Asia week ahead: Lots of Chinese and Indian data

Data out from China next week should show the third-quarter is off on a firmer start, but unlike China, the economic slump in India seems to be far from over and the data will only confirm that

China: More momentum

China’s July data pipeline started this week and will continue throughout next week with figures on industrial production, fixed investment, retail sales, consumer and home price inflation, and monetary and lending indicators.

We think most indicators will post better readings than they did in June, suggesting that the third quarter is off on a firmer start.

India: Not looking any better

Unlike China, the economic slump in India seems to be far from over, while resurgent inflation has closed the door on central bank monetary easing this week. We don’t think forthcoming data will alter this either.

We see July CPI inflation to be steady above the Reserve Bank of India’s 6% policy limit. Food remained a dominant inflation driver but high utility and transport costs also contributed. Real economic activity may have seen some pick up in recent months following the relaxation of the Covid-19 lockdowns, though it still remains way below the level that was seen just a year ago, as will be reflected by persistently big declines in exports and manufacturing.

Malaysia: The worst may be over

Malaysia’s 2Q20 GDP is out next week too. We forecast an 8.3% year-on-year contraction - the steepest since the 1998 Asian crisis. We think markets have almost become indifferent to downside GDP growth surprises from around the region and they are unlikely to be perturbed if Malaysia’s growth numbers follow a similar path.

With key drivers of exports and tourism missing, the negative GDP trend will remain over the second half of the year. And, with inflation continuing to be negative, the doors remain open for some more monetary easing from the central bank.

Rest of Asia: Looks pretty slow

Other things on the calendar include July labour report in Australia, a central bank meeting in New Zealand, a couple of activity releases in Japan, and revised 2Q GDP in Singapore.

We share the consensus view of a sharp slowdown in Australia's jobs growth (ING forecast 62.5k vs. 210.8k in June). There is unlikely to be much happening at New Zealand's central bank meeting with rates remaining on hold.

Singapore’s 2Q GDP might as well go unnoticed despite a likely downward revision from the -12.6% YoY first print on the back of weak June manufacturing.

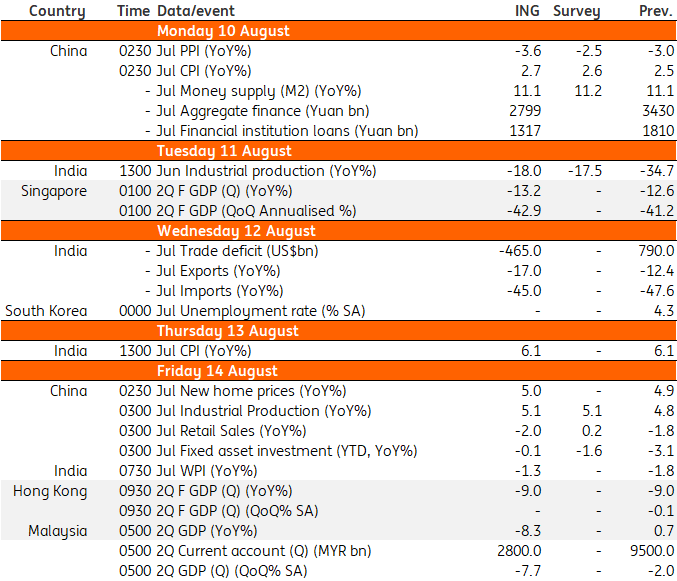

Asia Economic Calendar

Download

Download article7 August 2020

Our view on next week’s events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).