US shutdown stormclouds

The Republicans and Democrats are at loggerheads, meaning a government shutdown from midnight tonight is looming large. But with mid-term elections just 10 months away, the fear of being blamed will likely lead to eventual compromise

Real prospect of government shutdown

Ever since the government debt ceiling of $19.8 trillion was hit last March there have been fears that the US could experience yet another government shutdown. Subsequent short-term spending bills have kept things afloat, but that may not last much longer. There is a certain fatigue amongst some lawmakers, who argue that they can't keep doing this and that a government shutdown may not be the worst course of action in order to focus minds and get real progress on the US medium-term finances.

This was clearly evident last night. While the House of Representatives was able to pass yet another short-term funding programme (which would last just a matter of weeks) the Senate, where the Republicans have a wafer-thin majority, wasn't even able to agree on scheduling a vote. The Democrats are refusing to back the longer funding bill until there is more clarity on what happens to the 800,000 people that face deportation following President Trump's decision to end the "Dreamers" programme - young people brought illegally to the US as children. Disparaging comments reportedly made (but denied) by President Trump regarding immigrants from certain countries have made Democrat lawmakers more steadfast in their stance. At the same time, fiscal hawks in the Republican Freedom Caucus want any increase in the debt ceiling tied to either outright government spending cuts or at least a slower rate of spending.

As such, we face the very real prospect of a vote failing to pass given the need for 60 Senators to back the bill - Republican's control the Senate 51-49 (47 Democrats and 2 independents). Consequently, we are likely to hear over the weekend of plans to suspend non-essential services in the coming weeks - the US government still has some cash to give a bit of flexibility.

Financial impact of an impasse

Previous instances have led to some very tough decisions. The 1995 debt ceiling crisis saw 800,000 government workers furloughed for five days after a Republican-controlled House refused to back Democrat President Clinton’s budget and he subsequently vetoed the Republican spending bill. A temporary spending bill was passed, but this didn’t prevent another shutdown in December which saw 280,000 workers furloughed for another 22 days before an agreement was finally reached. This had a relatively minor economic and market impact, but the 2011 crisis led to much more volatility. A deal was eventually made, but the fall out led to the US losing its AAA rating with S&P and the S&P500 equity index falling 17% between 22nd July and 8 August. While workers weren’t furloughed, the economy saw just 0.8% annualised growth in 3Q11, before rebounding to 4.6% in 4Q11. The 2013 crisis saw the return of the furloughing of workers, this time 800,000 following a partial government shutdown before a bill was signed in February 2014.

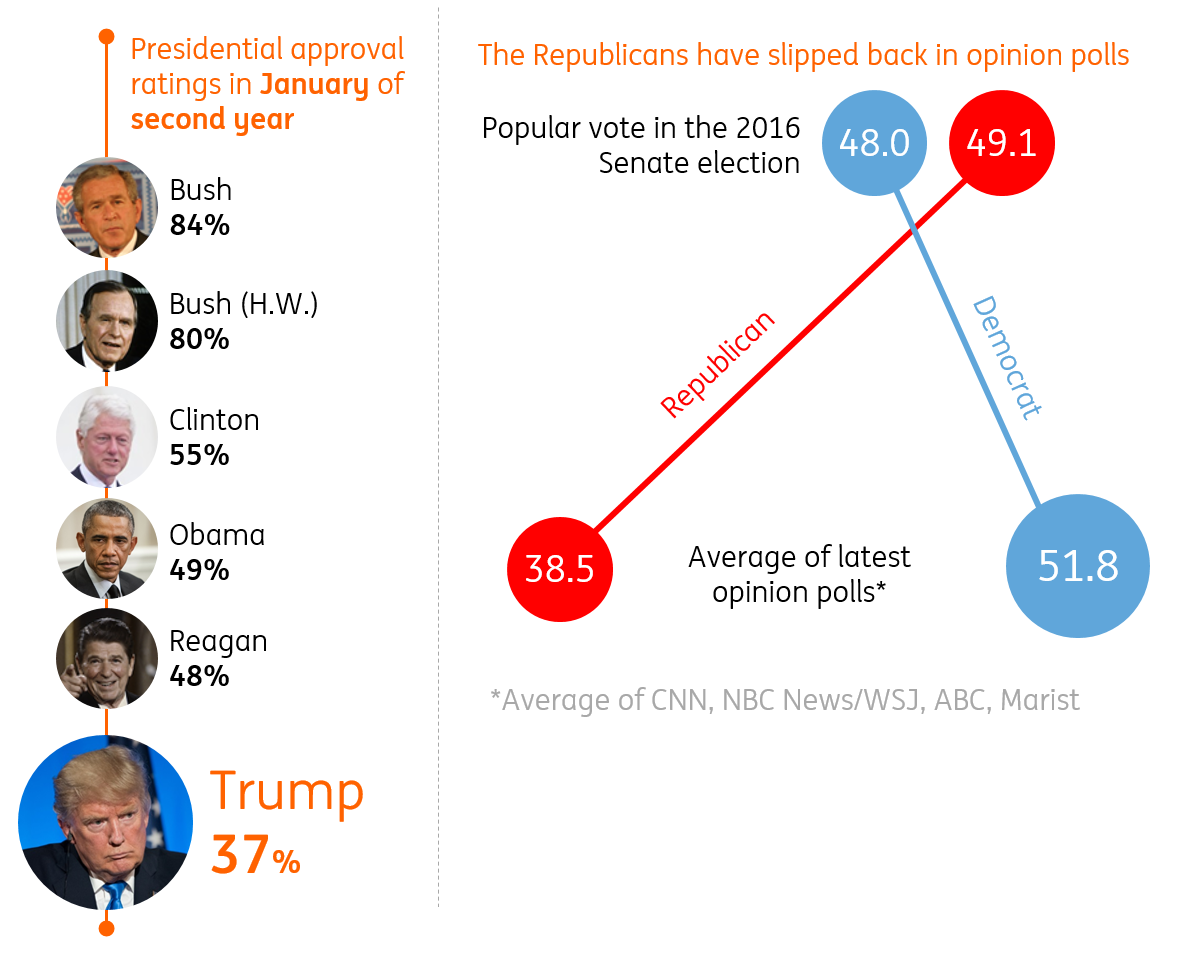

We remain hopeful that if a shutdown does happen it won't last as long and it won't be as economically or market damaging this time. The problem for the Republicans is that given they have the Presidency, the Senate and the House of Representatives there are presentational difficulties in blaming the Democrats. With support for the Republicans already at poor levels and Trump's personal approval rating languishing, we see scope for flexibility from them in coming days. The mid-term elections are just 10 months away and given such poor polling there is more pressure on them to resolve the situation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap