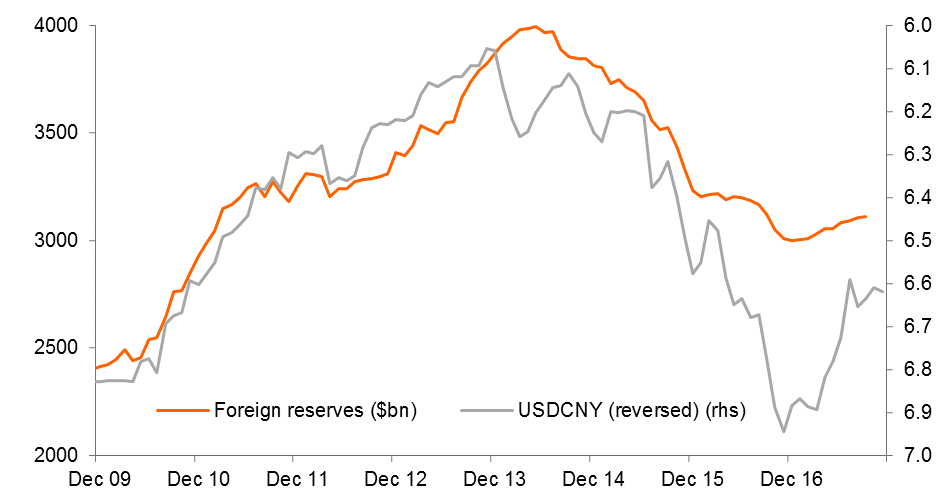

Positive signs for China’s ability to rebuild foreign reserves

The yuan appreciation in the month motivated some corporate conversion from dollars to yuan.

Foreign reserves should continue to increase

We are slightly more positive than consensus on China’s ability to attract capital inflows (INGF: $3,124bn; consensus: $3,122bn; prior: $3,109bn).

The strong yuan momentum is the dominant factor behind our expectation of higher reserves. The yuan appreciated 0.38% against the dollar in November and ended at 6.60910.

As in October, yuan appreciation in the month, even with slightly relaxed outward remittance, means we would see an increase in net capital inflows and so rising foreign exchange reserves .

This conversion should mostly come from corporates, with exporters, converting their dollar receipts from previous months (or even years) to the yuan when the yuan appreciates. This should be increasingly apparent nearer the end of the year as coroprates need to pay “double salary” to their staff before the Chinese New Year.

Increasing net capital inflows means SAFE would be more willing to relax outward remittances in practice

We believe that the central bank will lead the yuan stronger via the fixing mechanism. Even if appreciation is gradual, this should be sufficient to drive expectation of an even stronger yuan. The central bank’s intended result is net capital inflows in 2018. If this is achieved then this would be a real relief for a central government that has experienced a one-fourth reduction in foreign exchange reserves between mid-2014 and mid-2017.

Because we expect a strong yuan to bring gradual net capital inflows, SAFE should increasingly relax outward remittance. We do not expect a complete "no window guidance" on the speed of outward remittance because the central government would be very keen to avoid repeating any substantial loss in foreign exchange reserves.

Forecast strong yuan in 2018

We expect USCNY to end at 6.50 in 2017 and 6.30 in 2018, equivalent to 6.65% appreciation and 3% appreciation, respectively.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap