5 reasons why Korea does not need to hike (they still might)

We don't think the Bank of Korea (BoK) will hike at this Thursday's meeting, and we don't believe a hike is what the Korean economy needs. But government pressure is building, and we may see Governor Lee hint at a hike in November.

Governor Lee Ju-yeol has sent mixed messages

As far as forward guidance goes, BoK Governor Lee has provided a little for everyone recently. For the seven of 18 consensus hawks looking for a policy rate hike to 1.75% from 1.5% at this meeting, comments that inflation was no impediment to a rate hike now the headline rate was close to 2.0%, house prices high and household debt worrisome, the outcome must seem fairly clear.

But the Governor has also been clear to point out that structural issues such as household debt are not a monetary issue alone. He has also noted that the house price problem is largely a Seoul-only phenomenon. And any hike that is administered would have to be set against the expectation that the BoK will be revising down their GDP forecasts in their latest assessment.

We're reasonably comfortable in forecasting no change to rates this month, and will provide some more detail in the coming paragraphs. But we are less comfortable with our no change in rates this year. We may get a signal on Thursday 18th October that a November hike is coming. In which case, we will not ignore it and will change our current forecasts for no change this year. That doesn't mean we will agree with it.

Reasons not to hike 1: Housing

As I said, we don't see a rate hike as imminent. Nor does it seem like an effective policy response to Korea's economic stresses. Here are a few reasons why...

- Housing: As the chart below shows, Korean house price growth is a Seoul phenomenon. A 6-big city measure produced by Kookmin Bank shows house price inflation outside Seoul to be very low, and on broader measures, there are a number of cities with declining house prices. So popping a Seoul house price bubble may squash weaker housing markets in other regions. This does not seem a desirable, or a finessed policy response.

House prices outside Seoul flat to falling

Reasons not to hike 2: Household debt

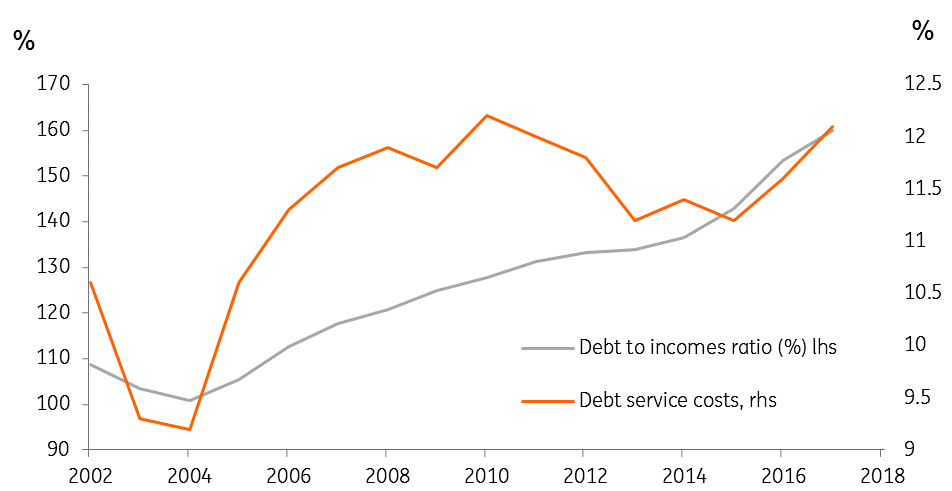

- Household debt: A similar argument applies to the household debt problem. Yes, Korean household debt is high, at nearly 160% of incomes. Most of this is mortgage related. And much of it will reflect the Seoul house price situation. Is a national interest rate increase an appropriate response to a regional market issue? Or would some more targeted macroprudential measure be more effective for a lower cost in terms of foregone economic growth. The answer is pretty clear to us, so why not to the Government and BoK?

Household debt to incomes ratio

Reasons not to hike 3: Official growth forecasts

- Economic Outlook: The Korean growth outlook has deteriorated this year, with softer exports and production growth as well as weaker labour market data spoiling the picture. GDP for 2018 and 2019 was forecast respectively at 2.9% and 2.8% in the BoK's July outlook update. Both these figures are likely to need downgrading. That seems an odd backdrop against which to be raising rates. This is why any rate hike decision will likely be postponed to November to avoid the glaring inconsistency it would otherwise generate. It doesn't really make it any less inconsistent though...

Reasons not to hike 4: Inflation

- Inflation: At 1.9%, the headline inflation rate is not far from the BoK's 2% target. Unlike the GDP backdrop, this is slightly more convenient from a reporting perspective. But besides some higher energy and food price-related inflation (stemming from higher crude oil prices and weather affected food prices) core inflation is very steady at only 1.0%. Given time, the food and energy price increases will drop out of the index. There is no evidence of second-round price effects. And with the labour market softening, there are not likely to be any in the future either. Inflation, therefore, does not warrant higher rates even if it does not create the reporting dilemma of GDP.

Korean Inflation

Reasons not to hike 5: Rate divergence

- Rate divergence: The divergence of Korean and US rates is only problematic if it results in a weaker Korean won (KRW). And even then, it really isn't a big deal. Korea has no external debt problem, having run a current account surplus for decades. Indeed, a softer economy and the additional currency competitiveness it would deliver might be quite helpful. Any imported inflation would, as noted, also likely only have transitory effects on the inflation rate. In any case, it is not as if Korea's regional trading competitors have seen tremendous currency strength recently. In fact, quite the opposite. So if Korea bucked this trend, it might find itself with a quickly uncompetitive currency.

Download

Download article

18 October 2018

Good MornING Asia - 18 October 2018 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more