Zinc: The case of mine supply growth remains choked

Expected zinc mine supply growth this year may remain choked in light of lingering disruption risks, which is why we are tempted to pencil in flat growth. Compound this issue with rising expectations over a better demand look ahead suggest a constructive outlook for the short-term zinc market

Hardest hit zinc mining still faces lingering risks

Zinc mine disruptions this year have led to a continuous trimming down of the supply growth.

This week, Bolivia based San Cristobal zinc-lead polymetallic mine announced it will be suspending activities for the second time this year after miners tested positive. Hence, we are tempted to pencil in flat growth of zinc concentrate supply this year, instead of the 100kt growth expected at the beginning of 3Q20.

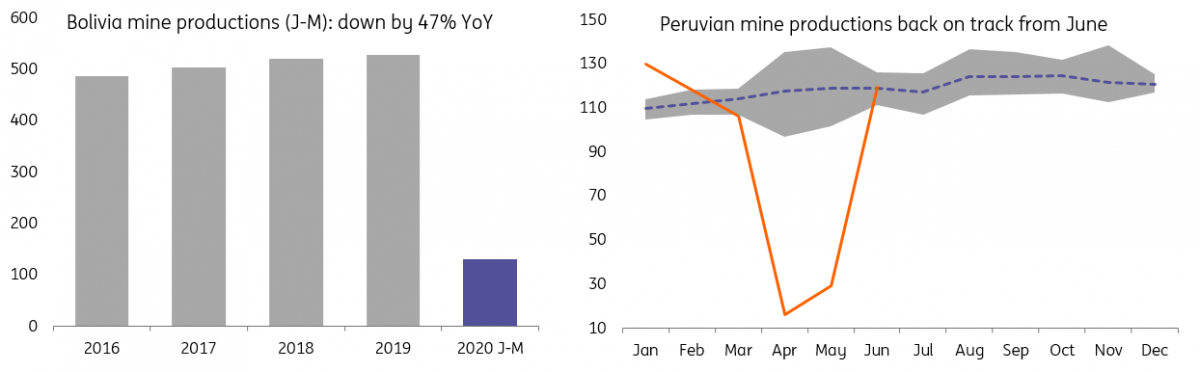

In Bolivia, zinc mine productions have fallen by 47% during the first five months according to the International Lead and Zinc Study Group, that is 97kt losses rebased to the productions from the same period of last year.

Earlier in June, San Cristobal restarted, and productions figures from Peru show that productions were already back on track. This is despite the shipment issue with Red Dog which had brought some concerns back in July (Zinc: A delicate supply status).

Meanwhile, mine production from China, the world's second-largest mine producer, have fallen by over 5% YoY during the first seven months. Mining operations in August still show little signs of improvement.

Zinc mine production: Peru's back on track but Bolivia is still struggling

What about TCs and refined growth?

In the Chinese import market, concentrate imports have started to recover since July to 272kt (physical weight). Hence, we have seen a mild increase in spot treatment charges (TCs) in July to US$160-170/tonne; however, they are heading downward again this week with some offers reported at USD$140-150/tonne. Having said that, the current TCs are only about half of the level seen in 4Q19 before Covid-19 hit.

Hence it would be hard to see a strong growth return in refined productions and this has lead us to chop off refined supply growth forecast too. We expect tight concentrate supply to continue and TCs are likely to be faced with mounting pressure, particularly towards 4Q20 when smelters usually start to replenish stock before winter.

So far, mining activities in Australia - the world's largest zinc mining country has remained overall intact sending more concentrate from its inventory to China. Going forward, the question remains how much more can Australia export beyond its existing contractual shipment.

Recently, there have been some talks about blending somewhere at Chinese ports. According to a Bloomberg report, copper concentrate Chinese companies are trying to blend high arsenic concentrate with cleaner concentrate at some ports such as Fangchenggang in Guangxi. The question is whether this also applies to zinc so that heavy-metal content concentrate will somehow be allowed to blend at ports.

Currently, China puts a threshold on cadmium content less than 0.3% in concentrate imports. However, things remain to be seen given that Beijing has been stricter in pollution standards in recent years.

China zinc concentrate productions

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ZincDownload

Download snap