Weak Japan manufacturing PMI clouds stronger outlook

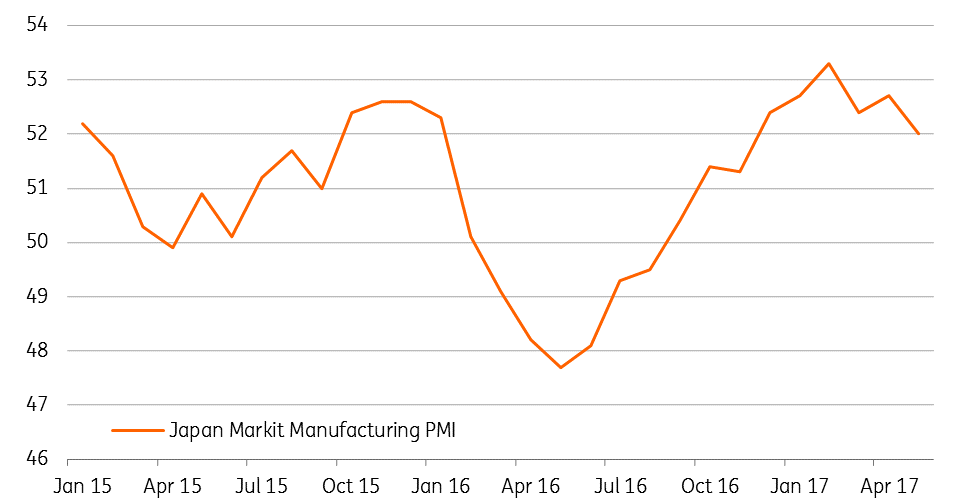

Positive sentiment on the Japanese economy has come in for some re-assessment following a further decline in the manufacturing PMI for May.

| 52.0 |

May manufacturing PMI(Previously 52.7) |

| Worse than expected | |

It's a six month low, but we wouldn't get too alarmed yet.

This is fairly noisy data, and the index still remains comfortably above the 50 boom / bust threshold, with the latest reading within (though at the lower end of) the range that is has fluctuated between since last November.

Weak investment figures in the latest GDP data are likely to be more reflective of the manufacturing sector than services, and weaker new orders data in this latest may hint at some further manufacturing weakness to come.

Japan manufacturing declines in May

But Japan’s economy is less tied to the manufacturing cycle than it once was. And despite an April dip, the service sector PMI is still trending higher.

Even then, these PMI surveys have a very spotty record of tracking broader economic activity trends. GDP tracks neither series well (unless inverted). And on past records, GDP has further to pick up in the short to medium term.

The bottom line

With the picture on Japanese activity at best mixed – we see no change in BoJ policy for the foreseeable future. And for this to change, we will not only need activity indicators to strengthen more consistently, but core inflation to stop trending ever deeper into negative territory.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap