US trade deficit narrows in May, but it may not last

As President Trump’s trade wars kick off in earnest, US trade data for May showed some improvement in the trade deficit

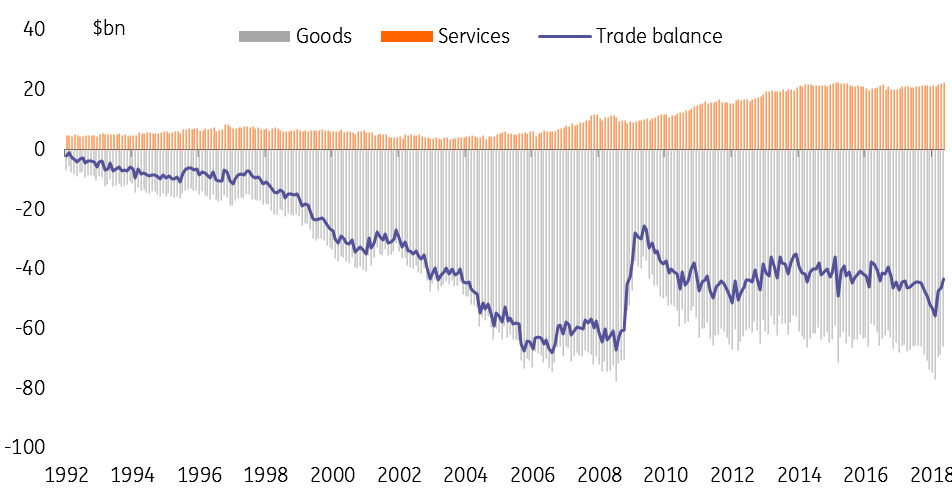

The US trade balance improved in May, rising from -US$46.1bn to -US$43.1bn, the third month in a row that US export growth has outpaced imports. Since February, the US trade deficit has narrowed from a post-2008 low of -US$55bn, with most of the improvement, accounted for by a narrowing goods deficit.

However, the narrowing trade deficit over the past few months has mainly served to unwind the fairly rapid deterioration at the end of 2017. So the change appears partly related to seasonality: the US trade deficit tends to improve in the spring and widen in the second half of the year.

Another factor in the worsening deficit at the end of last year may have been the fairly swift increase in the price of oil in the second half of last year. Though the US imports less oil now than it used to, the increase in price would have inflated the import figures. When oil prices rose quickly that inflated US imports. As oil prices have stabilised around US$70-80 per barrel this spring, that pressure on the trade balance has lessened somewhat.

US monthly trade balance

Exports and imports have been accelerating over the past couple of years as both US and global growth has picked up. But that trend may be coming to an end, as world trade looks set to slow down, even before the negative effect of the Trump tariff.

US export and import growth

While the improvement in the US trade deficit coincides with the Trump administration’s aggressive trade policy, first initiated in early March, it is unlikely to have made much difference to the May figures. The only tariffs actually in place in May were on steel and aluminum. Those goods account for less than 5% of US trade, and most important trade partners (the EU, Canada, and Mexico) were exempt from steel and aluminum tariffs until early June.

The effect of the more extensive tariffs the US has imposed on China today is likely to be more substantial, though it is unlikely to be fully apparent until a couple of months’ time. And so far US tariffs have been matched by counter-tariffs from other countries, which makes the impact of the escalating trade wars on the US trade deficit hard to judge. Both imports and exports are likely to take a hit. Other macroeconomic factors, such as the relatively strong dollar and the expanding federal fiscal deficit suggests the US trade deficit is set to widen.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap