Copper: V-shaped rally but curveballs ahead

After a V-shaped rally in the second quarter, copper faces challenges in the second half of the year. There are many potential curveballs as uncertainty mounts about the aftermath of the pandemic

A stunning V-shaped rally so far

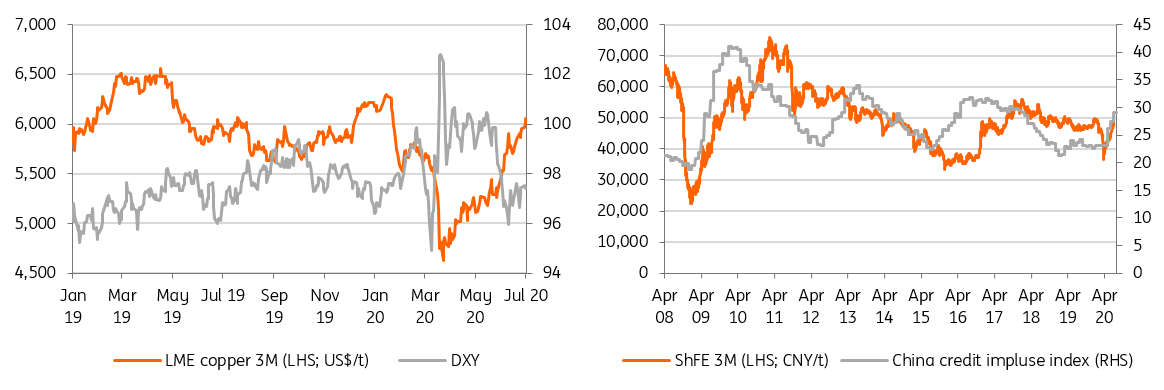

Copper has seen a stellar V-shaped rally, paring almost all of the losses since the outbreak of the pandemic. LME prices have extended above US$6,000/t, further boosted by supply worries from Chile.

So far, the V-shaped move has been driven by a number of factors: a) unprecedented monetary easing and government fiscal stimulus; b) the tailwind from a weaker dollar, with the downward trend expected to continue; c) supply disruptions across the supply chain from mine to smelting as well as scrap supply and d) more importantly, apparent demand from the world’s largest consumer China has made a strong recovery. This has been backed by pent-up demand following the easing of lockdowns and has dovetailed with the traditionally strong demand season.

The buoyance has also been underpinned by some micro indicators, including destocking in China and more recently in the LME. Spot treatment charges are still depressed at a low of around US$50/t. On the macro side, industrial profits and PMIs are pointing to economic resilience, though exports are still a pain point.

Fig 1. Copper prices vs DXY and China credit impulse

Cautious optimism towards short term market

For now, all the themes are there for the bulls to join the summer ‘party’. The worst economic damage is probably behind us. The market seems to believe that there won’t be a nationwide lockdown, even though there has been a resurgence of virus cases in some areas. Thus, the recovery is not expected to be derailed. With fiscal packages gradually kicking in over the coming months and a looser liquidity environment, it’s hard to be bearish.

However, further upside will be living on borrowed prosperity, and copper will need to find a solid chair while the music is still playing. Thus, we are cautiously optimistic for the short-term market reaction.

Still plenty of challenges in 2H20

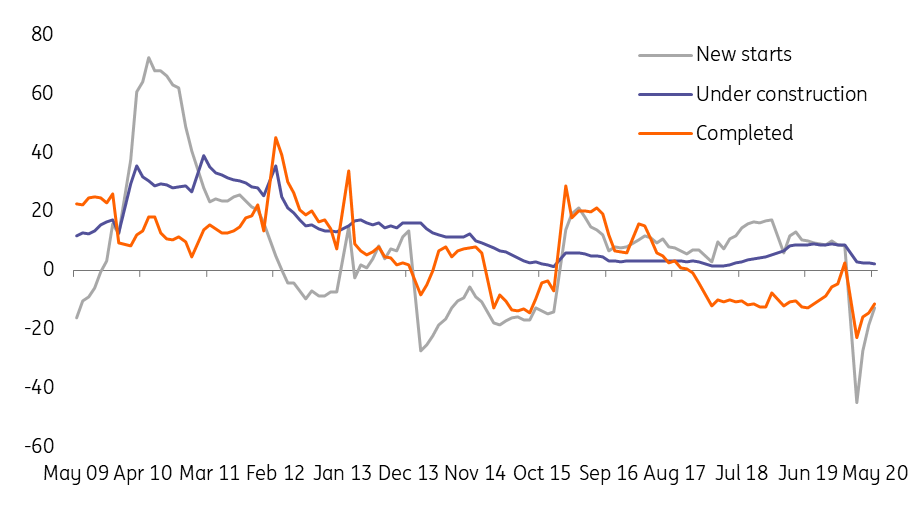

a) Demand faces a reality check. So far, the major pillars have been a mixed bag for copper demand in China. We maintain our view about demand (see Copper growth: Still reliant on traditional sectors). Recent property completion continues to recover, in line with our view. However, it remains to be seen to what extent stimulus goes into other metal-intensive sectors and how effective that is. At least so far, the grid company hasn’t offered much help.

Fig 2. China housing constructions

b) Supply return; we have seen close to half a million tonnes of losses so far this year, but some mines have started to make a comeback, such as Antamina. Chile's copper sector will eventually return to normal after the peak of the virus.

c) As it is a US election year, trade tensions could well spike. Therefore, despite short-term optimism, copper will need to navigate plenty of risks through the second half, and we see prices, on average, gravitating towards the upper bound of US$5,000.

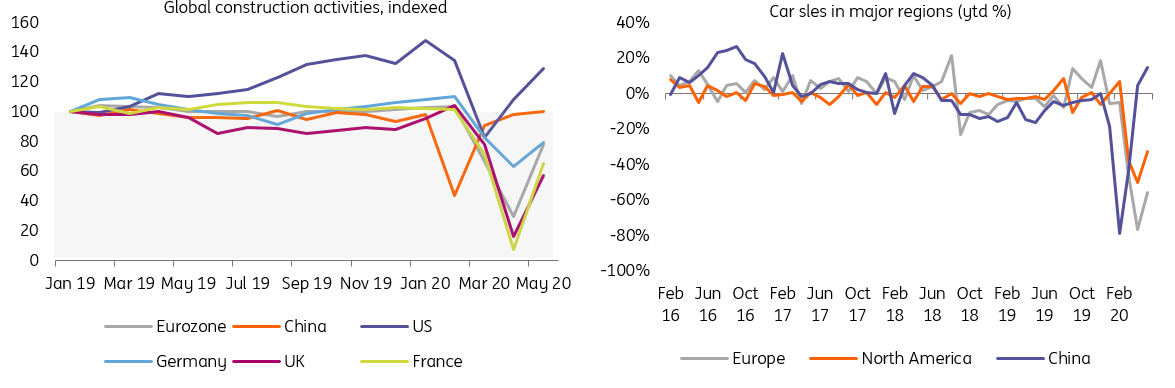

Fig 3. China leads the recovery in major demand sectors

Scrap re-debuts under a new identity but supply uncertainty remains

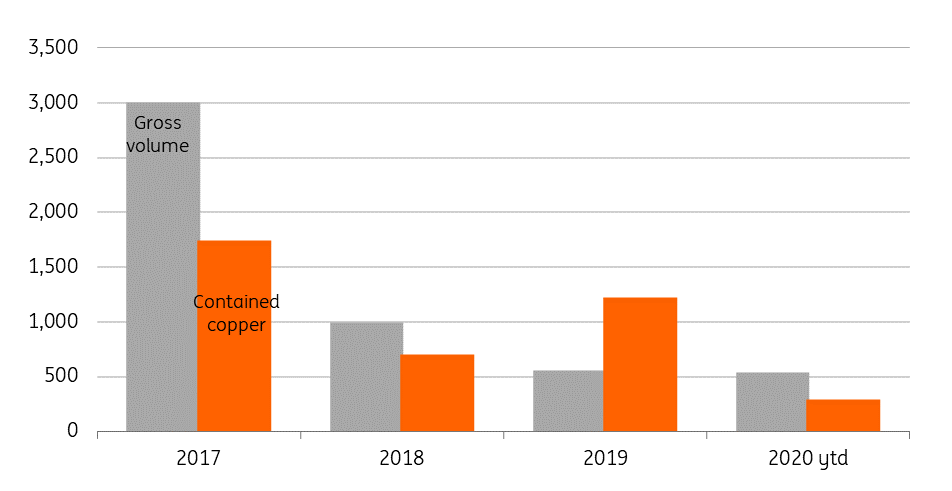

A strict scrap import policy, together with this year’s virus impact on the supply chain, have reduced scrap supply. Thus, there has been some displacement from cathode to fill the gap. Starting from today, 1 July, some scrap exports to China are re-debuting under a new identity –‘resources’ instead of ‘garbage’. We had expected this to recover from the second half. However, a recent report from Reuters and our own sources say it may take some time to disentangle the mess there. It remains to be seen to what extent scrap supply recovers in the second half.

Fig 3. China scrap import quota approval vs. estimated contained copper from actual imports (kt)

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).