Aluminium surges on Rusal sanctions but only premium impact is certain

US sanctions imposed on Rusal stand to majorly disrupt physical trade flows. While very bullish for premiums, the LME outlook is less certain if material can still make its way to the exchange

From Russia with love

Rusal, the largest aluminium producer outside of China produced 3.71 million tonnes (Mt) of aluminium in 2017 equivalent to 13% of production out of China.

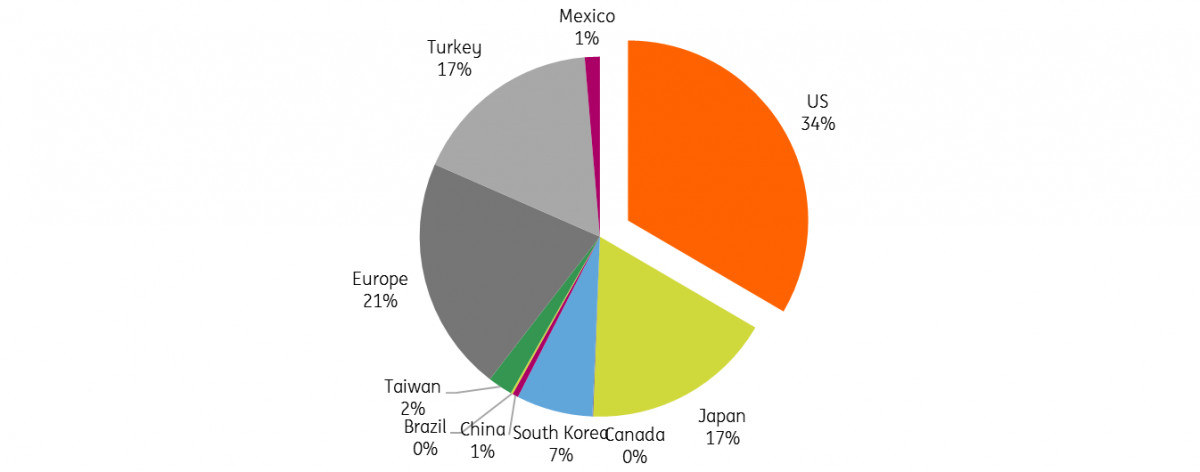

Of 3.96Mt in sales, 2Mt was primary material with the rest as value-added products. Trade data shows last year Russia exported around 1Mt unwrought aluminium to the US, 20% of US imports, with est.500kt as primary ingot. Other major destinations include Japan, South Korea, Europe and Turkey.

Last Friday, the US Department of Treasury’s office of foreign assets Control (OFAC) announced Rusal and other companies linked to Oleg Deripaska would be added to the US sanctions list. All US assets are since frozen, and US persons are prohibited from dealings with Rusal excepting a temporary license granted until June 5th that allows for existing arrangements to be wound down. Non-US entities/ persons also face risks for knowingly facilitating transactions with sanctioned parties and this extends from visa bans to accessing US dollars.

The implications for aluminium markets is serious. First and foremost we expect US premiums to rise. June 2018 contracts have already risen 0.5c/lb, and 2019 dates jumped 1.4c/lb on the CME. In practice, Russian material was not exempt from section 232 tariff’s (costing an additional 10% to US consumers), so exports to the US were likely to be reduced. The effect on premiums should be more muted, but US consumers have consistently proven to over-bid market premiums just as we have in the rally this year. We expect a degree of panic buying to take hold once more as those with Rusal contracts scramble for new material.

We expect the risk of secondary sanctions will impact well beyond just US imports, and Rusal material will indeed be shunned by many non-US consumers and their financing banks. Here the knock-on effects will be felt by premiums globally and we expect pricing agencies to exclude Rusal from assessments.

Russian exports to the EU were 10% of 5Mt net imports last year, and 19% into Japan and 13% to South Korea. With the US already set to grow imports from Canada/Australia/EU and other 232 exempt countries we would have expected Rusal’s stake in these regions to grow, but now the competition will grow for the section 232 exempt material.

Russia 2017 Unwrought Aluminium Exports by destination (%)

HS Code 7601 (Unwrought Aluminium)

A customer of last resort

An already deficit ex-China market (ING estimates 1.75MT in 2018), therefore looks a lot tighter for those unwilling to risk US sanctions.

We think this will be more than just US entities but will also have an impact on large traders and multinational consumers. While China would usually be suggested as the more willing buyer of US-sanctioned material, its role in aluminium flows is unique since its surplus domestic production makes it a minimal importer. A discounted SHFE price and saturated customer market renders China an unlikely destination but other South East Asian Aluminium consumers including India, Indonesia and Thailand may be more willing.

Crucial though is the preliminary decision by the LME to uphold Rusal brands for good delivery. This has the potential to reserve the rally for just premiums should Rusal and traders look to deliver the material on to the exchange. We can contrast this to the Iranian situation where the IRALCO brand was suspended. The practicality of Rusal brands being delivered on to the exchange could still depend on the willingness of banks to act as a counterparty. It’s worth noting that while the LME trades in USD, the trades can be cleared in EUR, JPY, GBP although the open interest in these currencies is small fractions.

While mass deliveries of Rusal on to the exchange might prompt the Bourse to rethink its Rusal treatment, as things currently stand the LME is not cut off from Rusal supply, while many end consumers (and their premiums paid) will be. Compare this with Iranian sanctions which saw the IRALCO brands suspended. The impact of any large Rusal deliveries is doubly negative for LME prices as those un-loved warrants would be highly available: continually delivered back and the resulting stock churn loosens spreads.

At this stage, consumers should look foremost at their exposure to market premiums which are sure to rise. Beware of the US premium which might shoot too high though.

News-flow this week will drive LME Aluminium prices but be cautious for any large deliveries which could prompt a correction. ING was already forecasting Aluminium prices to trend higher into 2019 (($2,300 H2 2019) on ex-china deficits, so consumers could still do well to consider any fresh dips that emerge.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).