US: More evidence of a jobs plateau

Initial jobless claims remain elevated despite the decent activity backdrop. With Covid-19 cases on the rise again, fears of renewed containment measures, similar to what we are seeing in Europe, could constrain job opportunities even more

The jobless claims report is a bit of a mixed bag. US initial jobless claims rose 4k to 870k for the week of September 19 versus expectations they would drop to 840k. Continuing claims moved down to 12.58mn from 12.75mn, not as good as the 12.28mn consensus. The total number of people claiming unemployment benefits (including pandemic unemployment assistance) dropped to 26.04mn from 29.77mn.

This latter number is encouraging although we don't have any detail as to why it was such a big drop in the number of people claiming PUA. The total number of benefit claimants remains nearly double the 13.55mn “official” level of unemployment whereby to be “officially” unemployed you have to be actively looking for work.

Unemployment levels by different classification

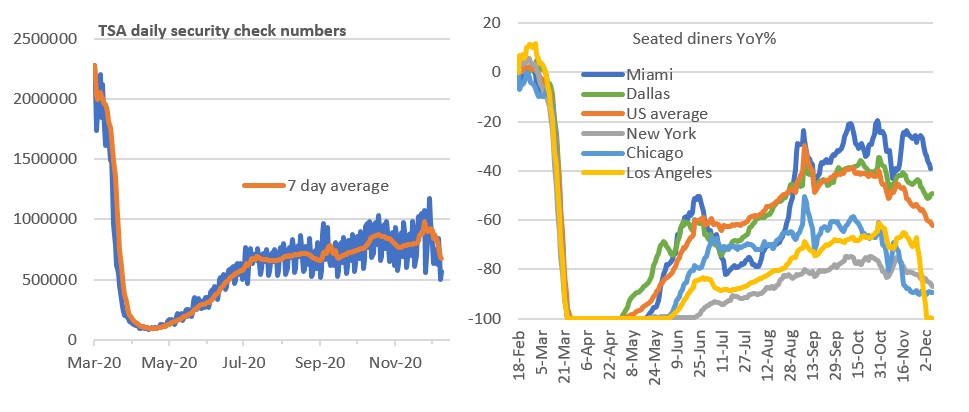

Given Covid-19 is far from beaten plus the fact that the supportive impact from the fiscal stimulus is fading, caution remains warranted. There are clearly ongoing strains in the jobs market – remember that the peak in initial claims during the Global Financial Crisis was 665k the week of March 27, 2009 so we are still 200k above that. Meanwhile, high frequency Homebase employment data suggests that jobs growth has stalled – see chart below – and with Covid-19 cases picking up again there are also worries about the reintroduction of new containment measures, similar to what we are now seeing again in Europe.

Homebase data suggests a levelling off in jobs

This coronavirus dataset is based on Homebase data for over 60,000 businesses and 1 million hourly employees active in the US in January 2020. All the rates compare employment that day vs. the median for that day of the week for the period January 4, 2020 – January 31, 2020.

There certainly is the risk of a renewed wave of cases in the US, particularly as the weather becomes more conducive to human transfer, so if renewed containment measures are introduced this will undoubtedly constrain business activity and hurt employment prospects. As such, calls for more fiscal help will only grow, but it is difficult to see a material package being agreed given election-related tensions in Washington.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap