US manufacturing: near-term pain, long-term gain?

Robust manufacturing and construction data suggest a solid base for activity as we head into year-end, but rising Covid-19 cases and hospitalisations threaten more movement restrictions that are particularly bad news for the service sector. With mounting concerns over jobs we could see growth temporarily dragged into negative territory

Manufacturing's solid fundamentals

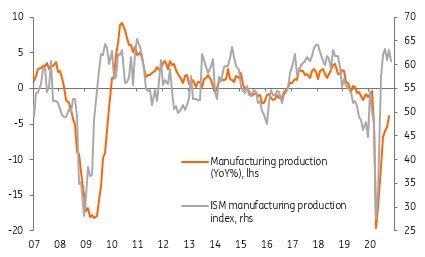

The US ISM manufacturing index dropped back to 57.5 in November from October's 59.3 reading (consensus was 58). New orders and production continue to point to robust activity given they both remain above 60 – remember 50 is break-even. Further supportive news comes from the fact that inventory levels are at a new 10-year low and the backlog of orders rose, both of which indicates demand should remain very firm for the next few months at least. As the chart below shows, we should soon see manufacturing output return to positive year-on-year growth.

ISM & production growth

But Covid-19 presents near-term risks

However, there is a surprisingly weak employment number, which dropped into contraction territory at 48.4 versus 53.2 in October. This perhaps hints at caution in the manufacturing sector as it could face constraints from rising Covid-19 cases or it could experience a drop-off in demand in response to containment measures.

This was borne out in the accompanying text that suggested “companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are causing strains that will likely limit future manufacturing growth potential”.

Europe chose not to close manufacturing when it returned to lockdowns and we doubt very much that US authorities would shutter US manufacturing. Nonetheless, it suggests we should be prepared for some softness in economic data for the December-January period. Moreover, if there are jobs are being lost in the manufacturing sector despite activity booming, there will certainly be jobs lost in the services sector, which is far more likely to face containment measures.

With initial claims already suggesting a shifting dynamic in the labour market, today’s ISM employment number adds to a sense that the consensus of 580,000 private sector jobs being added in Friday’s November payrolls report may be looking a little optimistic. Should Covid-19 containment measures be more widely introduced then the prospect of even weaker jobs data for December and January looks probable. We could even see negative consumer spending as a result over that period.

Nonetheless, once the vaccination program has reached a critical mass, perhaps in late 1Q21, we should see a vigorous period of economic activity. The combination of pent-up demand and the travel, hospitality and entertainment industries fully re-opening and hiring workers plus a fiscal stimulus on the order of $1 trillion under President Biden should be a heady mix. We expect the US to finally have recovered all the lost pandemic output in late 3Q/early 4Q21.

Construction activity

Meanwhile, US construction rose 1.3% month-on-month in October versus the 0.8% consensus, but there was a net 0.8 percentage point downward revision to September so on balance it is a touch weaker than hoped. As anticipated all the strength is in residential, which is up 7.5% since February and up 18% since its nadir in May! Record low mortgage rates combined with a sense that working from home means we don't need to do as much city living is fuelling a boom in residential construction. That is not going to change anytime soon.

Non-residential construction, on the other hand, is down nearly 6% since February. This diverging performance is unlikely to change until businesses have the confidence to put money to work and governments have got the money to spend and that may not be until 2Q at the earliest.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap