Indonesia and Philippines FX forecasts revised on better sentiment, hawkish policy

Sentiment towards emerging markets has improved substantially in recent weeks. But central banks in Indonesia and the Philippines are likely to remain hawkish to prevent their currencies from depreciating too much next year

Improved global scene: A phone call, the neutral rate and the oil slick

Concerns about the US-China trade war have subsided somewhat after President Trump said earlier this month that he'd had a "good conversation" about trade with China’s Xi Jinping and discussions are "moving along nicely". Meanwhile, the threat of a hawkish Federal Reserve has faded somewhat with dovish commentary from Fed Vice Chair Richard Clarida and lacklustre economic data suggesting that the global economy is slowing. Oil never threatened to hit $100/barrel and is now down 7.98% with Dubai crude trading at $58.74/barrel as the US sanctions on Iran were somewhat nullified after eight US allies were granted a six-month waiver to continue importing oil from Tehran. Sentiment towards emerging market currencies has improved dramatically since November.

IDR and PHP rode out the storm

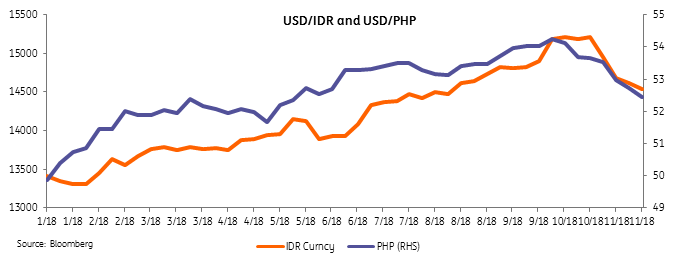

Emerging market currencies have recovered sharply in November and we expect the trio of the Indian rupee (INR), the Indonesian rupiah (IDR) and the Philippine peso (PHP) to continue outperforming over the forecast period. The IDR and PHP have bounced back by 3.7% and 1.1%, respectively, since the start of the month and given the prevailing global landscape coupled with the domestic outlook for Indonesia and the Philippines, we are revising lower our forecasts for the IDR and PHP as central banks remain hawkish going into 2019.

Hawkish central banks

Bank Indonesia (BI) has stayed on point, holding firm to its hawkish stance by saying it would remain “preemptive and ahead of the curve” even after delivering 175 basis points worth of rate hikes in 2018 to safeguard financial market stability. Meanwhile, the Bangko Sentral ng Pilipinas (BSP) showed a readiness “to adjust as necessary to keep inflation expectations well-anchored” even after revising 2019 inflation forecasts to 3.5% from 4.3% at the last BSP meeting. Given their hawkish disposition, we expect both BI and the BSP to hike by 50 basis points throughout 2019, with the Fed still expected to continue its policy normalisation, albeit at a less aggressive pace.

The oil slick and the current account reprieve

The IDR, INR and the PHP struggled in 2018 partly due to concerns about widening trade gaps and resultant deep current account deficits. With oil no longer threatening to jump to $100/barrel, we can expect some reprieve on the external front for both Indonesia and the Philippines, as their oil import bills may no longer swell in 2019. Indonesia and the Philippines will still see current account deficits next year but the oil slick will lend them some reprieve to help ease pressure on the PHP and IDR.

| 54.45 |

end-2019 USD/PHP forecastrevised from 54.95 |

Forecasts revised

We now forecast PHP to settle at 53.50 by end-2018 (from 54.0) and 54.45 in 2019 (from 54.95) while the IDR is set to close 2018 and 2019 at 14500 (from 15000) with the Fed expected to be less aggressive in its rate hike cycle while the BI and BSP maintain their hawkish rhetoric and hike 50 basis points each. The combination of this hawkish bias and actual rate hikes suggest the two currencies will face only mild depreciation pressure in the coming months. Market expectations of a blowup in the current account deficits of Indonesia and the Philippines have also subsided, which translates to less pressure on their respective currencies.

| 14500 |

end-2019 USD/IDR forecastrevised from 15000 |

Risks to the outlook

Despite the current outlook, risks stem mostly from the geopolitical scene, which can alter sentiment rapidly and dictate the direction of financial flows. As of this writing, the US and China remain in negotiations ahead of the G20 meeting in Buenos Aires. The result of the planned meeting between Trump and Xi will set the tone for portfolio flows into or out of emerging markets and could alter our forecasts going forward. Meanwhile, despite oil’s recent plunge to annual lows, any conflict in the Middle East or substantial cuts by OPEC leaders at the 6 December meeting could revive concerns about current account deficits. Lastly, despite the market’s outlook on the Fed dot plots, the US central bank may decide to maintain its current pace of three rate hikes in 2019 should the tight labour market push up wage inflation in the coming months.

Download

Download article

29 November 2018

Good MornING Asia - 29 November 2018 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more