$35tn wealth surge provides solid platform for US growth

Despite huge economic trauma from the pandemic, household wealth has surged by $35.5tn thanks to massive stimulus from both government and the Federal Reserve. In an environment where wages and incomes are rising, this wealth expansion provides a solid platform for household spending in 2022 and beyond

| $162.7tn |

US household wealth at end 3Q21 |

Money, money, money…

The US economy has rebounded remarkably well from the initial collapse in activity brought about by the pandemic. The economy is now around 1.4 percentage points larger than before it started and while there are still 3.9mn fewer jobs, the rebound in employment is also impressive. Yet despite all of the economic damage, today’s flow of funds data from the Federal Reserve shows that household wealth has surged by $29.4tn since the end of 2019 and is in fact up $35.5tn since the low point in 1Q 2020.

Cumulative change in household wealth since 4Q 2019 (USD tn)

Non-financial assets – primarily real estate, but also including things such as cars, jewellery and equipment – now totals $48.6tn versus $40tn at the end of 2019. Meanwhile, financial assets total $114tn, up from $93.4tn in 2019 – an astonishing 22% increase in 21 months.

Within financial assets the largest categories are corporate equities & mutual funds ($42.6tn) pension and life funds ($32.9tn), small business equity ($14.4tn), and time and savings deposits ($10.7tn).

Household balance sheets have never been stronger

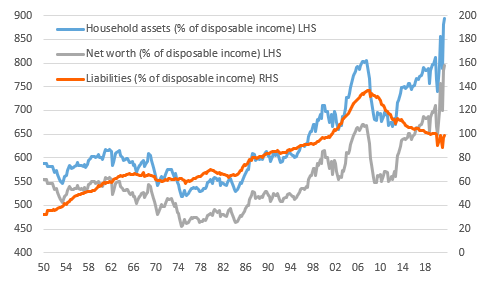

Household Liabilities are “just” $18tn and are primarily mortgage and consumer loans, which leaves household net worth at $144.7tn. This is equivalent to 624% of US GDP and 796% of annual disposable income. As the chart below shows, the household balance sheet, in aggregate, has never been in such a strong position.

The household balance sheet measured as a % of household disposable income

It is certain that the majority of the increases in wealth will have been experienced by higher income and already wealthy households since they will have been heavily invested in the “winning” asset classes. The biggest contribution to the financial wealth gains came from corporate equities and mutual funds due primarily to risk appetite rebounding and equity markets surging higher on unprecedented Federal Reserve and government stimulus. The same reasons led to strong performances for pension and life insurance funds. Conversely, the value of debt security holdings has actually declined as low yields prompted investors to sell.

Moreover, higher income and wealthier households spend proportionally more on services and “experiences” such as travel, eating out, theatre and the cinema – things that Covid containment measures have prevented. Consequently, we are likely to have seen a significant increase in unplanned saving amongst this grouping with the money instead put into various financial and physical assets.

There was also a substantial increase in wealth within cash, checking and savings deposits. Given such low interest rates being paid on balances we can safely say this was overwhelmingly due to people putting more and more money into these accounts – up $3tn since 1Q20 and up $3.4tn since 4Q19!

Low-income households have also improved their financial position

Lower income households will also have benefited to some extent with government stimulus cheques of $1200, $600 and $1400 combined with uprated and extended unemployment benefits contributing to significant increases in household incomes over the past 18 months. This can be seen in the chart below with the orange bars representing the income boost from the cheques and the grey bars representing the expanded unemployment benefits.

An NBER paper calculated that 69% of unemployment benefit recipients actually earned more money being unemployed than when they were working. The median recipient received 134% of their previous after-tax compensation. Encouragingly, we are now seeing positive income growth from higher wages and salaries and this will hopefully mean that incomes can keep rising despite the curtailment of additional unemployment benefits.

Contributions to the change in personal income levels versus February 2020 ($tn)

More ammunition to spend

With employment growth looking resilient and higher income growth becoming increasingly evident as firms compete for staff, the outlook for consumer spending remains positive. Today’s evidence of further massive accumulation of wealth only adds to the potential spending ammunition of the household sector, which gives us more confidence that the US economy can expand by more than 4% in 2022.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more