All aboard Europe’s electric bus revolution

With increased pressure to decarbonise and just four years to meet the minimum requirements, European public transport authorities are speeding up the rollout of e-buses. We expect the average share of zero-emission buses to surge to 67% of new sales by 2030, resulting in a fleet of 65,000 e-buses – an eight-fold increase

Battery electric buses at the forefront of the energy transition

Public buses are considered a natural starting point in the green transition. Electric buses are available, and the ranges match most of the daily distances. Importantly, authorities can also drive the transition forward via tendering processes and public contracts.

This will be the decade of change. Battery electric buses are perceived to be the most viable option to decarbonise most of the public buses that predominantly run in urban areas. Fast charging and with longer lifecycles, battery electric buses are also close to being competitive in terms of the total cost of ownership. Some 98% of the newly-registered zero emission buses across Europe in the last two years were battery electric vehicles (BEV). The other zero-emission option – Fuel cell electric buses (FCEV) – are less energy-efficient and expected to play a moderate role.

The pandemic heavily impacted public transport…

The pandemic has been tough for public transport. Due to the downturn in passenger volumes, as well as an uncertain outlook, the total number of new registered buses and coaches in Europe dropped by over a fifth in 2020 and has not yet recovered. Investment in new coaches has been hit the hardest. But new inflows of green buses slowed as well, as public contracts were extended, rather than allowed to expire, amid uncertainty over the return of passenger volumes. In effect, this meant that some of the buses due to be replaced were not.

… but passenger traffic has shown resilience; bus fleets won't shrink

With rising vaccination rates and countries lifting restrictions, public transport volumes are showing signs of a sustained recovery this autumn. Although the return of passengers is uneven across countries and a full recovery will take more time, as some structural impact could persist, we do not foresee a long-term contraction in the European public bus fleet.

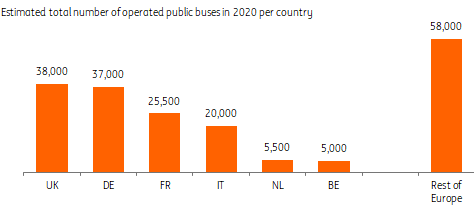

Large European public bus fleets in UK, Germany and France

Electrification propelled by EU targets, ambitious national plans

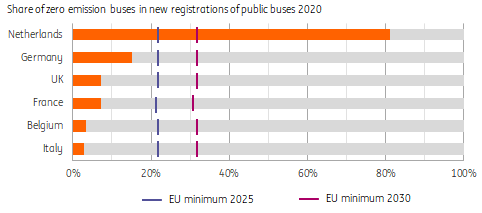

In most European countries, electrification of the fleet has just started. Most electric buses are currently purchased by Western European countries and the Nordics. The EU clean vehicle directive* sets minimum requirements for purchasing new zero emission public buses (electric + fuel cell electric) in member states, which differ across the continent. In most Western European countries, a minimum share of 22.5% should be zero emission by 2025, rising to 32.5% by 2030, for most countries. For some Eastern European countries, like Romania, requirements are lower. However, this sets only a bare minimum and several countries and cities have more ambitious targets (see at the bottom), with still a long way to go. This means electric buses will continue to be promoted and we expect to see an acceleration of the uptake in the years to come.

*Under the EU ‘Fit for 55’ plans, revisions to the clean vehicle directive are not on the table. But if the transition is not progressing fast enough, this could change, with minimum levels raised to help speed up the process. A separate European emission trading system for road transport could impact public bus transport as well, but this will only take effect from 2026.

Netherlands ahead with inflow of zero emission public buses

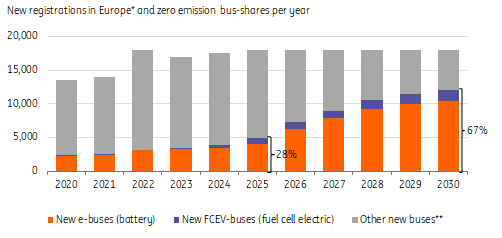

Annual electric bus sales to surge from 2023, quadruple by 2030

As European countries emerge from the pandemic and start looking forward again, we expect sales of electric buses to significantly increase from 2023 onwards. In 2025, we expect over 4,000 new e-buses to come online across Europe (vs an expected 2,450 in 2021). Beyond 2025, we expect new inflows to accelerate to over 10,000 buses as transition programmes come on stream and targets become more pressing. This is equal to almost 60% of new sales. While fuel cell electric buses are expected to take a larger share in the long-distance transport segment in the run up to 2030, battery electric buses will continue to dominate. Together, two-thirds of new buses are expected to be zero emission by then.

Annual European e-bus sales to exceed 10,000 by 2029

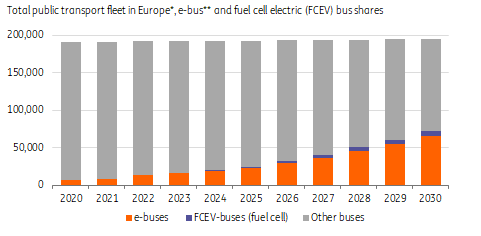

Most of the EU's bus fleet will still need to be replaced by 2030

With new sales of e-buses increasing, Europe’s bus fleet will continue to see further substitution. In nine years’ time, the electric bus fleet – including existing trolley buses, which play a significant role in some cities in Central and Eastern Europe – is expected to reach 65,000 units. Germany and the UK will run the largest e-fleets. This implies the fleet share will surge from barely 4% in 2020 to an expected 33% in 2030. Additionally, the rolling stock will contain a small share of fuel cell electric vehicles. This reflects a significant shift, but at the same time it means the largest portion will still need to be replaced after 2030.

European e-bus fleet in public transport expected to exceed 60,000 by 2030

The shift to e-buses won’t be without challenges

Electrification of Europe’s public fleets is not simply a matter of ambition and budget. Within countries, stakeholder interests will influence public contracts. Other challenges could also impact the pace of change along the way. The most important are:

-

Infrastructure: Enlarging the e-bus fleet requires upgraded charging infrastructure to efficiently deploy the vehicles in daily operation. This will mean added investment to expand and strengthen electricity networks. Alongside significantly increasing supply of (renewable) power to the grid, this is a general challenge for countries in the energy transition, but also a condition to electrify.

-

Production capacity: The manufacturing of e-buses will need to be expanded rapidly in the years to come. This will be a challenge. Manufacturers like Mercedes, Volvo and VDL, but also Ebusco, BYD and Switch are extending production, but shortages of capacity or components like batteries or semiconductors may be limiting factors. Meanwhile, manufacturing is just emerging from the pandemic-induced slowdown.

-

Contracts and operations: Aligning public contracts and authority-operator relations with longer life cycles and the deployment of electric buses is necessary. This may require legal and organisational adaptions, like upfront frameworks facilitating the takeover of vehicles by a successive operator, resulting in optimal commercial funding conditions for public transport fleets.

Germany and UK to see the largest fleets of zero emission buses

National and city specific transition plans for electrification of public bus fleets in Western-European countries

In 2016, the Netherlands adopted the ambitious target to fully decarbonise its public bus fleet of 5,500 buses by 2030, with 100% zero-emission new inflow from 2025 onwards. In 2020, over 80% of newly registered buses were already zero emission, resulting in a fleet share close to 25% in early 2021. This still means that 4,000 buses will be replaced by zero emission vehicles over the rest of this decade.

Within Belgium, Flanders aims to carbonise the full public bus fleet (2,300 buses) of operator De Lijn by 2035, with the challenging objective to electrify inner city bus traffic by 2025. Although plug-in hybrids will play a significant role to meet this target, the current small fully electric fleet of buses will start to grow next year.

Germany aims to have electrified half of its total public bus fleet in 2030 in its Klimaschutzprogramm. Large cities like Berlin, Hamburg and Cologne have announced plans to ramp up e-bus replacements this decade, leading to an inflow of thousands of new e-buses. A new federal government might also raise the ambition level.

In France, operators must ensure that 100% of the new buses are ‘ecologically friendly’ from 2025 (natural gas, hybrid electric or full electric). Additionally, regional authorities have their own targets: the capital region Ile de France aims to decarbonise its full fleet of 10,300 buses before 2030, with 30% (3,000) of this intended to be electric. For the city of Paris (over 4,500 buses) the objective is to have a full ecologically-friendly fleet by 2025.

Italy adopted a sustainable bus plan over the period 2019-2033 which offers funding for the electrification of public buses to meet the EU's minimum requirements. This has just started. The city of Milan aims to fully electrify its fleet by 2030, resulting in 1,200 e-buses.

In the UK, the city of London announced plans to completely decarbonise its fleet of over 9,000 buses by 2034, which was earlier targeted for 2037. By the spring of 2021, only 487 were classified as zero emission, meaning that 8,500 buses will have to be replaced by zero emission ones in 13 years. The Confederation of Passenger Transport has set a target for all new buses to be ultralow or zero-emission by 2025. The aim is that all sales of new buses are zero-emission by 2035.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 September 2021

Sustainability: here comes the hard part This bundle contains 8 Articles