US: Service sector shifting gear

Another strong reading from a major US business survey reinforces our confidence in the recovery story. With jobs and inflation pressures rising too and the vaccine program gaining momentum the Federal Reserve will increasingly face questions about potential timing on moving towards a more neutral monetary policy stance

An improving growth backdrop

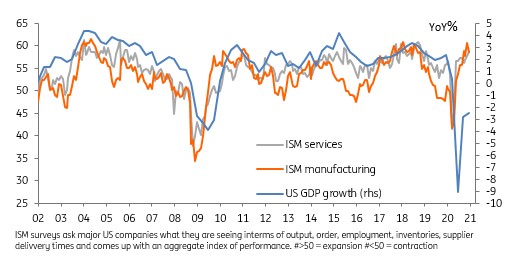

The January reading of the ISM services index confounded expectations of a dip to post a 23-month high of 58.7 (consensus 56.7). New orders rose to 61.8 from 58.6 while business activity held at a robust 59.9 where anything above 50 equates to expansion. The main negative was a 10 point drop in new export orders, but this index is not seasonally adjusted and could be related to the Chinese New Year as well as the effective lockdowns in Europe.

ISM surveys point to a robust economic recovery

With rising jobs and inflation pressures...

Meanwhile employment jumped to 55.2 from 48.7. With both the manufacturing and services ISM services reporting such strong employment jumps it bodes well for job creation in the months ahead. This follows on from the today’s ADP private payrolls number, which also came in above expectations posting a 174,000 gain versus a consensus forecast of a 70,000 rise.

However, we wouldn't get too carried away with the implications for this Friday's jobs report given the data collection is the week of the 12th of January. There will still be legacy drags from the California stay-at-home orders and the closure of dine-in eating in New York and other cities.

The California restrictions were, last week, partially rescinded with the benefits of the re-opening of restaurants (for outside dining), hair salons and nail bars in Americas most populous state likely to show up much more in the February report. We also know that New York restaurants are allowed to re-open for dine-in eating from February 14 (at 25% capacity) so that will show up in the March report. For this Friday’s January jobs report we are still forecasting employment growth in the 50-100k range.

Inflation pressures remain elevated at 64.2 (previously 64.4), but are much more modest than in the manufacturing sector where rising commodity and energy prices are having a major impact. Nonetheless, decent activity, rising prices, rising jobs and a vaccination program gaining momentum will increase doubts that the Fed will continue with QE on its current scale for another 12M and that it will be more than 3 years before the Fed hikes rates from zero.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap