US: Weather and chip shortage hit manufacturing

US industrial output fell hard in February as bad weather disrupted supply chains and the lack of semiconductor chips constrained auto output. Nonetheless, business surveys remain firm, order books are good and hiring continues so as with retail sales, this is temporary softness

Another February data miss

February US Industrial production fell 2.2% month-on-month, which is considerably weaker than the 0.3% rise the market was expecting although January’s output gain was revised up to 1.1% from 0.9%. That always seemed too high an expectation given the likely supply chain disruption from the bad winter weather, the chip shortage impacting the car industry and the fact the average weekly hours worked in the sector fell from 40.4 hours in January to 40.2 hours in February.

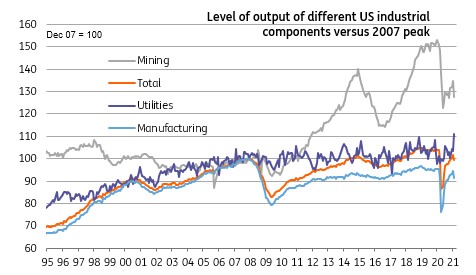

Manufacturing output fell 3.1%, led by an 8.3% drop in motor vehicle output. This appears tied primarily to the global shortage of semiconductor chips that are used in anything from brake sensors to parking cameras to entertainment systems. Excluding autos, manufacturing output was down 2.6%. This leaves manufacturing output 4.2% lower than pre-pandemic levels, but as the chart below shows, output is still 8.6% below the pre Global Financial Crisis peak in December 2007 – underlying the long-term struggles of the sector.

Levels of industrial output

March will see a bounceback

Utilities output rose 7.4% as people cranked up the heating to keep warm in what was the coldest February for at least five years. Meanwhile the bad weather hit mining output. That component fell 5.4%.

As with the the retail sales number, we expect to see this decline in output fully reversed in March and April given the ISM manufacturing survey is very strong and that manufacturing payrolls rose 21k in February, which is a clear sign businesses are confident in the outlook. We also know from the ISM report that customer inventories are at at very low levels so there are good reasons to expect ongoing strong order books and rising output. Nonetheless, the semi-conductor chip shortage, which shows little sign of easing, is likely to act as a brake on the gains.

Rising commodity prices should also provide support over the next few months with Baker Hughes data showing there were an average of 397 oil and gas rigs working in February, up from 369 in January. There has been some topping out in March with 402 rigs currently in operation, but the better weather is likely to mean more are working at higher capacity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap