American big tech goes green, driving PPA market

US based companies dominate the PPA market, with 53 GW of PPAs procured globally since 2008. American big tech companies lead the way with Amazon, Google, Facebook, Microsoft and Apple holding a top 10 position. Volumes from European companies are smaller, but they are catching up and the top players come from different sectors

This article compares the activity of US based companies, both corporates and utilities, versus European companies in the global PPA market. A Purchasing Power Agreement (PPA) is a contract between the corporate buyer (off-taker) and the power producer (developer, independent power producer, investor) to purchase electricity.

US based companies lead the way in the PPA market

Global amount of PPAs outstanding from companies* based in the countries stated, in GW as of May 2021

...but European companies are catching up

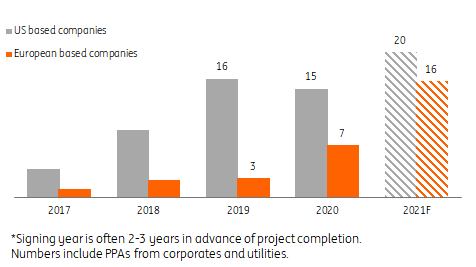

The PPA market has a long history in the US. Hence US based companies have been most active, both in the US and abroad. PPAs in renewables are a newer phenomenon for European based companies mostly as many European countries offered regulatory support. In recent years activity from European companies is catching up towards levels from US based companies. For 2021 we expect the gap to narrow further with 20 GW of new PPAs from US based companies and 16 GW from European companies.

European companies are closing the gap with US based companies

Newly closed PPAs in GW

US bigtech companies dominate PPA rankings…

Bigtech dominates the PPA market among US based companies. Amazon, Google, Facebook, Microsoft and Apple together have 25 GW of PPAs outstanding. The majority is related to wind and solar projects in the US, although they now also source renewable electricity in Europe through PPAs. Amazon, for example, recently bought half of the power from Shell’s offshore wind farm near the Dutch coast to green the power in their European warehouses (see table below).

…while interest from European companies comes from a wide range of sectors

Activity from European companies is catching up but activity is not dominated by bigtech companies. The five European companies most active with PPAs come from different sectors, like energy (Total), manufacturing (Norsk Hydro), food & beverages (AB InBev), chemicals (Dow) and transportation (Deutsche Bahn). Unlike Total and Norsk Hydro, the top 10 players so far have sourced less than 1 GW of green power through PPAs.

Bigtech dominates top 10 ranking of US based companies active in the global PPA market, but not so for European based companies

Total amount of PPAs outstanding* by top 10 companies out of US and Europe in GW

Green power generation becomes steadier when wind and solar are combined…

Some of the large players in the global PPA market source their power from both wind and solar projects. In doing so, they benefit from the different solar and wind generation profiles. The diversification effects of wind and solar and a portfolio of multiple projects at different weather locations allow off-takers to create more stable renewable power production during the day and week.

…, but mind the gap on cloudy days with little wind

However, wind and solar diversification is often far from perfect. On days or hours when the wind and solar assets of the PPA produce little power, the company still needs electricity, which it gets through the grid. PPAs are a good way to procure a companies’ annual power demand in a sustainable way, but not on a daily or hourly or on a minute-to-minute basis.

PPAs in practice

Some examples of PPAs

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 June 2021

Energy transition and power prices: ING’s view on long and short-term price moves This bundle contains 5 Articles