US trade: Vietnam remains the “winner”

The US trade deficit narrowed marginally in September with China feeling some pain. Vietnam remains the main beneficiary of US-China trade tensions with USD imports rising 40% YoY

Positives and negative for President Trump on trade

The US trade deficit narrowed slightly in September to stand at US$52.5bn versus US$55.0bn in August. This is the smallest deficit since April. The US-China trade tensions are clearly evident in the numbers with the US deficit with China narrowing to US$28bn from US$38.5bn in December last year. On the face of it this appears to be a victory for President Trump and his use of tariffs in his efforts to change China’s trade policy. However, the details suggest that there is no clear “winner” with imports from China falling 4.9% while US exports to China fell by 10%.

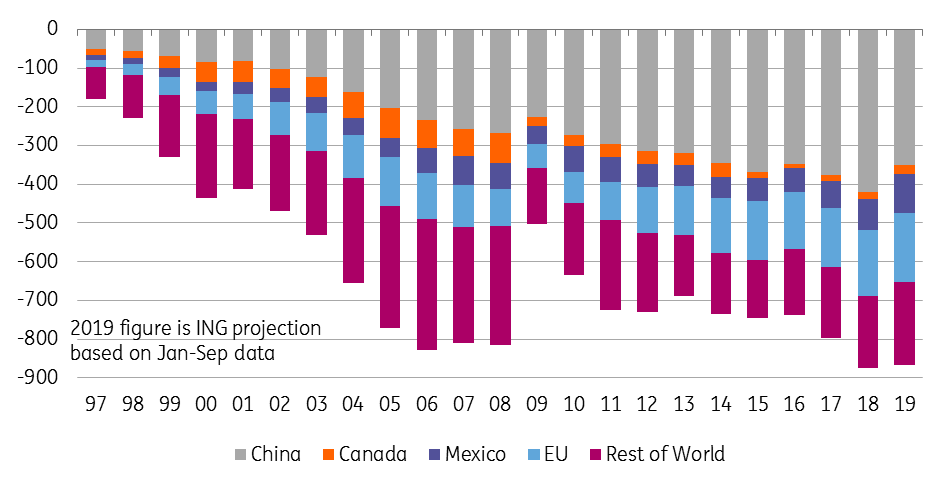

Moreover, the decline in the deficit with China is being offset by larger deficits with other countries. The deficit in goods with both the EU and Mexico looks set to hit an all-time high this year based on the January to September run rate. In aggregate the US trade deficit is currently on track to be broadly in line with the record trade deficit experienced last year.

US goods deficit by country (USD bn)

Vietnam remains the main beneficiary

As we highlighted in our recent piece on who is winning the US-China trade war, while China is obviously feeling some pain, the deterioration in the trade balance of what is likely to be around US$60bn this year equates to around 0.5 percentage points of Chinese GDP. However, there is evidence that this impact may be mitigated by some Chinese exports to the US being re-routed via Vietnam to avoid tariffs. After all, Vietnam manufacturing output is only rising 10% YoY yet exports to the US are running at nearly 40% YoY. As our Asia team continues to point out China is being hurt far more by the downturn in the tech cycle than through the imposition of tariffs.

Vietnam remains the big winner from trade tensions - US import growth by country

Tariffs remain a headwind for growth

Trade talks with China continue with negotiators looking to conclude phase 1 of the talks that suspends some tariffs in exchange for China purchasing more agricultural products from the US. However, optimism remains muted that this can then lead to phase two that deals with more structural issues regarding intellectual property and tech transfer in exchange for rolling back of already implemented tariffs.

As we repeatedly state, these trade tensions put up costs and impact supply chains, thereby weakening corporate profitability and business sentiment. This, in turn, leads to a downturn in investment and hiring, which is a clear threat to global growth. Consequently, central banks globally will retain an easing bias in this environment. Moreover, while the Fed is indicating a likely pause at the December FOMC meeting, we suspect there will be more rate cuts to come in 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap