Asia week ahead: Is this what calm after the storm looks like?

After the escalation of the trade and currency war unleashing a whole load of central bank policy easing in Asia this week, markets may get some room to breathe in a slightly shorter week ahead. Don’t hold your breath though, there are plenty of data releases which could sustain volatility, particularly in China and India

China: Still, steady as she goes

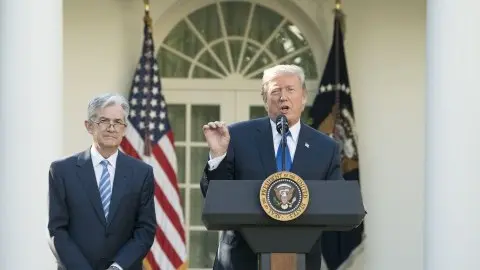

This week saw a further escalation in trade tensions, further diminishing hopes of the two sides returning to the negotiation table in September. The next event risk could be a hike in the newly-announced 10% US tariffs on $300 billion of Chinese goods, ( which are due to come into effect in September) to 25%, or even more as President Trump has hinted.

Despite all of this, the Chinese economy, especially exports have been performing quite well. Following slightly better manufacturing PMI for July, an unusual export bounce in July asserts this view, while also sustaining the upside potential for the rest of July economic data next week. Hence the above-consensus growth forecasts by our Chinese economist Iris Pang, who expects manufacturing to rise by 6.5%, fixed asset investment by 6%, and retail sales by 9.5% (consensus 6.0%, 5.9%, and 8.6% respectively). Meanwhile, July monetary data due any time from now until 15 August should reinforce that the authorities aren’t letting their guard down in providing the necessary fiscal stimulus.

India: Test of RBI’s aggressive easing

India’s forthcoming manufacturing, trade, and inflation releases will be gleaned in the light of RBI’s additional rate cut this week. Like China, India's 2% export growth in the first half of 2019 - the fastest among Asian countries - testifies that the Indian economy is performing well despite external headwinds, while stimulatory economic policies support domestic spending. As this holds a line under GDP growth, rising food price inflation has already begun to drive headline consumer price inflation higher.

With the escalation of border tensions undermining growth prospects further, we can’t rule out RBI cutting rates further this year. We now pencil in additional 50 bp easing by yearned, replacing our stable policy view.

So far economic data conforms to our view that the economy has had enough stimulus and the latest RBI rate cut wasn’t really required. However, coinciding with the RBI meeting, the events about the disputed state of Kashmir may have had government’s heavy hands in the RBI’s unexpectedly big, 35 basis point rate cut decision this week. With the escalation of border tensions undermining growth prospects further, we can’t rule out RBI cutting rates further this year. We are now pencilling in additional 50 bp easing this year, replacing our stable policy view.

The rest of Asia: Reeling under export weakness

July trade figures form Singapore and Indonesia will inform on the growth of these economies coming into the third quarter of the year. Singapore seems to be the weakest link in export performance in Asia with contraction in non-oil domestic exports now running in high teens (-17% YoY in June, -20% ING forecast for July). If so, any recovery from a sharp GDP slowdown in the second quarter would be a far cry, though we estimate a slight upward revision to 2Q growth to 0.2% YoY from 0.1% in advance report. Our Singapore watcher, Rob Carnell, sees this week's sharp fall in the 3-month SIBOR (Singapore interbank offer rate) as a clue to the imminent off-cycle central bank policy easing.

However, alongside China and India, Malaysia is also another notable exception to the export-led GDP slowdown, as what we expect the country’s GDP report for 2Q to reveal next week. Relatively firmer exports and manufacturing growth led us to raise our 2Q GDP growth forecast to 4.8% from 4.6%, following a brief slowdown to 4.5% in the previous quarter.

Also due next week is Malaysia’s inflation data for July, which is likely to underscore the lack of inflation pressures, allowing the central bank to cut rates in the event that growth deteriorates. That's not quite our baseline though, with a forecast of stable BNM policy maintained for now.

Asia Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 August 2019

What’s happening in Australia and around the world? This bundle contains 14 Articles