Zinc: Chinese pile on the shorts

Zinc is trading deep in the red today as rumours of government stockpiles are encouraging Chinese speculators to pile on short positions. With LME spreads so loose, hopes of the last rally are quickly diminishing

The catalyst for today’s sell-off is circling reports that the Chinese strategic reserve bureau is preparing to sell 50-60kt of zinc stocks into the domestic market.

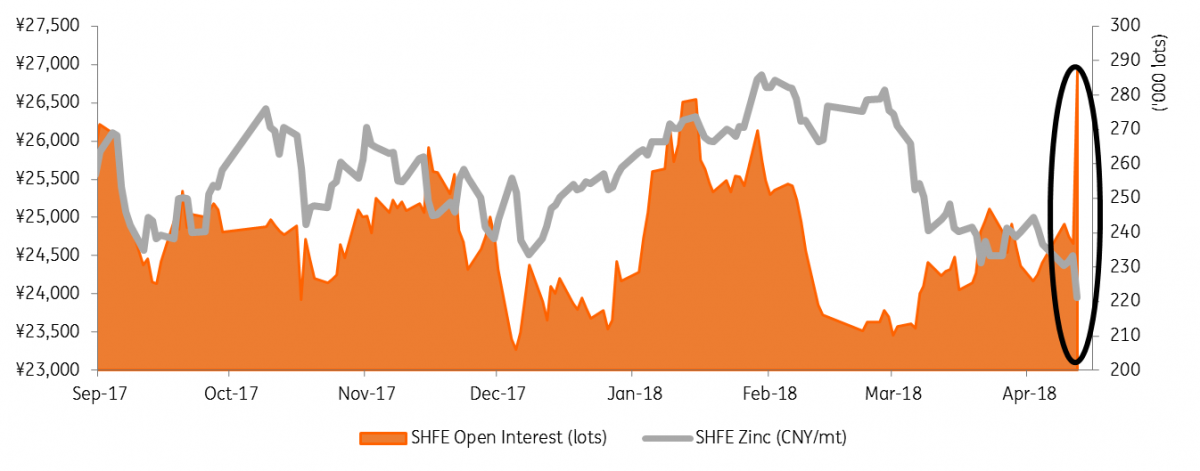

Open interest on the Shanghai exchange has surged 22% as speculators pile on short positions. Such aggressive levels of shorting could be vulnerable if prices rebound in the coming days so expect zinc to remain volatile in the near future.

Shanghai Zinc open interest jumps 22% as sepculators build short bets

The tightness is unwinding

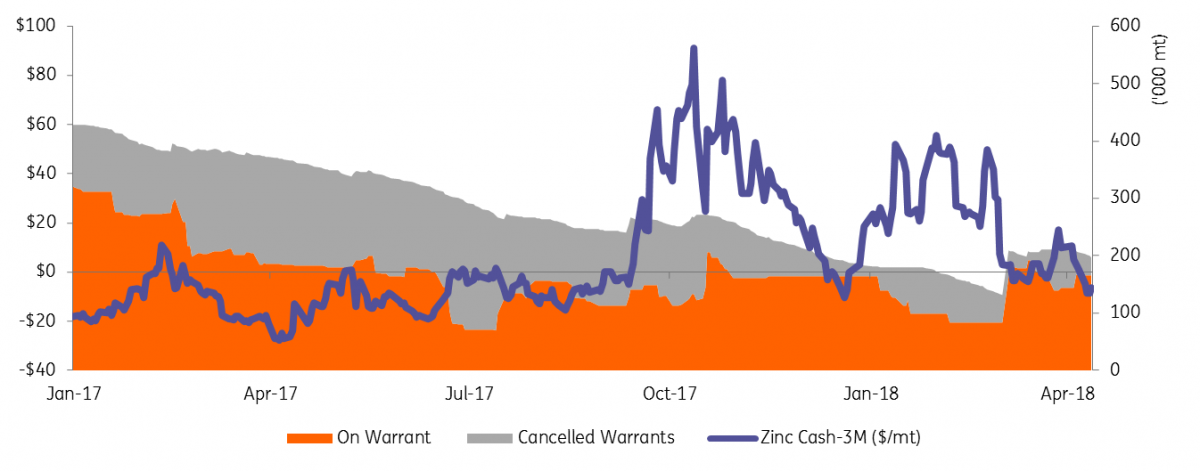

While other base metals were lifted with aluminium this last week, zinc has been the clear laggard. As we wrote in our last zinc note, prices have been looking vulnerable since those spreads eased significantly on the LME. (It is unprofitable to roll a short position through a backwardation but profitable in a contango).

The Zinc cash – 3M closed at a contango of $6.50 yesterday compared to a $17 backwardation just two weeks ago. As we have argued previously, the tightness on the LME that came through last year appears to have been exaggerated by the combination of more tightly held inventory and the over-zealous imports into China. The Shanghai Metal Markets reported total social zinc stocks in China at 212.9kt, down 20% from its March peak, but still at elevated levels.

On the LME, the total stock levels are down 50% YoY, but the on warrant (live) stocks are down by only 10%. Since the live stocks nearly doubled from February, they are in fact around the levels last year when the cash-3 remained in a constant contango.

The shape of the LME zinc curve is a crucial driver in a market still dominated by positions being rolled, and when it comes to the curves relationship with inventory, it’s the availability of stocks rather than the total amount that matters the most. The higher amount of live, on-warrant stocks leads to looser spreads because each warrant holder is covered when selling nearby LME prompts and buying far our (lending the spread).

LME Zinc stocks fairly flat on a live warrant basis

Now, the downside for zinc bulls is that the lack of any imminent market squeeze is quickly removing the chance of a last upshoot before mine supply starts to ease the fundamental picture from the second half of the year onwards.

One last squeeze higher is now looking more in doubt.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap