Aluminium: Mind the Closing Gap

LME Aluminium prices have been falling faster than in Shanghai. The shrinking export arb for Chinese aluminium products reinforces our view that weakness in the first half of 2018 will be short-lived. Deep deficits outside China will eventually drive a tight LME higher

Norrowing export arbs to provide support

LME prices have fallen 12% year-to-date compared to only 5% to prices in Shanghai (in USD, ex-VAT).

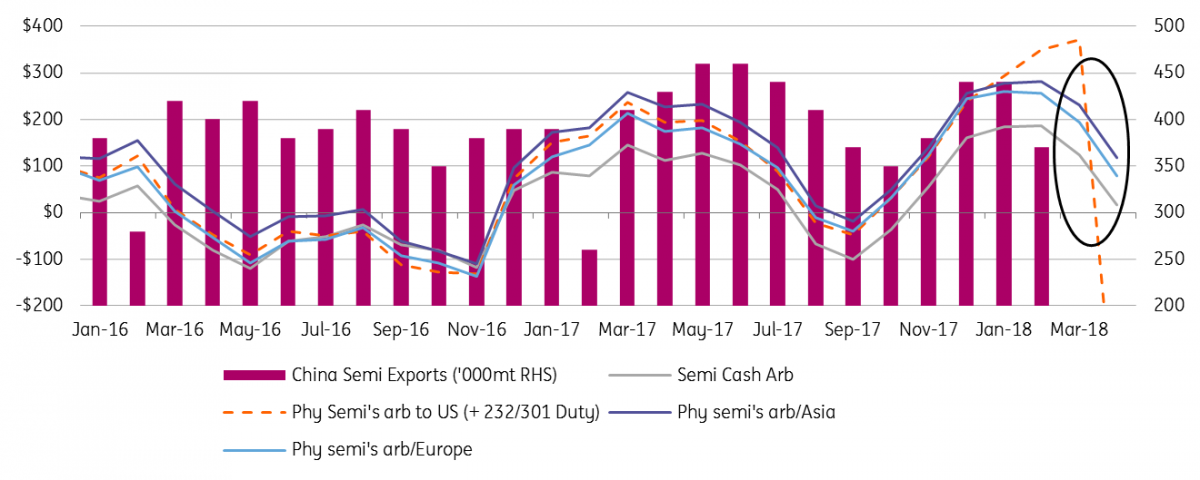

Supporting the Chinese prices, domestic stocks have stopped swelling and are beginning to be drawn down as activity rebounds after an extended new year/party congress lull. LME markets meanwhile have been sold off amid a general risk-off mode across assets. The resulting export arbitrage for Chinese semi-fabricated product has therefore fallen significantly, going below $100/mt when shipped to Europe and Asia, compared to the highs above $300/mt in January. On a pure cash basis without premiums paid on either side, the arb is entirely closed.

How Shanghai re-opens on Monday could indeed see some swings, but the divergence would have to go a long way to restore the arb to previously wide levels

The US market isn't profitable given the 10% section 232 duties, add on the additional 25% from section 301, and it's deeply negative. Following the wide differentials that drove semi-exports to 440kt highs in January, we view this narrowing arbitrage as extremely supportive for the LME aluminium price as Chinese exports should now fall.

How Shanghai re-opens on Monday could indeed see some swings, but the divergence would have to go a long way to restore the arb to previously wide levels. Harbor Aluminium estimates the cash profit margins at Chinese smelters are now effectively averaging zero with 14.6M tonnes capacity underwater which should support SHFE prices from around these levels.

Chinese semi exports looking less profitable globally ($/mt)

Physical semi's arbitrage: ((LME+ regional premium)- (SHFE Aluminium + Domestic premium/discount)+13% VAT rebate - Freight)

Semi's Cash Arb: LME- (SHFE Aluminium + 13% VAT rebate)

Chinese surplus behind borders

The export of Chinese aluminium semi's is key since this the main route through which China's surplus can impact upon the LME price. It is important to remember LME price discovery is principally a measure of the availability of primary metal ingot across a warehouse network that is outside of China. Chinese aluminium product exports indirectly affect LME prices in so far as those semi's can displace would be ingot demand. So-called "fake-semi'' exports (quickly re-melted into ingot) do exist but are far lower since major flows into Vietnam/Mexico were stopped.

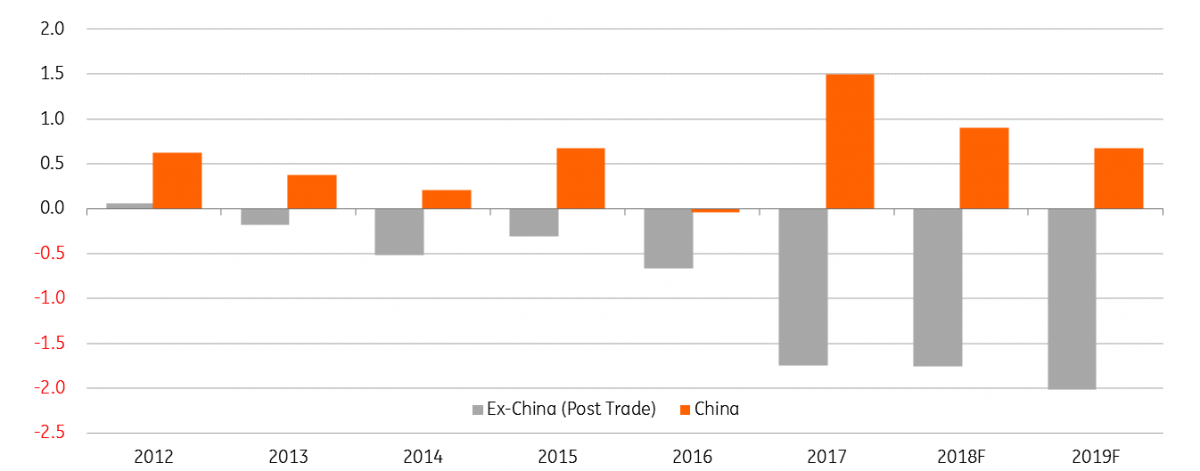

As we wrote in our 2018 aluminium outlook the indirect nature of this China-LME price connection is often overlooked, and it is foremost the ex-China supply-demand balance of primary metal that matters most for LME prices. We have already included generous assumptions for US re-starts in our balance and see a deep ex-China deficit of 1.7Mt this year and almost 2Mt in 2019 (post-trade).

Growing protectionism highlights the challenge for Chinese semi exports to maintain current levels let alone be able to fill such a void. China exported a record 4.8Mt last year, an increase of 5% YoY. Section 232 and 301 already displaces the 0.7Mt of China-US exports mostly in the form of plate/sheets and foils.

In practice, this is not new since they were already facing anti-dumping measures from the ITC. Other anti-dumping cases are also ongoing, eg. India (Foils), Australia (Extrusions), Europe (Extrusions).As trade tensions build the likely re-routing of Chinese and other non-232 exempt products to new markets could bring further challenges, further walling off China's surplus from the emerging tightness outside.

The ex-China deficit matters most for the LME price (Supply-Demand, Mt)

The bear case

The biggest downside for aluminium as trade tensions escalate would be for China to lift the 15% export tax on primary metal that isolates the domestic surplus. Even as rhetoric gets aggressive, we think this possibility remains highly unlikely as it runs counter to the government's central goals of curbing pollution and overcapacity.

Aluminium production is highly energy intensive, exporting ingot becomes tantamount to exporting the energy at the cost of the pollution, lifting the 15% tax would be a license for smelters to overproduce and flood foreign markets, only risking greater trade tensions with China globally.

Our great concern was whether the tariffs prompted any mass unwind of off-warrant stocks, especially those customs cleared in the US, which could displace imports. With US premiums sky high this is a tempting time to unwind those financing trades. The LME is once again in contango, so financing is profitable, but we highly suspect a return to sharp monthly rolls in the not too distant future. LME stock levels, and especially those on free-float, remain fractions of the wider market, so the structural imbalance between borrowers and lenders of aluminium spreads remains.

Therefore, we remain watchful for any signs of a mass stock unwind but although some overstocking took place pre-tariffs, no mass unwind has since occurred. The very slow U-turn of the US premium even after announced exemptions is good evidence of this and how sticky and enduring those stocks in financing are.

Instead, it is likely to take the corresponding pull of a primary deficit (ex-China), resurgent LME tightness and in turn higher prices to draw those stocks down. Consumers should consider these dips carefully.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).