US manufacturing weakness adds to slowdown fears

US manufacturing output surprisingly fell in May and following softer housing and retail sales numbers adds to a sense of gloom that is hanging over the US economy in the wake of the Federal Reserve outlining a more aggressive interest rate hiking path. There are still pockets of strength with oil and gas drilling a key area of growth as prices remain elevated

Manufacturing falls led by machinery output

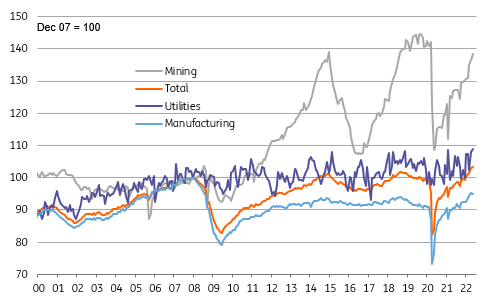

After the weaker-than-expected retail sales figures and clear softness coming through in the housing data, we can now add weaker industrial production to the list of recent disappointments. Output rose 0.2% month-on-month, but this was below expectations of a 0.4% gain while manufacturing output actually dropped 0.1% versus predictions of a 0.3% increase.

The chief reason for the fall in manufacturing was a 2.1% drop in machinery production, but there were also declines in food and beverage output, aerospace, wood products and fabricated metal. On the positive side autos were up 0.7% while computers/electronics were up 0.9% petroleum and coal rose 2.5% and metals output increased 0.8%.

Breakdown of US industrial output levels

This isn’t a terrible outcome after a decent run with manufacturing output overall still up 4.8% year-on-year, but the signs of a loss of momentum and the recent weakness in some of the regional indicators mean there is reason for caution. With the Federal Reserve hiking rates more aggressively and the dollar remaining strong the sector is going to come under increasing pressure. Combined with falling equity valuations this is likely to make management more cautious on expansion plans which could dent the outlook for investment and hiring which would exacerbate the slowing US growth narrative.

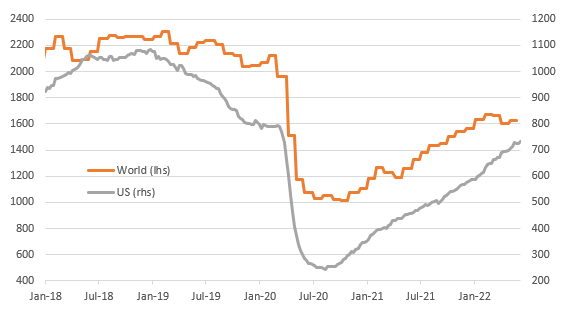

Baker Hughes oil and gas rig count

Oil and gas an areas of ongoing growth

There was better news in other parts of the report with utilities output rising 1% MoM while mining output gained 1.3% within which oil and gas drilling rose 6.2%. Drilling is a real success story in the US with 489 out of the 609 increase globally in the Baker Hughes oil and gas rig count since August 2020 being in the US. Given ongoing upward pressure on global energy prices this is likely to be an important growth story to partially offset some of the increasing negativity elsewhere.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap