2021 FX Outlook: Are we ‘Back on Track’?

As the end of 1H21 approaches, it is probably a good time to review some of the major FX themes we proposed last year in November. Our 2021 FX Outlook published back then was titled: ‘Back on Track’ and focused on reflationary themes and a weaker dollar. Things were going well until last week….

Recovery doubts morph into tightening fears

The core theme of our 2021 FX Outlook, published 20 November 2020, was that we subscribed to a global recovery and a reversal of the two factors (Trump, Covid-19) that had pushed the dollar higher from 2018 to early 2020. Here’s how we phrased it at the time:

‘2021 will be the year that FX markets get back on track, as the gravitational pull of the dollar fades. We forecast the dollar to broadly decline in 2021 - generally by 5-10% against most currencies"

‘2021 will be the year that FX markets get back on track, as the gravitational pull of the dollar fades. We forecast the dollar to broadly decline in 2021 - generally by 5-10% against most currencies’

In practice, we were looking for the dollar to reverse to levels seen in March 2018, when President Donald Trump started a trade war – confident that a large tax cut would protect the US economy.

The reversal of the 2018-2020 dollar strength was premised on: i) Federal Reserve executing on its new monetary policy strategy, meaning that US real interest rates would stay negative for longer into the cycle and ii) clear recovery stories coming through around the world as vaccine success spread.

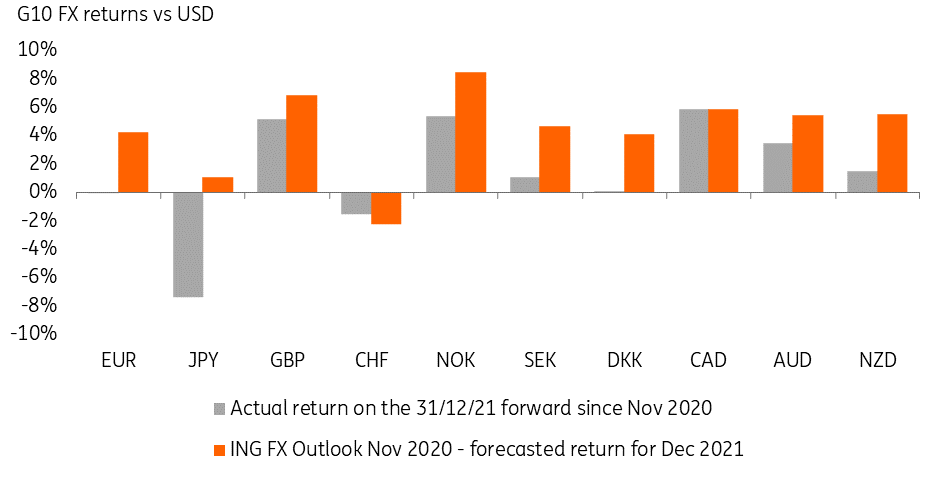

Year-end 2021 targets we set at the time were: EUR/$ - 1.25, $/CNY 6.30 and as outlined in the total return chart below, we expected commodity exporters and GBP to be the out-performers in the G10 space. By year-end 2021, we were looking for the dollar to be weaker across the board against every G10 currency except the CHF.

G10 FX: How well did our November 2020 forecasts perform?

So what happened?

Up until a hawkish turn from the Fed last Wednesday, we would largely say that our forecasts were ‘On Track’.

Broad trade-weighted measures of the dollar had fallen 3% since we published our outlook – and commodity FX had out-performed. Our JPY call was a clear outlier, however, and we had not seen large, outright JPY losses against the dollar. Clearly, we had underestimated both the negative commodity impact on the JPY and also what a dovish Bank of Japan would mean – somewhat remarkably money markets still price BoJ rate cuts over the next two years.

However, last week’s hawkish FOMC triggered a 2.5% rally in broad measures of the dollar and effectively wiped out the gains we had forecast against the low-yielders – especially against the EUR. Yet the commodity complex, even now, boasts good gains against the dollar and the out-performance rankings are largely as we expected. The removal of the Brexit risk premium and vaccine roll-out have helped GBP, while NOK and CAD are out-performing, backed by two of the more hawkish central banks.

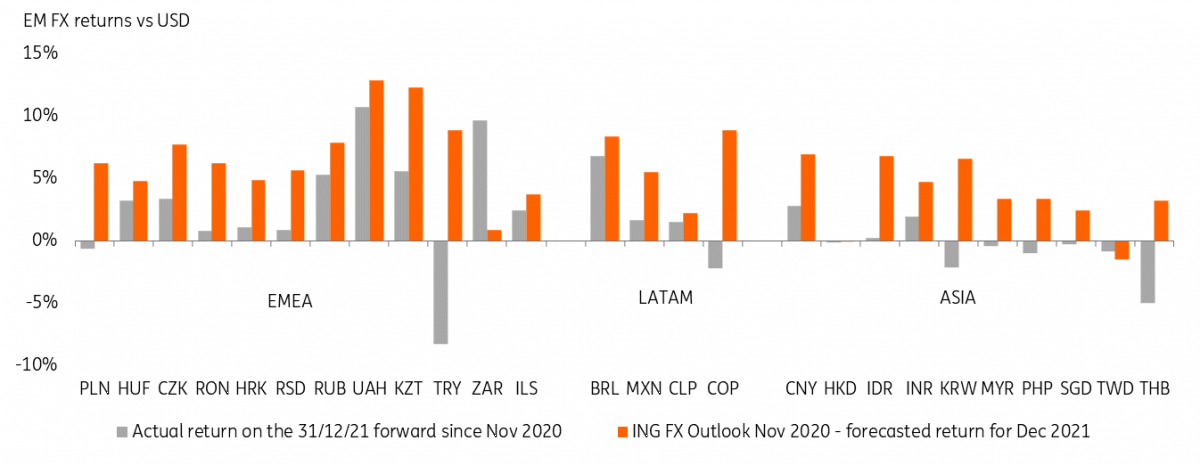

What about the EMFX space?

We were pretty bullish on the EMEA FX space – largely on the positive EUR/USD view and high-yielders enjoying the search for carry. Within CE4, we very much preferred the CZK, which would be backed by one of the most hawkish central banks in the world - that view has worked out well.

Clearly, the setback in EUR/$ has dragged CE4 lower and poses some challenges to the view later this year. We are pleased the CIS views have worked out well – largely helped by Russia’s aggressive tightening cycle. Two big outliers to our November views are i) ZAR much stronger as we under-estimated the terms of trade gains from booming commodity prices and ii) TRY much weaker after the central bank Governor, Naci Agbal, was surprisingly replaced in March 2021.

In Asia, we were pleased to see $/CNY recently inch closer to our 6.30 end-21 target – though the hawkish Fed has again interrupted that trend. For the rest of Asia, the FX performance has been a little disappointing. A large part of that can be blamed on our overall dollar view, but semi-conductor challenges faced in the region and some ongoing battles to get Covid-19 under control (e.g. Thailand) have weighed on the attractiveness of Asian FX markets.

For Latam, Gustavo Rangel’s call for a stronger BRL has worked out well – though that has not been one-way traffic. Only once Brazil's central bank turner very hawkish in March – and new Covid-19 case numbers stabilised – did the BRL start to rally impressively. And arguably Latin FX has not advanced as much as one would have expected given the commodity rally – largely due to the success of left-wing politicians in elections in Chile and Peru.

EMFX: How well did our November 2020 forecasts perform?

What's next?

News that seven of 18 FOMC members are looking for a 2022 rate hike has upset the reflation trade and questioned whether the Fed’s average inflation target strategy was just an elaborate form of forward guidance – one that would be dispensed once the Fed felt the recovery on track.

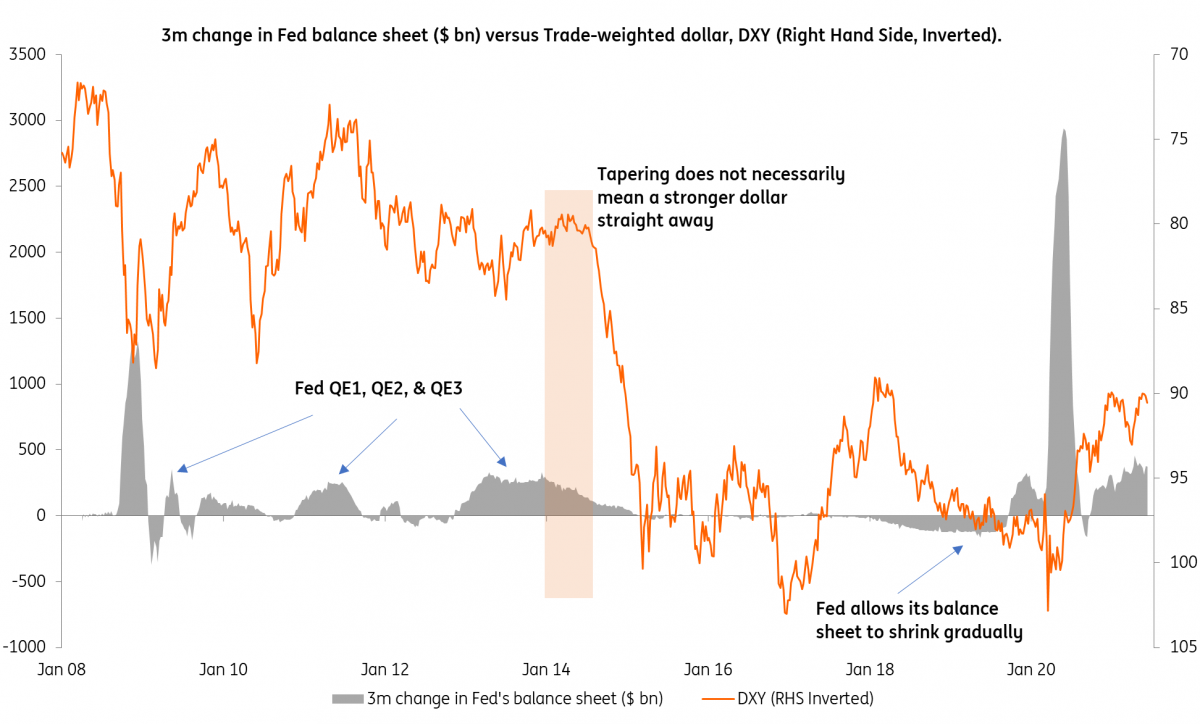

Forthcoming US data – and how quickly the Fed adjusts its communication – will be key. Clearly, our year-end forecasts of EUR/USD in the 1.25/28 range look very difficult to achieve now. Yet US markets remain flush with liquidity and may well remain so deep into 2022. And as the chart below shows, the DXY only really started to embark on a rally six months after the Fed had started tapering. This begs the question whether the dollar needs to enjoy a broad rally now?

Our initial thoughts are that those currencies (both in G10 and emerging market FX) backed by tightening cycles can continue to make some progress against the dollar over the next year – but the window for a rally in low-yielders against the dollar may be nearly closed.

We’ll be publishing a new set of FX forecasts shortly.

Start of Fed tapering does not necessarily mean a stronger dollar straight away

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more