US: Signs of stalling in jobless claims

Today's jobless claims numbers suggest the reopening story isn't having as much of a positive impact on the labour market as hoped. It reinforces the case for more fiscal support to keep the economy on the recovery path

| 1.508mn |

The number of new jobless claims last week |

| Worse than expected | |

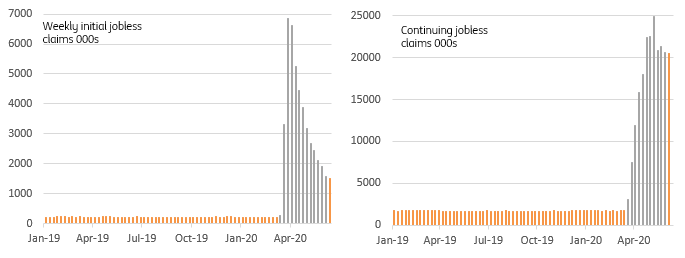

Initial claims didn't fall as much as the market hoped - dropping to 1.508mn in the week of June 13 versus an upwardly revised 1.566mn for the week of June 6 (consensus 1.29mn). There had been indications of a potential miss from some of the individual states that release their own data early – Arizona and Wisconsin had both reported rises, for example. Continuing claims are also proving to be sticky, falling to 20.54mn from 20.6mn versus the consensus of 19.85mn.

This means the insured unemployment rate remains at 14.1%, which is higher than the “official” unemployment rate of 13.3% published by the Bureau of Labour Statistics – you have to be actively looking for work to be classified as unemployed by the BLS, whereas due to benefit changes relating to Covid-19, you temporarily don’t have to do this in order to claim benefits. Moreover, if we add in all the unemployment benefit claimants (including those receiving pandemic unemployment assistance) we get a total of 29,140,557 Americans, equivalent to an unemployment rate of 20%.

Improving claims numbers showing signs of stalling

Today’s numbers suggest that the reopening story may not be generating as much momentum for job creation as the surprise May payrolls number had suggested. It also tallies with comments yesterday from the Cleveland Fed's Loretta Mester and Atlanta Fed's Raphael Bostic. Mester implied firms are recalling workers more slowly than originally intended and the initial deterioration was "even steeper" than official statistics implied. Bostic said that after speaking to industry participants, 20-30% of restaurants and entertainment venues may not reopen in the Atlanta region with the labour market experiencing structural change.

So, while recent activity data, particularly surrounding the consumer sector, has been very encouraging we are a long way from returning to “normality”. The extended unemployment benefits including the extra $600 per week payment, have clearly supported incomes and spending. However, the $600 payment is due to end in six weeks and if it isn’t extended in an environment where unemployment remains very high, there is a clear risk spending subsides again. We are also carefully watching the renewed increase in Covid-19 cases in the south of the country. There is clearly the potential for reopening plans to be put on hold or even reversed in some localities and this would obviously have a detrimental impact on the economy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap