US manufacturing shows its resilience

Despite near-term Covid-19 challenges, the 2021 manufacturing outlook is bright. The post-vaccine global rebound should be further boosted by new corporate investment, major European and US fiscal stimulus focusing on infrastructure and energy and the competitiveness boosting effects of a weaker dollar

Manufacturing continues to outperform

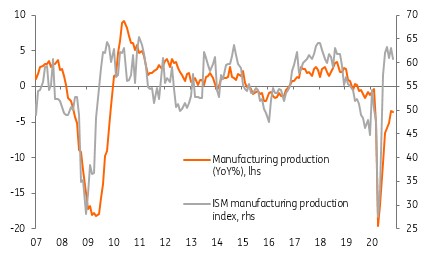

November US industrial production rose 0.4% month-on month with manufacturing output rising 0.8% versus the respective 0.3% and 0.4% consensus forecasts.

A very good performance given hours worked in the manufacturing sector actually fell in November. Utilities output declined 4.3% reflecting the warmer than usual weather while mining rebounded by 2.3%MoM.

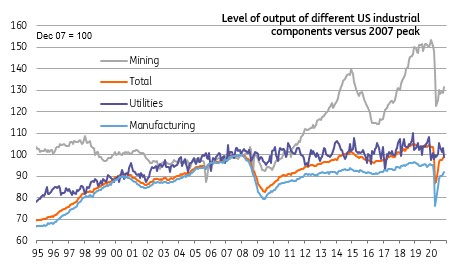

Breakdown of industrial output (levels: December 2007 = 100)

Near-term challenges, but 2021 is looking good

Covid-19 containment measures are likely to exert a heavy economic toll over the next few months and the manufacturing sector won't be immune, but it is going to be far less directly impacted than consumer services in big cities.

The stop-start-stop-start nature of restrictions around the world means demand is choppy and uneven with uncertainty undermining confidence. This is likely to keep business relatively cautious with hiring and investment. Moreover, we need to remember that manufacturing output is still 3.7 percentage points below pre-pandemic levels while total industrial production is 4.9 percentage points lower.

Manufacturing surveys point to ongoing recovery

The prospects for US industrial production in 2021 look good

As vaccination programs get underway, we can start to look forward to a full re-opening of the global economy that can boost confidence and spending. The dollar’s weakening trend, which we suspect will continue through 2021, will boost US manufacturers’ international competitiveness at a time when trade is picking up too.

We believe the manufacturing sector will have fully rebounded to pre-pandemic output levels by the end of 3Q21

Corporate investment plans have largely been put on hold through the pandemic and once the all-clear has been sounded we could see a boom for construction and capital equipment demand. Major government fiscal stimulus plans and a growing focus on infrastructure and energy investment plans in both the US and Europe also present opportunities for US manufacturers.

Consequently, we believe the manufacturing sector will have fully rebounded to pre-pandemic output levels by the end of 3Q21.