US: quick out of the blocks

Data suggests the improvement in US-China trade relations has led to reduce uncertainty and provided a platform for stronger US growth in 2020. The worry is the coronavirus might mean this strong start loses momentum

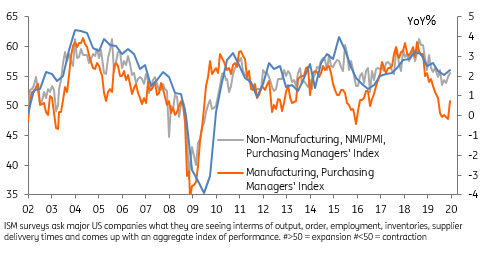

Business surveys turning higher

We have had quite a few interesting data releases from the US today and they broadly paint a positive picture. The ISM non-manufacturing index has risen to 55.5 in January from 54.9 in December with new orders and business activity showing a clear acceleration. New export orders are close to flat while the pace of employment gains have moderated a little, but overall it suggests decent growth at the start of the year.

This backs up the strong reading in Monday’s ISM manufacturing survey and offers an indication that the improvement in US-China trade relations has led to reduce uncertainty and provided a platform for stronger global growth for 2020. Time will tell whether the coronavirus outbreak will derail the situation. Clearly that is a major threat with the human and economic cost in China plain to see. So far though there are only 11 confirmed cases in the US, but it is another uncertainty that could roil markets and has the potential to depress activity.

ISMs show clear improvements post the trade agreement

Trump and trade...

Separately, the US trade balance widened out marginally more than expected in December to US$48.9bn from US$43.7bn in November. Imports rebounded 2.7% month on month having fallen for the previous three months while exports rose 0.8%.

It is a series that has obviously been swung around by the trade tension story through 2019, but the net result is that the full year trade deficit has shrunk for the first time in six years, which President Trump will use to vindicate his decision to confront China on its trade practices. The deficit with China has clearly narrowed while there has also been an ongoing decline in energy imports given greater domestic output with the US running positive net exports of petroleum products through 4Q19.

Trade could remain volatile through 1H20 as virus-related impacts on Asian production and logistics look virtually certain. This could cause some strain in US supply chains. At the same time the US administration is already pulling back on hopes of a phase one trade deal related "export boom" given the likely hit to China growth. As such the overall the effect on trade may largely net off in the near-term.

US trade balances ($bn)

Jobs and mortgage boost

We also had the ADP payrolls series, which came in well ahead of expectations at 291,000 job gains in the month versus 157,000 consensus. Mild weather is likely to have helped seeing as goods sector jobs rose 54k - construction didn't need to come to its usual seasonal halt due to less wintery conditions. We would caution that the ADP hasn't got a great history in predicting the official payrolls figure (due Friday). For example, ADP significantly undershot the official payrolls number throughout much of late 2019. We are still going for 150,000 BLS payrolls on Friday given the employment components of the non-manufacturing index slipped back and the manufacturing survey remains firmly in contraction territory.

Finally, we had another strong set of figures concerning the mortgage market. Mortgage applications surged again on the back of new lows for mortgage borrowing costs (led by re-financings). Mortgages specifically for home purchases declined, but the strength seen in recent months has been remarkable and is consistent with the view that residential investment spending and construction in general will remain a key source of growth for the US in 2020.

Overall the US economic situation looks good, but things could quickly unravel due to the coronavirus, which is something we can’t predict. Our concern is that in an environment of already subdued global growth, fears over what it could lead to may heighten the potential for medium-term US economic weakness despite the good start to 2020.

Housing demand boosted by cheap borrowing costs

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap