Asia week ahead: China activity data, Australia’s jobs report plus key central bank decisions

Next week’s data calendar features China’s GDP numbers, jobs data from Australia, and a rate hike by Bank Indonesia

RBA looking to jobs report next week for direction

After the disappointingly high November inflation numbers, the Reserve Bank of Australia (RBA) will want to see some evidence of slowing in the labour market if it is not going to have to raise rates more than the additional 50bp we are currently forecasting.

The consensus is for around 64,000 new jobs, which would indeed be a strong figure, and unless there was an offsetting rise in the unemployment rate, would probably prompt us to review our peak rates forecast in favour of an increase. We expect total employment of roughly 45,000 fresh jobs of which only 20,000 would be full-time jobs.

Lending rate and activity data out from China

The People's Bank of China (PBoC) will decide whether to cut the 1Y Medium Lending Facility rate (MLF) on 16 January. We expect the PBoC to pause at 2.75% as the economy is recovering. Furthermore, the government has emphasised that the central bank's actions should be more focused, and a general rate cut would not be considered a focused monetary policy move.

After the PBoC’s announcement of 1Y MLF, Chinese banks will announce 1Y and 5Y Loan Prime Rates (LPR) on 20 January. We expect no change in these interest rates as banks usually follow the move of MLF and banks’ interest margins have been thinner. But the government has urged banks to lend out more loans, which may imply banks could be under pressure to cut.

Meanwhile, China will announce activity data and GDP data between 10 and 27 January. We expect retail sales to contract deeper on a yearly basis while industrial production could turn from positive growth to mild contraction in December. This leaves the economy mainly supported by fixed-asset investments. As a result, GDP growth for the fourth quarter should be in slight year-on-year contraction.

BoJ to reiterate dovish stance while BI set to hike

The Bank of Japan (BoJ) is expected to stand pat after delivering its unexpected decision in December to expand the yield curve band. Governor Haruhiko Kuroda’s future guidance will remain dovish, but apart from that, the market appears to be pricing in additional normalisation steps from the next BoJ governor. Considering that Tokyo CPI inflation hit 4% year-on-year earlier this week, national CPI inflation for December is likely to climb up to 4%. But, pipeline prices, such as import price and producer price, are expected to be lower than in the past month.

Meanwhile, Bank Indonesia (BI) meets to discuss policy next week and we expect Governor Perry Warjiyo to start the year with a rate hike to support the Indonesian rupiah (IDR). Softer inflation reported in the past few months and fading growth momentum suggest that BI will likely opt for a 25bp rate increase which would widen interest rate differentials to support the currency.

Indonesia’s trade report to show slowing export growth

Indonesia also reports trade numbers next week. With commodity prices moderating, exports will likely manage to grow a modest 6.2% while imports could contract for a second straight month. The trade balance will likely remain in surplus but could slide to $3bn, lower than the previous month and less than half of the record $7.6bn recorded in April last year. With the trade surplus fading, we could see the IDR missing a key support in 2023, which could suggest some depreciation pressure on the currency this year.

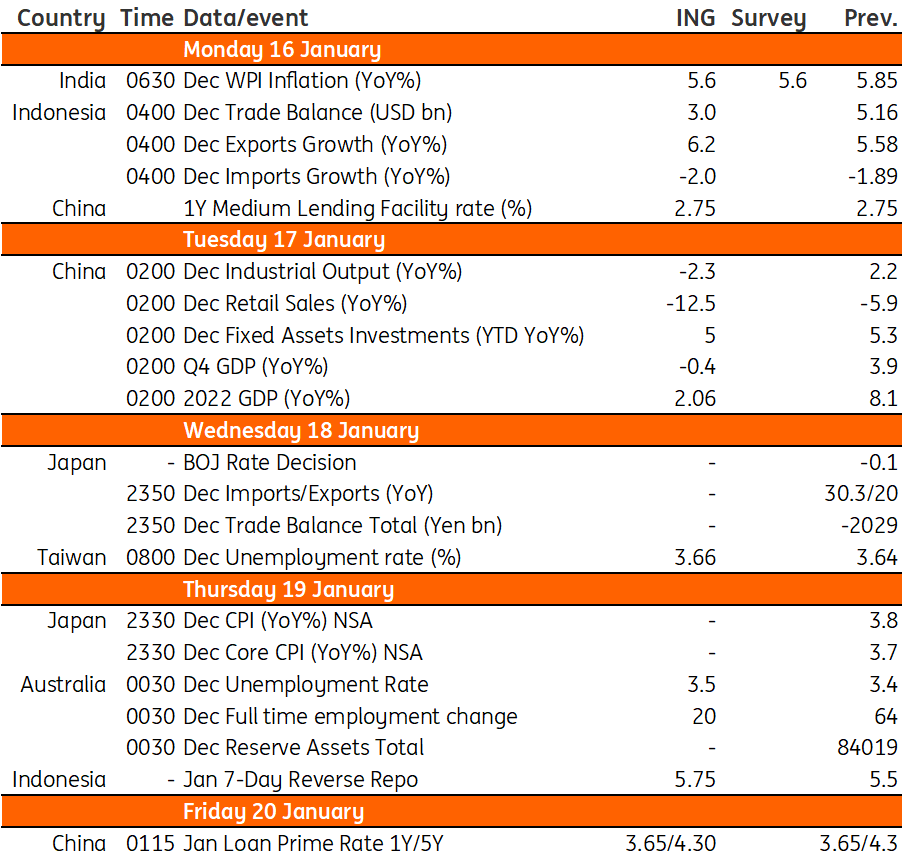

Key events in Asia next week

Download

Download article13 January 2023

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more