US resilience may mean the Fed has to talk tougher

The market is firmly backing a 50bp hike from the Federal Reserve in December, but the 7% drop in the dollar against major currencies and the plunge in Treasury yields is the exact opposite of what the Fed wants to see as it battles inflation. With US data proving to be pretty resilient the Fed's rhetoric may need to toughen even more

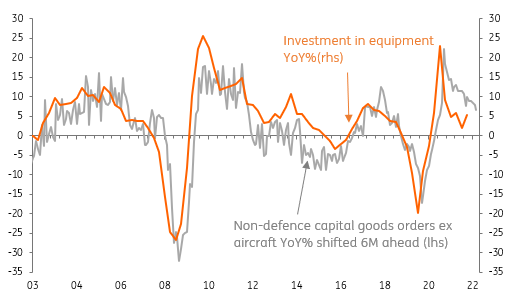

Investment holding up better than expected

This morning's US data is a little mixed. The good news is that the durable goods report is solid and points to business capex holding up well in the fourth quarter. We always ignore the headline number, which rose 1% month-on-month versus the 0.4% consensus expectation as it gets buffeted around by Boeing aircraft orders, which were decent at 122 planes versus 96 in September. The Fed tends to look more at the non-defense capital goods orders ex aircraft as a cleaner measure of what is happening in the corporate sector. It rose 0.7% MoM versus expectations of 0.0%. Admittedly the September number was revised a little lower to -0.8% from -0.4% and, as the chart below shows, it is trending towards slower growth, but it is not suggesting companies are looking to retrench imminently.

US core durable goods orders and business investment

Jobs story looking potentially troubling

As for mortgage applications, they rose given the typical 30Y mortgage rate has followed Treasury yields lower to 6.67% as of last week versus 7.16% four weeks ago. The result is that mortgage applications for home purchases rose for the third consecutive week.

The not-so-good story was the rise in initial jobless claims to 240k from 223k (consensus 225k) while continuing claims rose from 1503k to 1551k, suggesting that there is evidence of a cooling in the US labour market. This has certainly been the case in the tech sector, but more broadly the job openings data suggests there are still 1.9 job vacancies to every single unemployed American, i.e. demand is vastly outstripping supply of workers. The consensus for next Friday’s payrolls number is for a 200k jobs gain and we doubt expectations will shift much for that, but the rising lay-off story is something we will be closely following and could hint of early signs that the jobs numbers in early 2023 being softer.

Fed may need to toughen its stance

All in this week’s data probably doesn't mean much for the Federal Reserve policy meeting on December 14th. Instead, all eyes will be on next Friday's jobs report and the December 13th release of November CPI. The market is firmly behind a 50bp hike call given Fed speakers have indicated the likelihood of less aggressive step increases in interest rates after four consecutive 75bp hikes.

However, we are a little nervous that the 7% fall in the dollar against the currencies of its main trading partners and the 45bp drop in the 10Y Treasury yield is leading to a significant loosening of financial conditions – the exact opposite of what the Fed wants to see as it battles inflation. Consequently, we wouldn't be surprised to see the Fed language become even more aggressive over the coming week, talking about a higher terminal interest rates – with some of the more hawkish members perhaps even opening the door to a potential fifth consecutive 75bp hike in December to ensure the market gets the message.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap