Asia week ahead: Chinese holiday may reduce market volatility

Plenty of activity data and central bank meetings should keep markets busy, though the National Day Golden Week holiday in China may provide some respite from recent elevated volatility

Manufacturing data dominates

The usual end- and start-of-the-month activity releases dominate the calendar at the crossover from September to October and a typical focus around this time is on purchasing manager indices.

As we see from advance September PMI releases in developed countries, manufacturing has likely gained some more traction while services continued to suffer.

China’s PMIs are usually more market-moving than those in the rest of Asia. We expect a slightly higher manufacturing index but a lower services PMI than August readings, though both indices should stay comfortably in growth territory. Meanwhile, China’s industrial profits data for August due over the weekend will be another clue to manufacturing recovery.

Judging from upbeat August exports and industrial production (up 9.5% YoY and 5.6% YoY, respectively), profits growth remain strong. If so, firms should continue to expand production, in our view. But, as they gear up for the long National Day holiday (1-8 October), the local markets might overlook this data flow.

Korea’s export data for September - the first from the region, will be a leading indicator for the rest of Asia’s export recovery. The upturn of the semiconductor cycle bodes well for Asia's electronics heavyweights, such as Korea, and the same goes for Malaysia, which reports August trade data next week.

Hong Kong’s retail sales and Indonesia’s CPI inflation will tell us more about the consumption recovery, as high unemployment continues to weigh on consumer spending.

Central bank policy non-events

The central banks of India and the Philippines will meet next week and announce their decisions on Thursday, 1 October.

We believe the Reserve Bank of India’s easing cycle has ended. With inflation running well above the 6% policy limit, the central bank has no scope to ease policy any further. The RBI paused after 115bp in rate cuts from March to May. This, together with rampant liquidity measures, has pushed the real interest rate to negative and flooded the system with liquidity. Yet, bank lending growth remains on a steady downward grind. As such, additional stimulus isn’t going to be of much use for the economy. Confidence has to return first.

Likewise for the Bangko Sentral ng Pilipinas, whose chief Benjamin Diokno sees the monetary accommodation provided so far, including a total of 175bp of policy rate cuts this year, as sufficient for the next two years.

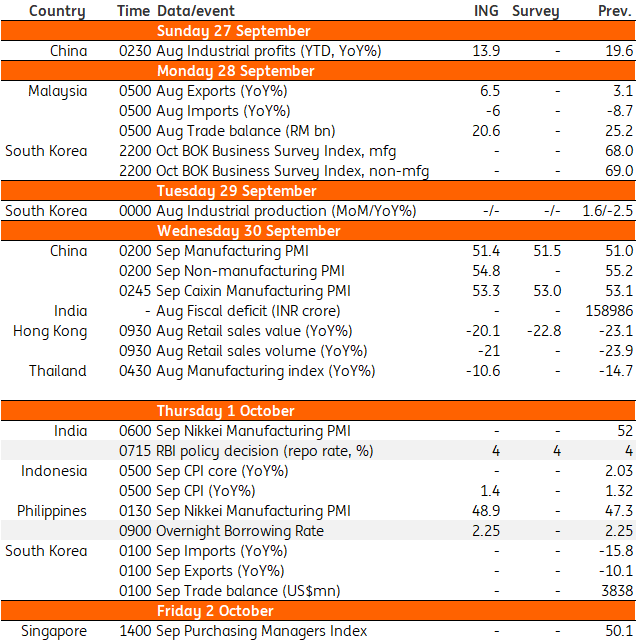

Asia Economic Calendar

Tags

Asia week aheadDownload

Download article

28 September 2020

Good MornING Asia - 28 September 2020 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).