Asia week ahead: Australian and Indian central bank meetings

As two central bank meetings are likely to pass as non-events, the markets will be left to ponder a flood of economic activity data from around the region

Central bank meetings

The Reserve Bank of Australia (RBA) reviews policy next week, Tuesday, 1 December. The central bank is missing important data though on which to base its policy decision – the country’s 3Q20 GDP figure which will be out just a day later than the policy meeting. Whatever the 3Q GDP outcome (ING forecasts +2.5% quarter-on-quarter vs. -7% in 2Q), it’s still history and doesn't reflect current trends. And, having cut the Cash Rate by 15 basis points to 0.10% at the November meeting, it’s hard to see the RBA moving the policy rate again in less than a month. Reinforcing this view further is the latest labour report for October with a 179,000-strong surge in employment, hinting at a faster economic recovery in the current quarter.

The Reserve Bank of India (RBI) meets on Friday, 4 December. The persistently weak growth and accelerating inflation dynamics have put this central bank in a jam, in our view. As covered in this space a week ago, India’s 3Q GDP data out this Friday (27 November) will underscore the need for more policy support (ING’s 3Q GDP forecast is -12% YoY). But the counter-argument is still-high CPI inflation. Inflation has stayed above the RBI’s 6% policy limit in all but one month in the year through October (7.6% in October). As these divergent growth-inflation trends are likely to be stretched well into 2021, stable RBI rate policy throughout the next year seems to be the safest wager for now.

Busy data pipeline

A typical market focus around the turn of the month is the Purchasing Manager Indices. China’s PMIs are more market-sensitive than most other countries’. So, we will have November China PMI releases on Monday setting the tone for regional and global markets.

We think the recent pattern of services outperforming manufacturing activity in China was intact in November as weak global demand due to the second Covid-19 outbreak weighed on exports. Korea's November trade figures, the first in the region for this month, will bring more information about global demand, especially the electronics cycle, given some signs of tapering in the electronics upcycle lately.

Meanwhile, Korea and Japan’s October manufacturing data will shape expectations for their GDP performance in the fourth quarter. And the October retail sales from Hong Kong and Singapore, together with a raft of November CPI inflation releases elsewhere, will inform about the private consumption recovery. The downside risk to regional economies has increased, however, with the recent surge in Covid-19 cases around the globe.

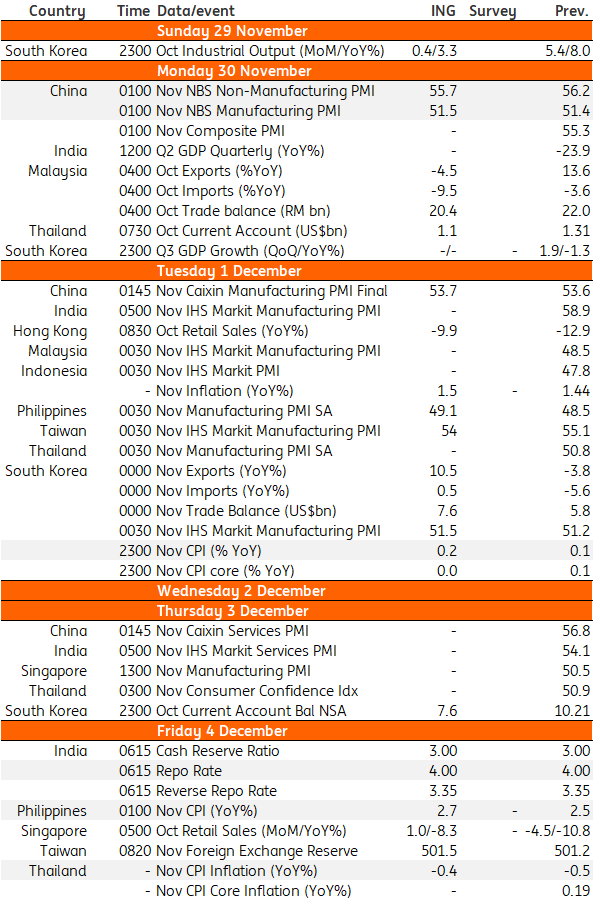

Asia Economic Calendar

Download

Download article27 November 2020

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).