Wage growth keeps Hungarians happy despite rising inflation

March wage statistics show what we already knew based on the strong first-quarter GDP data: real disposable income is increasing at a fast pace

| 17.5% |

Average gross wages (YoY)ING forecast 14.2% / Previous 31.7% |

| Better than expected | |

Both regular and one-off payments rise

After the extreme increase in wages in February, there was an expected slowdown in March. However, March's figure is still nowhere near the average wage growth by historical standards. In March 2022, the average gross wage rose by 17.5% on an annual basis in Hungary. However, it is important to note that the headline wage data takes into account regular earnings as well as bonus payments and one-off benefits.

If we are interested in the underlying wage growth, it is better to check the development of the regular gross average earning (without premium, bonus, one-month special allowance, etc.). March brought a 15.5% year-on-year regular wage increase. While it shows that bonus payments had a significant impact on wages during this month as well, it also points to an acceleration compared to the previous month. The same direction can be seen in the median value of gross earning: wages increased in that category by 16.5% on a yearly basis. In all, no matter what type of underlying statistics we study, there is a strengthening in the outflow of wages.

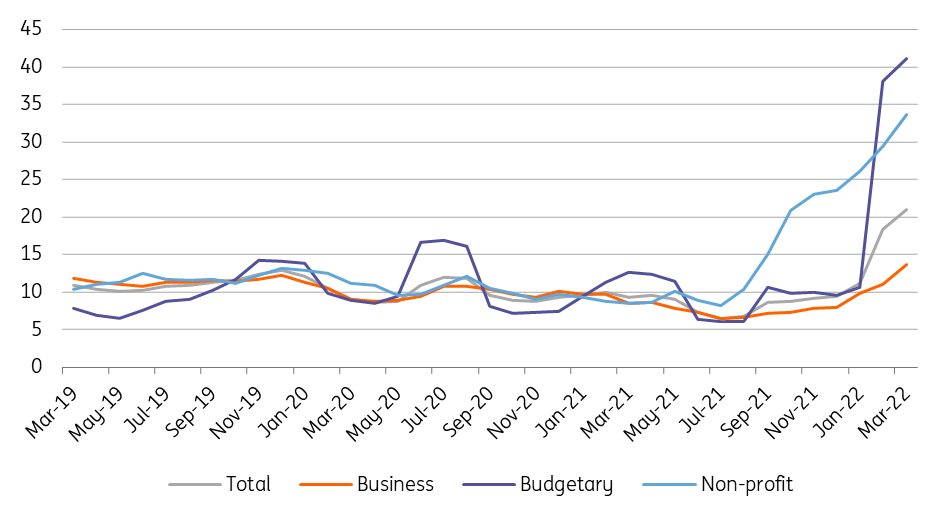

Total and regular wages (% YoY)

There are a lot of drivers of wage growth

The statistics on wages on a sectoral basis include one-off benefits as well. Against this backdrop, the 4ppt acceleration in the private sector’s average wage growth to 16.2% year-on-year suggests that bonus payments were strongly in play in March. Looking at the details, there was an outstanding acceleration in wage growth in three sectors: energy, finance and insurance, and professional and scientific activities. These are the sectors where a significant payment of bonuses could be behind the strong wage data. On the other hand, sectors like construction, accommodation and food services are still facing labour shortages and have a high share of minimum wage earners, thus wage growth has remained above average as well. In the public sector, salaries increased by 17.3% year-on-year, outpacing wage growth in recent months as well (except for the extreme February data), meaning that one-off payments may have strengthened wages in this sector too.

Wage dynamics (3-month moving average, % YoY)

Real wage growth to fuel inflation further in 2022

Today’s data continue to support our expectation that we will see strong double-digit (probably above 15%) wage growth on average this year, thanks to wage settlements in the public sector, one-off benefits, minimum wage increases, and the labour shortage. The March wage statistics fit our view that the surprisingly strong first-quarter economic activity was driven primarily by consumption, given the outstanding expansion of household real disposable income.

We do not expect a substantial change in this process in the coming months. On the consumption side, growth this year may not be affected by developments in disposable income itself (as it won’t be a limit in any aspect), but rather by the behaviour of consumers. What will be the decisive factor in the coming quarters is the rebalancing between savings and spending. The rising interest rate environment and soaring inflation will sooner or later drive households toward savings, but this will be a slow process as real wage growth will remain in positive territory for the remainder of 2022. As long as the economy faces supply-side constraints, we see further pro-inflationary pressure coming from the labour market, adding to the demand-driven inflation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap