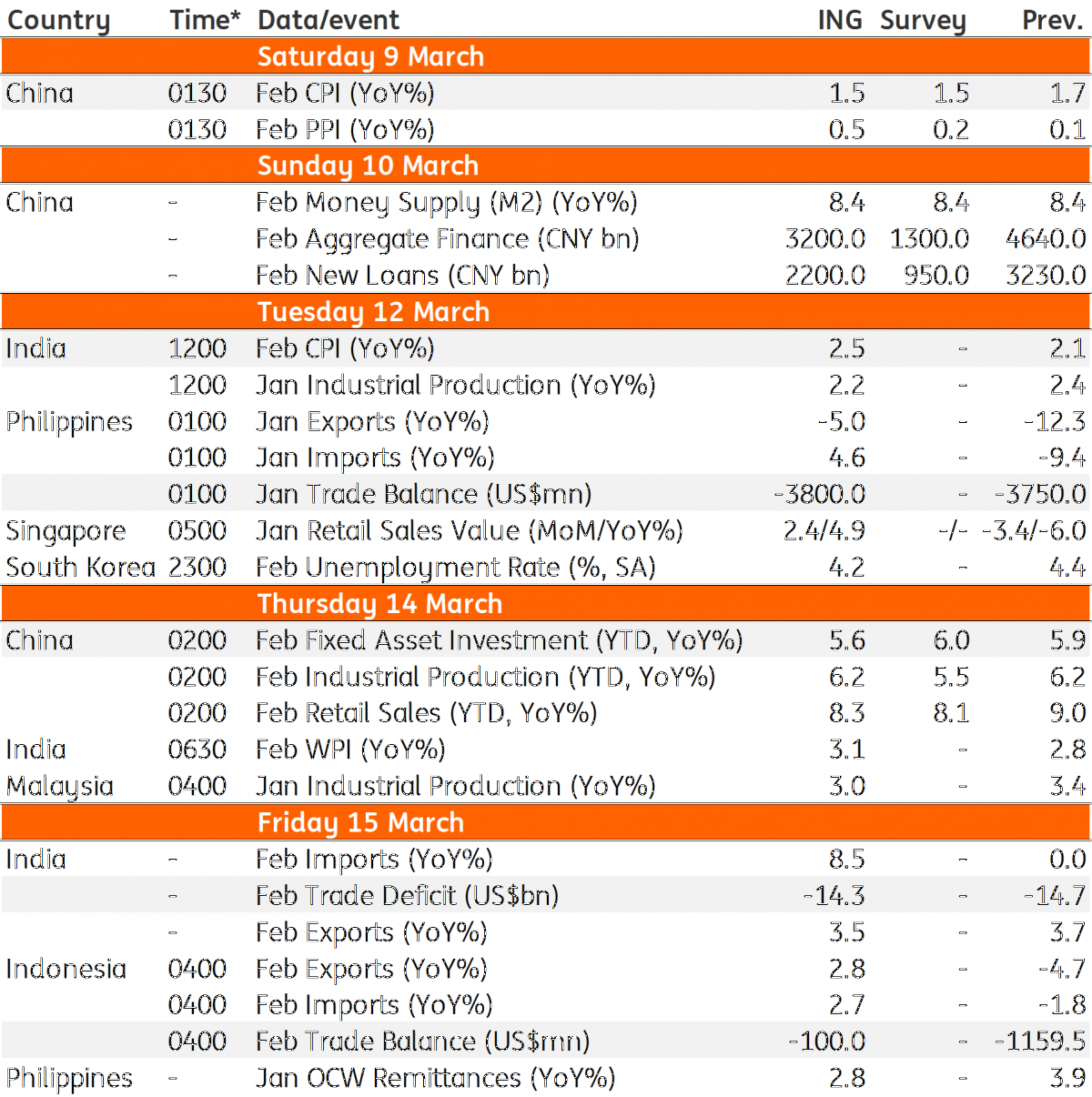

Asia Economic Calendar

Download

Download article8 March 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).