Asia week ahead: Softer Indian inflation

But not soft enough for the Reserve Bank of India to let down its guard, while a return of GDP growth to the potential range now provides room for pre-emptive policy tightening

Winds shift for Asian central bank policies

As central banks in the developed world gear up for an accelerated unwinding of monetary accommodation, Asian central bank policies are largely lagging. However, we do anticipate some regional central banks breaking out of this drift, sooner rather than later. Central banks in India and the Philippines, the countries with rapid growth as well high inflation, are the obvious candidates.

Change of ING view on Reserve Bank of India policy

The Reserve Bank of India’s monetary policy returns to the spotlight as we get all-important consumer price inflation data for February in the coming week. High food, housing and utilities prices lifted inflation above 5% year-on-year pace in December and January. We expect some softening below 5% in February owing to the base effect and seasonally lower food component. However, we do not consider it soft enough for the RBI to take its eyes off the potential inflation risks which, according to the central bank, could stem from a wider fiscal deficit, rising oil prices, an increase in minimum support prices for farm products and higher housing allowances for civil servants. We see inflation hitting the top end of the RBI’s 2-6% target by June this year.

| 4.9% |

ING forecast for India's inflation in February |

India’s GDP growth is accelerating too

At 7.2% YoY in the third quarter of FY2017-18, (fiscal year runs from April to March) growth exceeded expectations. We believe the economy’s return to the 7-8% potential growth range, and the broad consensus of growth staying in this range over the forecast horizon of the next two years, opens the door for a pre-emptive RBI policy tightening to curb inflation. The bank also needs higher rates to stem weakening pressure on the currency. We have revised our view of the RBI rate policy from no change to two rate hikes of 25bp each in the second and the fourth quarters of FY2018-19. We expect the RBI to allude to possible policy tightening at the next meeting in early April.

Upside risk to China's activity growth

China's January-February data on industrial production, retail sales and fixed asset investment will shed light on GDP growth in the current quarter. We consider the consensus forecasts of moderate activity growth at risk to an upside surprise. At least that’s what a 24% YoY surge in exports in the first two months tells us. We are above consensus in forecasting a steady 6.8% GDP growth in 1Q18 (consensus 6.6%, data due in mid-April). The fiscal tightening implied in a narrower budget deficit, continued capacity reductions in manufacturing and financial deleveraging reduce the likelihood of growth exceeding the “about 6.5%” official target again in 2018.

| 24% |

China's export growth in January-February |

| Higher than expected | |

Still sceptical about Singapore MAS tightening in April

Singapore’s non-oil domestic exports data for February is an important release before the MAS (central bank) policy statement in April. Electronics, in particular semi-conductors, drive NODX growth. A 10% YoY fall in chip exports in January was a bad start to the year, while the Lunar New Year holiday slack in activity provides little hope of a bounce back in February. The narrowness of production and export strength will weigh on GDP growth despite a favourable base effect supporting it for now. This and the latest print of zero CPI inflation in January make the MAS returning to a ‘modest and gradual’ SGD-NEER appreciation policy in April a difficult call even if an expansionary fiscal policy provides some leeway for such a move.

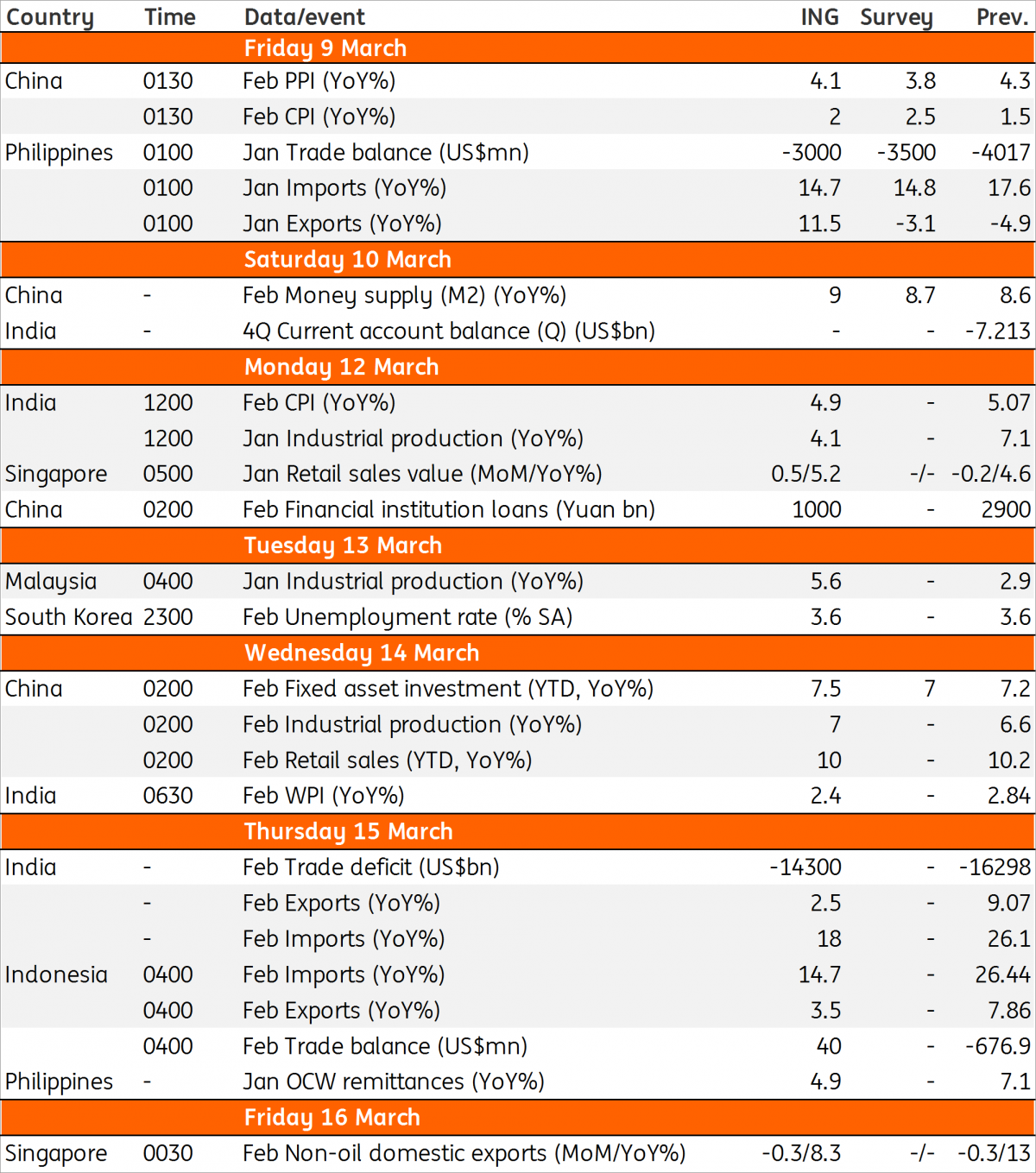

Asia Economic Calendar

Download

Download article9 March 2018

Week Ahead: Our view on the key economic events This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).