What can we expect from Singapore’s central bank?

There are many good reasons why a meeting of the Monetary Authority of Singapore (MAS) on Friday 12 October will likely deliver no additional steepening of the Singapore dollar's nominal effective exchange rate (NEER) path or change to exchange rate bandwidth or central point

Why even consider anything other than no change?

It might seem like we are preaching to the converted. After all, why on earth would the MAS tighten monetary policy on Friday? I admit we don't see it.

But MAS Managing Director, Ravi Menon, gave an upbeat view of the global economy in comments to Bloomberg at the recent Singapore Fintech Festival. He felt that China's growth was still pretty healthy, though the trade wars did deliver cause for concern if, for example, growth fell below 6%. His description of the US economy as "chugging along" also sounds like quite an understatement given 2Q18 growth in excess of 4%. But although he viewed the global economy as fairly resilient, he did indicate that global growth would likely slow a touch next year and the year after.

Reasons not to be cheerful

But were Mr Menon's remarks those of a man about to tighten policy and either push up the slope or the central point of the MAS Nominal Effective Exchange Rate (NEER) band? Or were they simply observational?

Reasons not to hurry into changing the MAS' policy target are legion:

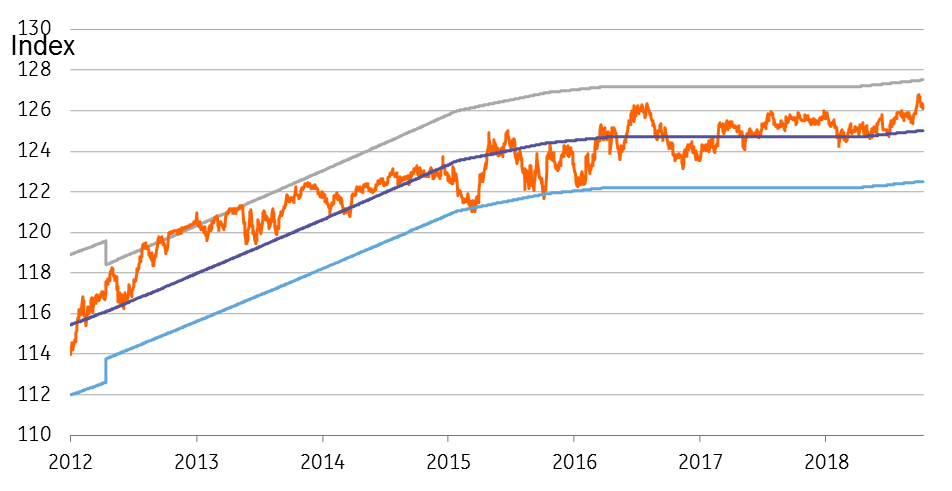

- The SGD is doing nicely without any change in target. Indeed, recent regional FX weakness has seen the SGD appreciate quite sharply before returning to its current value of USD/SGD 1.38.

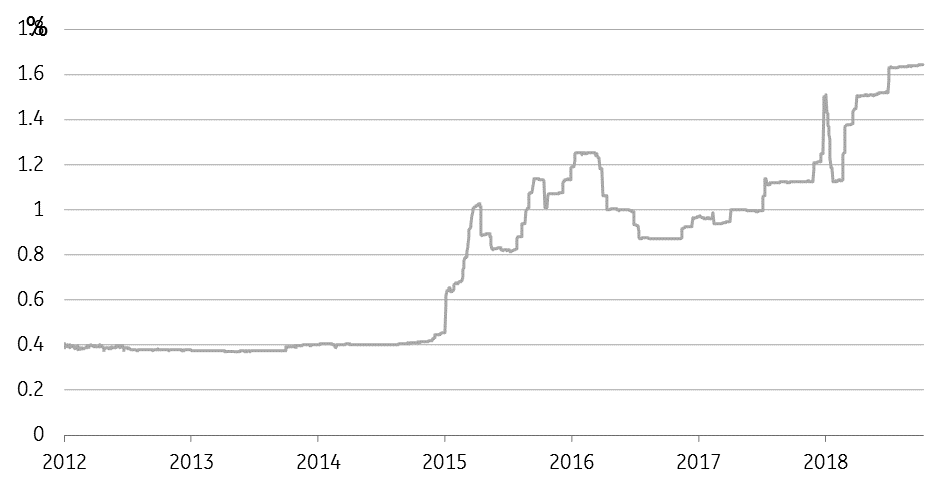

- During this recent SGD volatility, the 3M Sibor rate has been very steady - so it does not look like the MAS is leaning against either recent appreciations or depreciation.

- The outlook for the international economy is highly uncertain - Chinese GDP Growth, trade wars, oil prices, Brexit, risk appetite and financial market valuations might all turn more negative in the near future, so why not wait?

- The domestic economy is not in amazing shape either. Recent production data growth has slowed to 3.3%YoY, down from 20.5% just over a year ago. And non-oil domestic export growth is not that good either at 5.0%YoY, though the trend rate of growth is maybe firming a little.

- The NEER is already a little stronger than the mid-point of our calculated band and requires no further official response.

- Some of the better signals of domestic economic strength, such as the certificate of entitlement (COE) for car ownership, keep falling.

- Private home prices and rentals are apparently now rising quarter on quarter, month on month according to official figures. But the official view does not stack up against anecdotes and some private measures, which suggests that condo rentals at least, are still struggling.

SGD Nominal Effective Exchange Rate band

Its not all bad

But then on the other hand, inflation is now on a core basis, virtually at 2.0% (1.9%YoY), though this sounds less impressive when you realize that the core MAS measure subtracts exactly those meaningful domestic demand signals, such as private transportation (the COE) and accommodation (rentals), so the headline measure at 0.7%YoY, may be a better indicator of actual "core" inflation. And is clearly less impressive.

3M SIBOR

Though GDP might be very soft

In addition to the MAS' currency path decision, the Ministry of Trade and Industry (MTI) will also release advance GDP estimates for 3Q18. The QoQ annualized figure we estimate doesn't sound bad at all, at 5.5%. But this will still leave the annual growth rate at only 2.6%YoY, a noticeable slowdown, even if this leaves the economy still on track for a 3.3% growth total for the year.

We will also get the MAS range for GDP in 2019. This is currently 1.5% to 3.5%, with a mid-point of 2.5%. We don't see this changing, though there is a risk it gets trimmed to 1-3%, for a midpoint of 2%, reflecting the risks facing the global and Singaporean economy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

10 October 2018

Good MornING Asia - 11 October 2018 This bundle contains 4 Articles