Aluminium: Still standing, for now

Despite poor demand prospects and rising supply, aluminium is standing its ground. The bearishness rooted in its fundamentals will continue to weigh on the medium-term outlook, but this may not lead to a bear trend anytime soon amid an asymmetric recovery path following Covid-19

'V' or 'U'? depending on which market you are looking at

Aluminium recovered during the second half of 2Q20 in defiance of surging inventories (LME) and a widely expected market surplus. Compared to some of its peers in the industrial metals complex, aluminium's recent recovery path looks to be more U-shaped. Having spent a month carving out a bottom, LME aluminium was initially reluctant to follow its peer on the ShFE peer, which has seen more of a V-shaped rally. We have discussed the market decoupling and recent convergence, and their background dynamics in previous notes.

In the second half of the year, aluminium shares the same macro background as copper, including negative dollar themes and US election-related trade rhetoric growing louder. Aluminium has always been at the forefront of trade friction, and the light metal's premium was recently caught in the crossfire of US tariff threats on Canadian aluminium exports. We also continue to see risks of a more difficult environment for world aluminium trade in other markets such as the EU and China.

The market surplus continues to be supported by weak demand prospects and rising production, and more alarmingly, we are anticipating another 1.8 million of capacity in the pipeline to come online during the remainder of the year. Thus, it's hard to be optimistic towards this metal. However, in the meantime, and while this may sound strange, it's equally hard to call for a broad bear trend in the short term.

To bet against demand, not an easy thing…for now

The asymmetric recovery path following Covid-19 around the globe has caused some confusion in the London aluminium market. Though different market dynamics are sometimes affected by trade, London and Shanghai market prices are also interdependent. London aluminium has been anchored around US$1,600 for a while since late May. Some themes are playing underneath to fend off the bears, and aluminium could end up caught in a range-bound market in the short term.

- Ex-China: As aluminium consuming countries are still sticking to reopening plans, optimism about pent-up demand could outweigh concerns about any surpluses. Also note how much is readily available for purchase when stocks that have been locked away for financing purposes are stripped out.

- China: It is not clear how much pent-up demand there will be in China after Covid-19, or whether such demand would be sustainable in the short term.

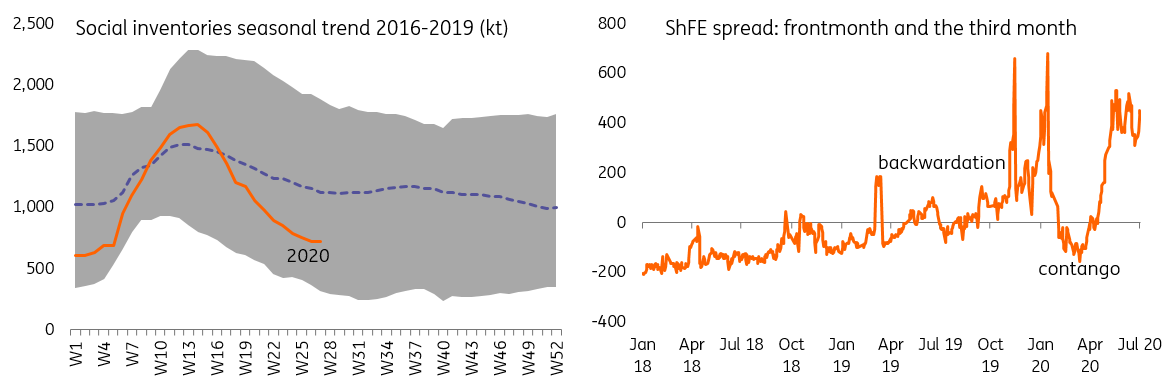

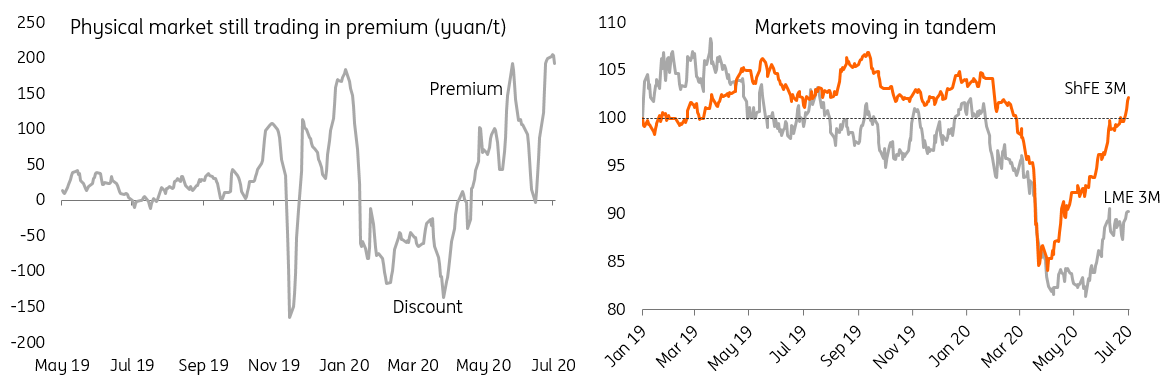

- In the ingot market, continuous destocking has reinforced this view. In particular: a) ShFE is still in backwardation and the physical stock is at a premium; b) the market hasn't sorted out scrap supply completely, and it's been importing an increasing volume of alloys and ingots so far this year, which will continue to add to apparent demand; and c) housing construction is still pointing to a recovery in terms of completions and there is hope for stronger demand, along with better copper demand in China. Sales in some consumer products and car sales have been holding up well, perhaps suggesting that pent-up demand has not yet dried up.

Fig 1. Falling inventories and tight spreads

Meanwhile, the market continues to expect an even looser liquidity environment and fiscal stimulus packages to kick in over the coming months. For the rest of the year, we generally see prices, in average terms, gravitating lower from the current level towards US$1,570/t, but spikes towards US$1,650/t are likely.

Fig 2. China physical still implies tightness

Potential themes to unfold in 2H20

Some market themes could potentially unfold in either direction this year, throwing a curveball to the price path and giving both bulls and bears something to latch onto.

- China's apparent demand is set to remain elevated (positive) - whether backed by arbitrage-driven imports or commercial stockpiling domestically.

- Exports of semi-refined products fall more deeply (bearish) - a further slide in aluminium semi-refined exports coming alongside a drop in exports of other aluminium products, could weigh heavily on Chinese consumption.

- We see the effect of cost inflation as neutral so far and risks on this front look more moderate. With recent disruptions (Hydro Alunorte/Shanxi Huaxing), and Chalco's announcement yesterday that it would implement so-called 'flexible production' at its three alumina refiners in Shanxi province (possibly affecting 1.8mn tonnes of capacity) things are worth monitoring in the short-term, particularly in light of further aluminium smelting capacity coming online.

- Lastly, Covid-19 remains the largest uncertainty.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article