Artificial intelligence is driving online sales to a new reality

Online retailers have been given a phenomenal sales boost during the pandemic with so many physical stores closed. And those which use artificial intelligence to help with the three major challenges of automation, big data analysis and process optimisation are set to have a major competitive advantage over their rivals

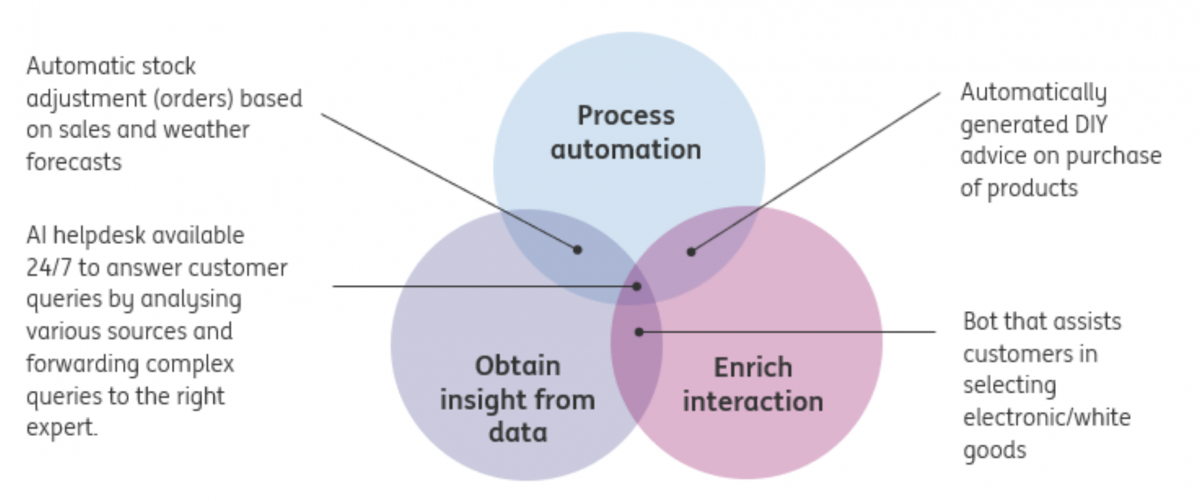

Retailers use AI for three main things

How we shop is changing and Artificial Intelligence, AI, is revolutionising retail. Those companies which can afford or who are nimble enough to adopt the latest technology will clearly have an advantage over their competitors.

AI is a collective term for systems that imitate areas of human intelligence. So we have image recognition software that identifies counterfeit products. There's data analysis software which can spot a potential loss of customers at an early stage, prompting action on the retailers' part to get them back. In fact, we identify three main purposes of AI in retail:

- The automation of all kinds of digital and physical processes.

- The gaining of useful insights from collected and analysed data and third parties to improve retailers’ online experience with their customers.

- The optimisation of processes which focus on generating sales and keeping costs down.

High growth for online retail sales

The Covid-19 lockdowns have given a significant boost to online retailers. We've seen year-on-year sales rise between thirty and fifty percent in several European countries. In the UK, the share of online in total retail sales jumped from 16% in 2019 to 23% last year. Dutch online retail sales were 45% higher in 2020 compared to the previous year and that momentum is sure to keep going; we expect another 15% increase in online sales in the Netherlands in 2021.

Obviously, sales in physical stores have massively declined. The acceleration of 'online' poses numerous challenges for omnichannel retailers

Artificial intelligence's three main purposes

Three main purposes of AI with examples of AI applications where those purposes overlap

Acceleration of online growth demands process adaptation

The three main purposes of AI ultimately contribute to improving the management of retail companies. The potential improvements and adaptations are especially relevant for those omnichannel retailers now that the balance between the sales channels has changed significantly.

The switch to online demands changes in how logistics, marketing and after-sales are organised

The shift from physical sales in stores to online sales via websites and apps has been ongoing for many years and the Covid-19 crisis accelerated it still further. In 2020, online retail sales rose 32% in the United States, 44% in the Netherlands and 47% in the United Kingdom compared to 2019. A situation in which physical stores are generally closed and a complete dependence on online channels is extreme, but online sales are expected to continue to form a larger proportion of sales. This demands changes in how logistics, marketing and after-sales are organised.

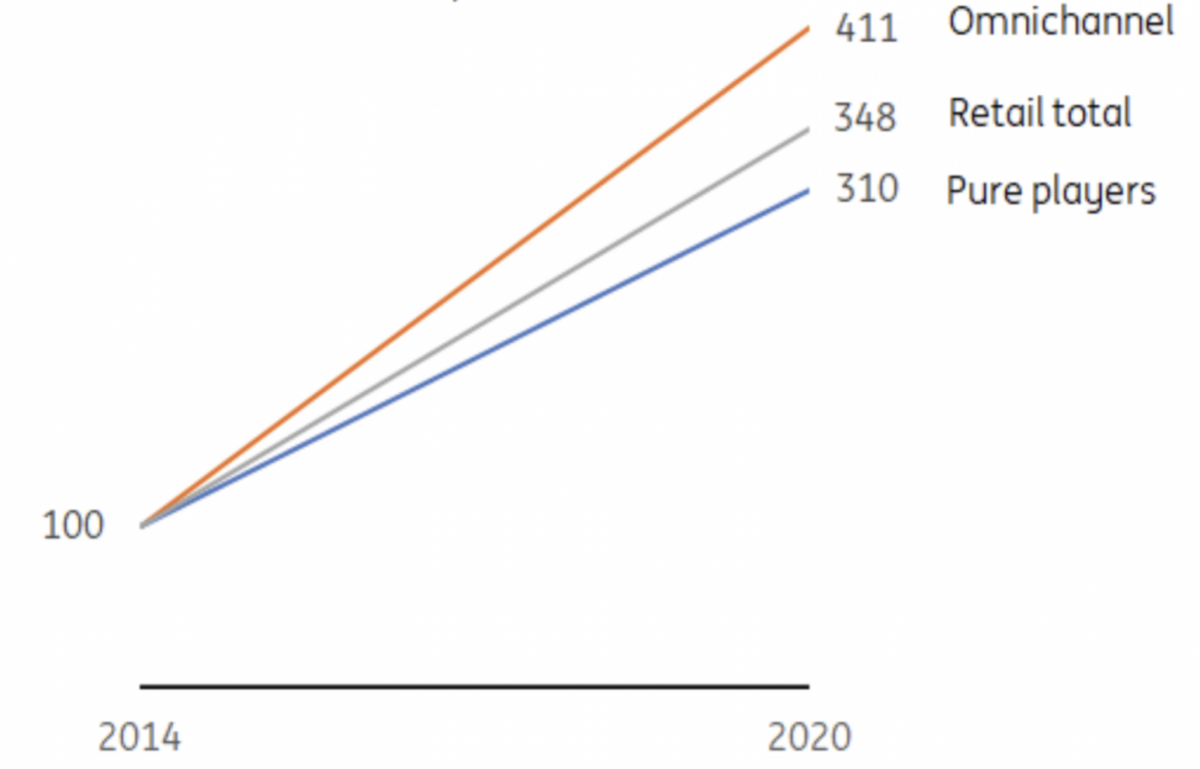

Sales for online omnichannel retailers show fastest increase in the Netherlands

Index revenue online sales, 2014 = 100

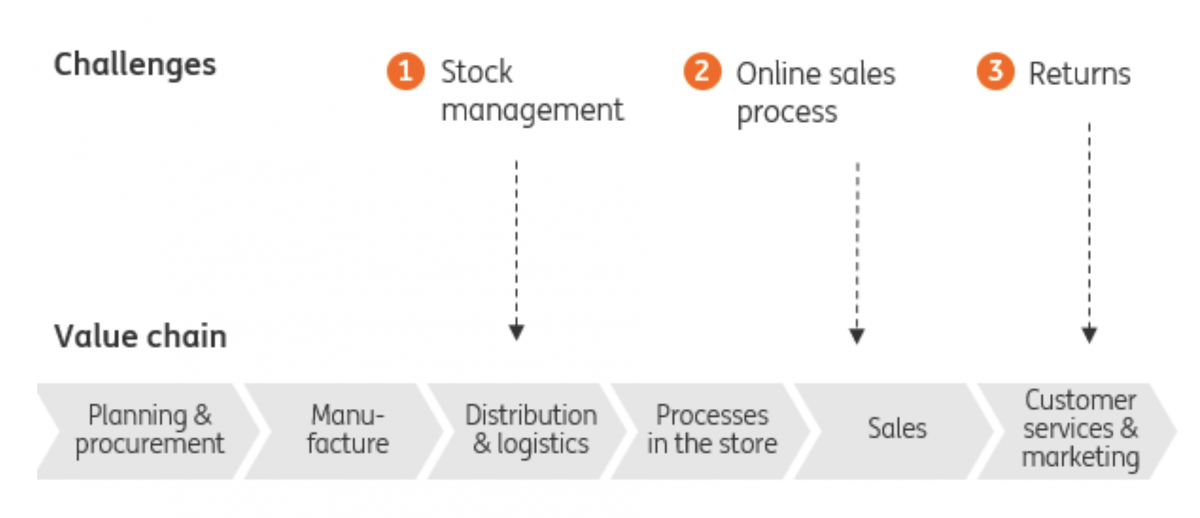

Challenges in various areas

Three common challenges facing omnichannel retailers relating to online sales channel growth are:

- Insight into stock management, with a complicating factor being that sales take place via both physical and online channels.

- Optimising the online sales process, for example when searching for and finding the right products, so that this is not an inferior experience to either physical shopping or the experience at competitor online stores.

- Improvements in the returns process.

These three challenges each have an effect on specific areas of the value chain in retail, notably for sales, distribution and logistics, and customer services and marketing.

The impact of AI across the value chain

The three biggest challenges for omnichannel retailers impact various parts of the value chain

Challenge 1: Use AI to improve alignment between channels

AI improves the alignment between channels by making better predictions and by making automation processes smarter. Aggregated data forms the basis for predictions to enable process improvement.

And you can see where this could make big improvements for companies. About a third of Dutch retailers, for instance, analyse big data but only 14% actually use AI technology to do it. Getting more accurate sales predictions by analysing historic transactions and other variables, such as behaviour, the weather, the time of day and so on would help make logistics' streams far more efficient.

Intelligent automation has a lot to offer

The online and physical channels and the interaction between these can be specifically examined for this. Moreover, this reduces the waiting time or the risk that customers miss out, which improves customer satisfaction. Intelligent automation has a lot to offer, particularly for core processes such as stock management. Stock adjustment then takes place automatically for many products and categories.

| 29% |

Number of Dutch retailers using big data analysis |

Optimise sales with automatic price adjustments

Store prices generally move most during sales periods; discounts increase incrementally as the sales’ period progresses. AI offers online and physical retailers the opportunity to significantly refine price adjustments. Such dynamic pricing has been used in aviation and the hotel industry for decades. Prices are adjusted upwards and downwards based on numerous factors including availability, competitor prices and click behaviour.

Increasing numbers of retailers are now taking this approach, although products are often less standardised than hotel rooms or flight seats. Amazon has been using advanced algorithms for many years to analyse data, discover patterns and adjust prices in real time. Economic principles such as price discrimination - the right price for individual customers - and price elasticity - how demand changes when prices change - play an important role in this. A lot of historical and other data are needed here, such as prices and sales, but retailers can also use an abundance of ‘pricing’ software to get their dynamic pricing strategy started.

| 14% |

Number of Dutch retailers using one or more AI technologies |

Challenge 2: insight into customer behaviour for an improved experience

Artificial intelligence is about data. Online stores can collect, process, and analyse a wealth of information to gain insights about customers that help simplify the sales process. This includes how long you stay on a page, what you click on and what you buy and why. The insights offered by these patterns and data connections can improve the customer experience during the purchasing process, for instance by offering personalised purchase suggestions.

Voice search or visual search, where a photo can be used to search for comparable items, also makes life easier for customers. The combination of AI with other technologies also appears to be promising in bringing the online experience closer to the physical shopping experience. For instance, customers can use augmented reality to try on virtual clothing and see what that new sofa will look like in their living room.

Omoda mainly uses AI for sales processes and marketing

Omoda is a retailer that sells shoes online and via stores and has many years of experience with both analysing big data and with AI. Omoda mainly uses AI to improve the online sales process. The fashion sector is seasonal, with collections that disappear after one season and involve a considerable human component in terms of procurement. This means that the contribution AI can make towards more intelligent stock management is generally smaller.

A wealth of data is available to develop models, particularly in the sales process and marketing. Models play a significant role in determining which customer segment sees which specific online offer. The company also uses a predictive model to identify site visitors, which improves the likelihood that these people will switch to making a purchase. Retargeting marketing campaigns, for instance via Facebook, then only focuses on this group. The models demand continuous adjustment. New patterns have arisen during the Covid-19 crisis as customer groups that used to visit stores have now started purchasing items online, resulting in models needing to be adjusted and retrained.

Challenge 3: Reduce the cost of returns by reducing returns and improving logistics

AI can make a twofold contribution to improving processes in relation to returns. The first objective is to reduce the number of times someone sends back. For some product categories, such as clothing, returns can reach 40% or 50%. Suggestions, virtual assistants, and virtual changing rooms are important AI applications that will lead customers to the right products.

Ensuring an improved match between supply and demand reduces the number of returns and improves customer satisfaction. As well as reducing returns, AI offers the opportunity to reduce the costs of reverse logistics. This mainly takes place by deciding what needs to happen with a returned item and automating this. For instance, sales trends, shipment, and repair costs can be used to determine whether the item returned to the store can stay there or whether it needs to go to a central warehouse, be repaired or can no longer be sold.

How AI helps resolve multiple challenges

Using AI is not an easy or quick solution

Although AI helps resolve omnichannel retailers’ three challenges, it is often not a quick solution. Those new to artificial intelligence need experience with data, data analysis and actually applying AI. Using it in different processes is not something you can manage within a short time. Even if off-the-shelf software is available, many solutions demand data that is specific to the retailer and adjustments to models.

Investing extra time and money is extremely difficult for some retailers

To be of value, a chatbot, for example, must be trained in the queries that are relevant to customers. And these queries differ for an electronics chain or a fashion retailer. Moreover, existing models are not trained for circumstances in which only the online channel is open. Investing extra time and money is extremely difficult for some retailers in the current economic situation. According to CBS (Statistics Netherlands) data, one in five retailers is expecting to invest less this year compared with one in ten in the two previous years.

After online acceleration, AI helps steer growth in the right direction

Despite the drawbacks, there is a great opportunity to use AI to address omnichannel retailers’ most important online challenges. Improved matching of supply and demand with AI will both reduce returns and drive sales and customer satisfaction. Improved sales predictions feed efficient logistics streams and improve stock management. AI helps steer growth in the right direction. Larger, fully online stores often already work with AI, which means they are more efficient and are better able to match supply with demand. We expect this will also become the standard for omnichannel retailers.

Download

Download article14 May 2021

It’s now or never This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).